- AVAX is showing signs of an impending breakout from a long-term falling wedge pattern.

- On-chain metrics are hitting all-time highs, hinting at strong underlying demand.

- A breakout above $18.50 could lead to $28, with $50 still in play if momentum holds.

Avalanche (AVAX) has been sitting real quiet lately—but sometimes quiet isn’t a bad thing. With the price floating around $17.88 today (a tiny 0.5% move), it’s been slowly tightening up above key support. And honestly? It’s starting to look like a breakout’s brewing. That falling wedge pattern on the weekly chart? Yeah, it’s looking textbook.

Wedge Pressure Is Building—And $20’s Right There

If you zoom out a bit, AVAX has been stuck inside a falling wedge for what feels like forever. Lower highs, higher lows, classic compression. But here’s where it gets spicy: momentum’s flatlining, volume’s cooling… and that’s usuallythe calm before something breaks. Price is hovering just above $18 right now, and if it can punch through $18.50 and close above that on the weekly? That’s when you start talking $28, maybe even $48 if momentum sticks around.

Not everyone sees it yet. But Ty, one of those chart-watchers on X, says $20 could come as soon as this month. And honestly? He might not be wrong.

On-Chain Activity’s Exploding

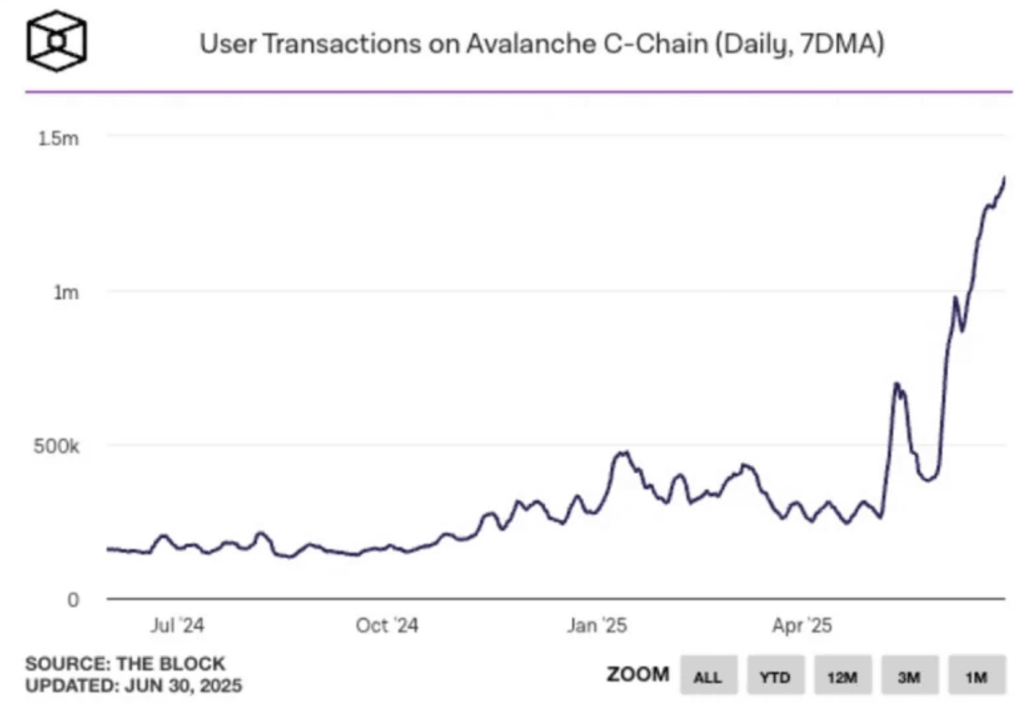

While price action’s been dragging its feet, Avalanche’s network has been on a tear. Daily C-Chain transactions just blew past 1.5 million—that’s not just some monthly spike, it’s an all-time high. And get this: that number doesn’t even include Avalanche’s subnets or other chains. Just C-Chain alone.

When on-chain use starts heating up before price moves, it’s usually a good sign. That kind of network demand tends to drag the price up with it eventually. It’s happened before… and we might be seeing it happen again.

The Real Test? $50 Resistance—and It’s Still in Sight

Let’s not get ahead of ourselves, though. $50’s still a stretch—but it’s not off the table. Analyst BullSignal points out that $50 marks a breakdown level from past cycles. It’s a sticky zone, yeah, but also a magnet. First, though, AVAX needs to handle business at $20, then grind past $24–$28. Only then do the bulls get a real shot at retesting $50.

Oh, and on the BTC pair? AVAX/BTC is hanging around a big trendline support that’s held for more than a year. If that level bounces, and AVAX gains strength versus Bitcoin, it could give the USD pair the extra gas it needs.

Final Thoughts

AVAX isn’t making headlines—yet. But between the wedge setup, the rising on-chain demand, and support levels holding firm, the pieces are definitely falling into place. If it clears resistance soon, don’t be surprised to see AVAX back in the $28 zone… or even making a move on $50 sometime this year.