- Avalanche bounced 9.26% after a brutal downtrend but still shows bearish indicators.

- On-chain activity is up 204%, yet trading volume remains low, hinting at fragile momentum.

- With most holders underwater, any rally could face heavy resistance from exit-hungry sellers.

Avalanche (AVAX) has been through a rough patch lately—no sugarcoating that. Since June 11, it’s dropped like a rock, losing about 26% in just under two weeks. But hey, there’s been a bit of a bounce. On Monday, the coin posted a 9.26% rally, giving holders at least something to smile about… for now.

What’s interesting is the behavior of smart money. Despite the downtrend, these seasoned investors are still holding their AVAX bags. Meanwhile, retail traders—less patient and probably more spooked—have started cashing out. Derivative traders are also piling into short positions, betting there’s more pain ahead.

On-Chain Signs: Uptick or Fakeout?

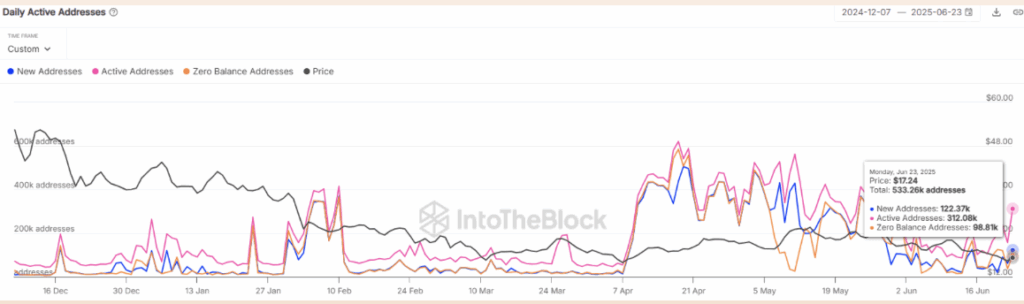

Looking at the chain data, activity is definitely picking up. Nothing close to April’s boom, but still—it’s heading in the right direction. The number of active addresses has jumped big time, up 204% in just seven days. That’s not nothing.

If this continues, demand for AVAX might rise too, which could help price recovery efforts. But that’s a big if. The trend is promising, sure, but let’s not get ahead of ourselves—price action is hinting at a bullish reversal, but nothing’s confirmed yet.

AVAX Chart Paints a Cautious Picture

Zooming into the daily chart, AVAX seems to be stuck in a range between $16 and $22.9. Right now, it’s bouncing off that lower bound—a level that held up back in March and April too. If the bulls stay in charge, we might see a push to the $19.5 mid-range. That’s the hopeful scenario.

But here’s the catch: momentum isn’t quite on their side. The Awesome Oscillator? Still bearish. OBV? Below its May low. Translation? Sellers still have the upper hand. If trading volume doesn’t pick up soon, that $19.5 resistance could slap AVAX right back down again.

And let’s not forget the big picture. Back in December 2024, AVAX was chilling around $54. Now? It’s at $18.1. That’s a brutal 66% haircut.

Bagholders Still Waiting to Break Even

According to IntoTheBlock’s metrics, nearly 66% of AVAX holders are underwater, while about 27% are just barely breaking even. That’s a lot of people who’d probably sell the moment price rallies enough to give them an exit.

Even if AVAX does claw its way up, expect lots of resistance—psychological and literal. Until Bitcoin dominance drops and money starts flowing back into altcoins, Avalanche holders might be in for a slow, choppy road.