- Wyoming and Japan both launched stablecoins on Avalanche, signaling global recognition.

- Corporations like Toyota and SkyBridge Capital are experimenting with Avalanche for RWA projects.

- AVAX looks undervalued relative to its growth, but competition and volatility remain key risks.

Avalanche has been quietly stacking wins across its ecosystem, carving out a growing niche in stablecoins and real-world asset (RWA) tokenization. While the broader crypto market wrestles with volatility, AVAX continues to see steady adoption—leaving many to wonder if its current price is a bargain hiding in plain sight.

One of the most notable developments came out of Wyoming, where the state launched the first-ever U.S. state-issued stablecoin—and chose Avalanche over Ethereum as the deployment network. Across the globe, Japan approved a yen-pegged stablecoin that’s also set to launch on Avalanche, signaling that institutional confidence in the chain isn’t just local, it’s international. These moves underscore how Avalanche is positioning itself beyond the typical DeFi use cases, pulling in recognition from governments and regulators alike.

Institutional Momentum Builds

The corporate interest is just as eye-catching. Toyota recently published a whitepaper on its Mobility Orchestration Network, a project that taps Avalanche as part of its new infrastructure strategy. Meanwhile, Anthony Scaramucci’s SkyBridge Capital revealed plans to tokenize $300 million worth of assets on Avalanche—strengthening the platform’s position in the RWA race.

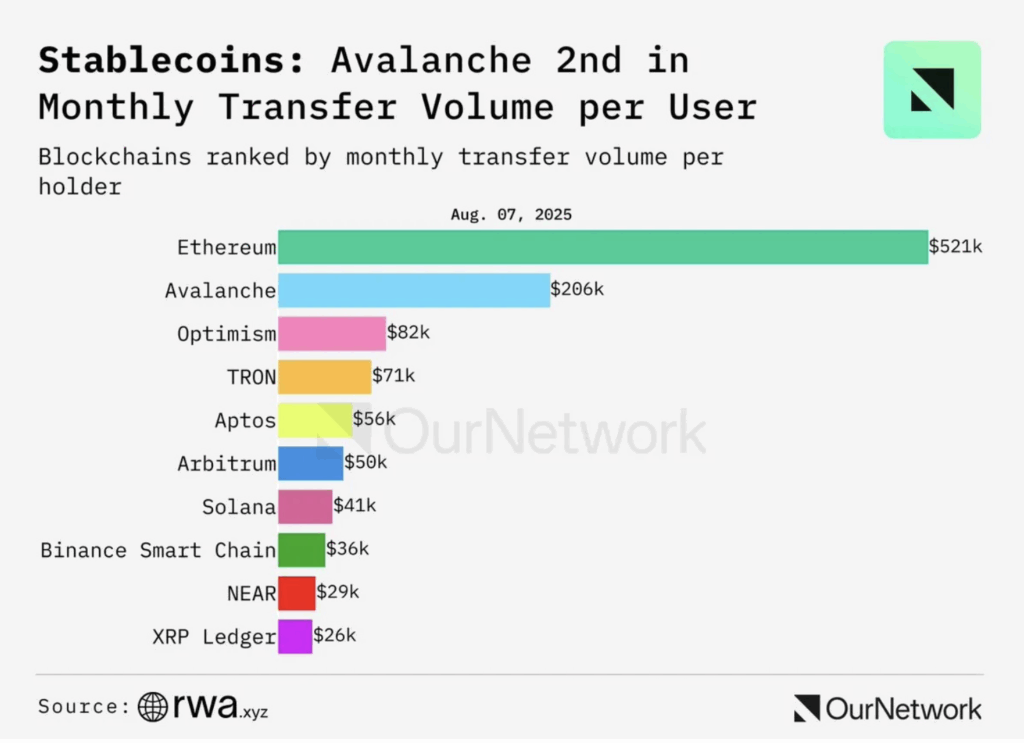

On-chain numbers back up the momentum. AVAX ranks second among blockchains in average monthly transaction volume per user, hitting $206,000 (Ethereum still leads with $521,000). The network also recently passed 50 million unique wallet addresses, with Nansen data showing Avalanche near the top in RWA-related development activity. Put simply, Avalanche is closing the gap with Ethereum across multiple fronts, but its valuation hasn’t quite caught up.

Undervalued or Overlooked?

Despite this growth, AVAX’s market cap remains modest compared to its peers. Many analysts argue it’s one of the most undervalued Layer-1s in the market today. As one user on X bluntly put it: “It’s actually embarrassingly cheap considering the developments of the last 12 months.” Between the regulatory tailwinds, corporate experiments, and on-chain expansion, there’s a case to be made that Avalanche hasn’t yet been priced fairly.

The Risks Still Linger

Of course, nothing comes without risks. The crypto market remains in a fragile spot, influenced by macro uncertainty and sharp volatility. Ethereum and Solana remain fierce competitors with larger ecosystems and more liquidity. Still, Avalanche has proven resilient, and if its ecosystem keeps expanding at this pace, AVAX could attract fresh capital inflows and eventually climb into a market position that better reflects its progress.