- TIS, Japan’s largest payments processor ($2T yearly), is launching a blockchain platform with Ava Labs.

- The platform, built on Avalanche’s AvaCloud, will tokenize stablecoins and assets under Japan’s Payment Act.

- AVAX forms a bullish falling wedge — holding above $11 could send it surging toward $30+.

Avalanche (AVAX) just landed one of its biggest partnerships yet — and it’s from Japan. TIS, one of the country’s largest payment infrastructure providers handling over $2 trillion annually, has teamed up with Ava Labs, the developers behind Avalanche, to launch a new blockchain-based payments platform. The Avalanche community is buzzing, seeing this as a much-needed boost for the AVAX ecosystem, though the token slipped 1% over the last 24 hours.

Japan’s TIS Pushes for On-Chain Financial Infrastructure

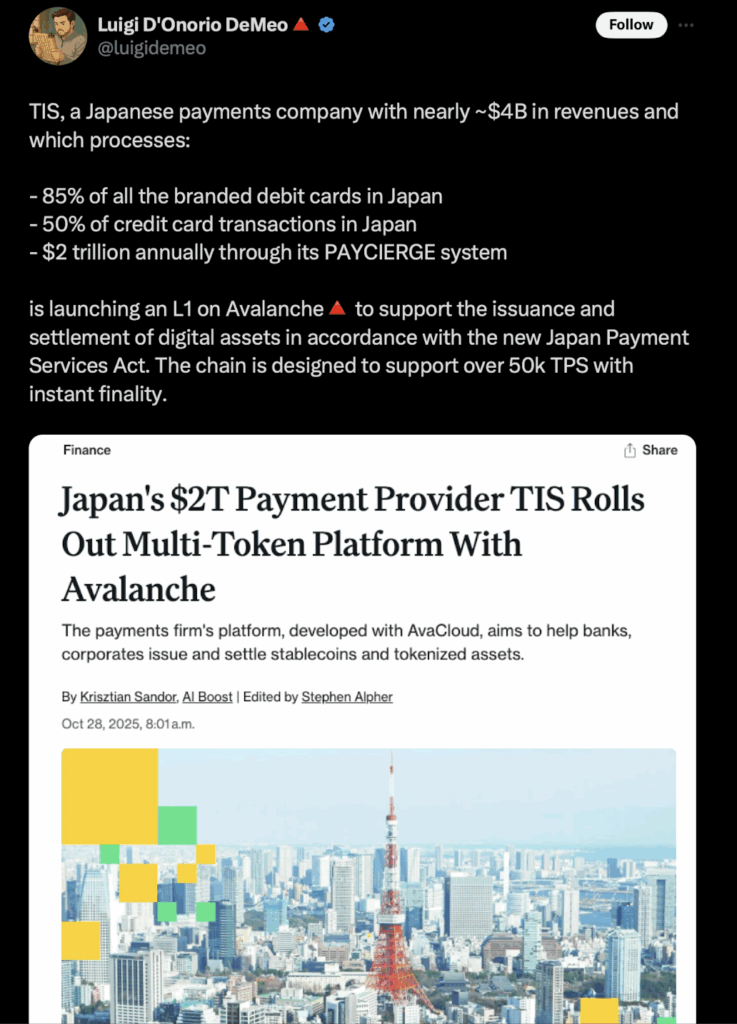

TIS is rolling out what it calls the “Multi-Token Platform”, built on AvaCloud, Avalanche’s enterprise blockchain suite. The platform is designed to help Japanese financial institutions issue, settle, and manage tokenized assets — everything from stablecoins to digital bonds — all under the Payment Services Act.

TIS plans to collaborate with banks, corporations, and even government agencies to scale this platform globally. The timing couldn’t be better, as Japan’s appetite for digital assets is heating up. Just this week, JPYC, the country’s first regulated yen-pegged stablecoin, launched with backing from bank deposits and government bonds.

For context, TIS processes roughly ¥300 trillion ($2T) a year through its PAYCIERGE network — a system that handles nearly half of all Japan’s credit card transactions. If successful, the new platform could reshape how institutions handle payments, replacing legacy systems with programmable blockchain rails.

Why This Partnership Matters for Avalanche

TIS isn’t just any company — it’s a publicly traded giant with a market cap around $1.2 trillion yen (~$8 billion USD). Partnering with Ava Labs gives the Avalanche ecosystem a massive institutional footprint in Asia. The deal will provide TIS with a dedicated Layer-1 blockchain, offering full control over privacy, governance, and performance, all powered by Avalanche’s network — capable of processing over 50,000 transactions per second with near-instant finality.

AvaCloud CEO Nick Mussallem highlighted that this platform could support real-time settlements, embedded finance, and even central bank digital currency (CBDC) testing down the line. If it works as intended, this could serve as the foundation for Japan’s broader move toward on-chain financial systems.

For the Avalanche community, this announcement feels like a breath of fresh air. The ecosystem — once seen as a top Layer-1 contender — has struggled to keep pace with faster-growing competitors like Solana, Base, and Ethereum. But a partnership of this scale could help reignite investor interest and bring new liquidity into the network.

Avalanche’s TVL Slips, But Chart Patterns Look Bullish

Despite the big news, AVAX price hasn’t reacted strongly yet, hovering around $23.5 after a small 1% decline. Total Value Locked (TVL) on Avalanche dropped below $2 billion recently, showing weaker ecosystem participation — a reminder that this network still has ground to recover.

Still, the technical outlook isn’t all bad. On the monthly chart, AVAX appears to be forming a falling wedge pattern, a structure that often precedes breakouts. As long as the price stays above $11, the bullish setup remains valid. If momentum picks up, a breakout above $23.5 could trigger an explosive rally toward $30–$32.

Momentum indicators are starting to align too — the RSI recently broke out, and the MACD flipped bullish, both signaling the potential for a strong move ahead. With the FOMC meeting expected to bring a 25bps rate cut, risk-on assets like crypto could see renewed volatility — and AVAX might be among the biggest beneficiaries.

Final Thoughts: Can Avalanche Reclaim Its Spot Among Top Layer-1s?

Avalanche’s new partnership with Japan’s $2T payments powerhouse TIS could mark a turning point for the network. If this blockchain platform proves successful, it could help AVAX reclaim lost ground and re-establish itself as a major Layer-1 contender.

With global finance shifting toward tokenization and programmable settlement systems, Avalanche’s bet on institutional-grade infrastructure might finally start paying off. The charts suggest a breakout could be brewing — and the fundamentals just got a serious upgrade.