- AVAX reclaims $20 support, rising over 5% with strong trading volume.

- Bullish structure forms with higher highs and lows; targets $24–$27.

- Avalanche’s network metrics surge, reinforcing investor confidence and long-term upside potential.

Avalanche is finally heating up again. After weeks of choppy sideways movement, AVAX has started showing signs of strength, reclaiming the $20 support and edging higher. Traders are taking notice, and sentiment across the market seems to be shifting back in favor of this Layer-1 heavyweight.

At the time of writing, AVAX is trading around $20.87, up more than 5.6% in the past 24 hours, according to Brave New Coin. That push comes with strong trading activity — over $558 million in daily volume — and a market cap nearing $9 billion. The rebound from $19.8 has built a short-term uptrend that suggests early accumulation by buyers near key zones of support.

AVAX Price Structure Flips Bullish

Technically, things are looking much better. After multiple rejections between $18.50 and $19.00, AVAX is finally starting to push higher. A clean breakout above $21.50 could open the door to $23–$24, where earlier supply zones sit. On shorter timeframes, the chart has been printing a series of higher lows, hinting that momentum is slowly shifting from consolidation to expansion — if volume keeps up.

Analysts from Crypto Chiefs highlighted that AVAX has printed a higher low (HL) near $19.8 and a higher high (HH)around $21.2 — classic signs of a bullish structure forming. If the $20 region continues to hold firm, price targets line up with the $23.40–$24 range, which could trigger a stronger breakout toward $27 in the coming weeks. For now, that higher-low structure is the bulls’ best proof that the reversal is real.

On-Chain Growth Adds Fuel to the Rally

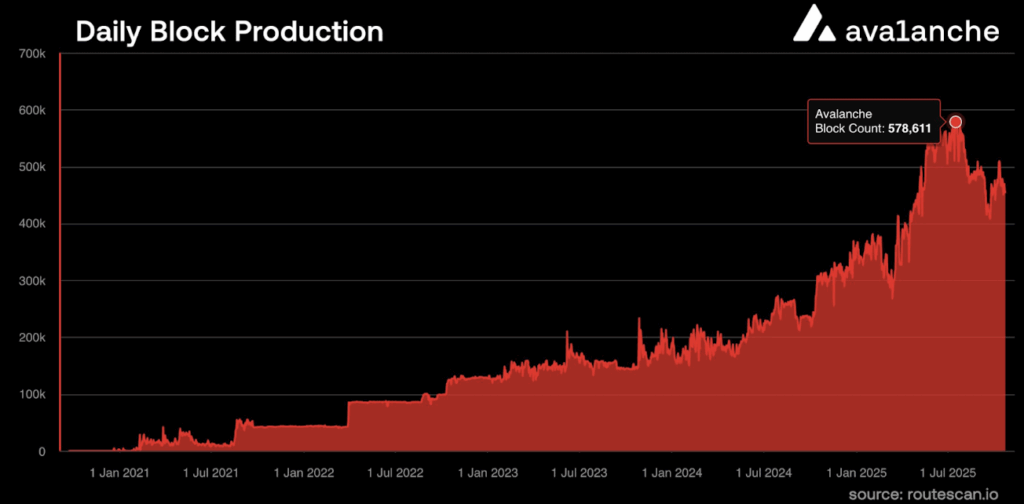

Avalanche’s fundamentals are backing the move too. On-chain data shows the network’s performance has improved significantly, with block production doubling compared to last year. Over 578,000 blocks are now produced daily — a sign of strong validator activity and scaling efficiency.

This uptick in network performance builds investor confidence. More on-chain activity often translates to higher demand for the AVAX token, and it supports the idea that this rally isn’t just speculation. It’s also worth noting that Avalanche’s DeFi ecosystem continues to grow, giving the token stronger long-term fundamentals to lean on.

Long-Term Chart Still Looks Constructive

Despite the recent dips, Avalanche’s bigger picture remains positive. According to analyst Sheldon The Sniper, the broader chart shows a steady accumulation zone between $19.4 and $21.2, where every dip has been absorbed quickly by buyers. The descending trendline that’s capped prices since midyear has finally been broken — a potential shift toward full structural recovery.

Any pullback into the $19.5–$20 range would still be healthy and could even act as a springboard for the next leg higher. Analysts have their eyes on $24.14 as the first big resistance level, followed by $27–$30 if bullish momentum continues into Q4 2025.

Final Thoughts: Avalanche’s Momentum Is Back

Between its improving on-chain metrics, solid technical structure, and renewed market attention, Avalanche looks ready for its next leg up. Holding above $19.5 keeps the short-term bullish setup intact, while reclaiming $23–$24 would confirm a full trend reversal.

If network activity continues to climb and volume stays consistent, AVAX could be gearing up for a strong breakout — one that might define its Q4 performance and set the tone for 2025.