- Aster plans to launch its Layer 1 mainnet in March 2026

- The project is endorsed by Binance founder Changpeng Zhao

- The chain will power onchain perps, governance, staking, and real-world asset markets

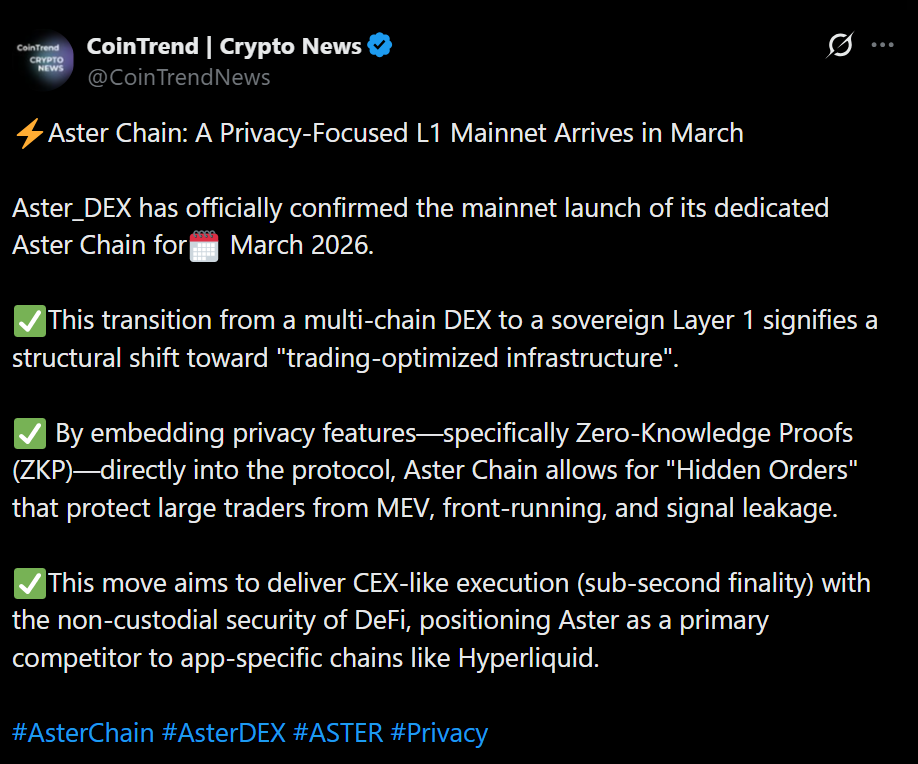

Aster, a decentralized perpetual exchange endorsed by Binance founder Changpeng Zhao, has announced plans to launch Aster Chain’s mainnet in March. The update, shared on X, marks a major milestone in the project’s 2026 roadmap and signals a shift from experimentation to production infrastructure.

The Layer 1 testnet went live in early February 2026 after initial whitelisted testing in late 2025. More than 50,000 participants joined across test phases, suggesting early traction is real, not just theoretical. The mainnet launch will effectively transition Aster from a perps app running on borrowed rails to a chain with its own dedicated base layer.

Why a Dedicated Layer 1 Matters

Instead of remaining purely an application-layer decentralized exchange, Aster is building its own network to support onchain trading products, developer tools, and integrated fiat onramps and offramps. That’s an ambitious pivot. Running your own chain allows deeper control over execution speed, fees, and product design.

For perpetual trading platforms, infrastructure flexibility is crucial. Perps require tight liquidity mechanics, fast settlement, and risk management logic that can’t lag. Owning the base layer gives Aster more room to optimize for derivatives trading specifically, rather than competing for blockspace on generalized networks.

Community Governance and Token Utility

Aster’s 2026 roadmap emphasizes community-driven upgrades to its decentralized exchange. Governance features powered by the native token are expected to play a central role. Staking, onchain participation, and proposal mechanisms are all part of the plan, reinforcing the project’s push toward decentralized coordination.

That’s not just branding. Governance tokens tied to real protocol revenue and trading activity can anchor long-term participation. If users trade, stake, and vote within the same ecosystem, retention tends to strengthen, especially in derivatives markets where loyalty can be thin.

Expanding Beyond Crypto Perpetuals

One of the more notable goals for Aster is expanding into real-world asset exposure, including stock perpetual markets. That signals a move toward synthetic trading beyond pure crypto pairs. If executed properly, it would position Aster closer to platforms offering tokenized derivatives that track traditional assets.

This hybrid model, crypto-native infrastructure supporting synthetic access to offchain markets, is becoming a clear theme in the derivatives space. Traders increasingly want unified access without jumping between centralized brokers and decentralized protocols.

The Bigger Competitive Context

Perpetual DEX competition is intensifying, and Binance’s implicit endorsement adds visibility. But infrastructure alone won’t guarantee adoption. Liquidity depth, incentives, and execution quality will ultimately determine whether Aster Chain can compete with established onchain perps leaders.

Still, moving to a dedicated Layer 1 is a signal of long-term ambition. Aster isn’t positioning itself as just another perps venue. It’s attempting to build a vertically integrated derivatives ecosystem with governance, staking, and synthetic market expansion built in from the ground up.