- Aster hit a record $2.14 before easing back to $1.95–$2.00 support.

- Trading volume surpassed $11B, while TVL soared to $1.6B, showing rapid adoption.

- Key levels to watch: $1.90 support and $2.14 resistance for the next breakout.

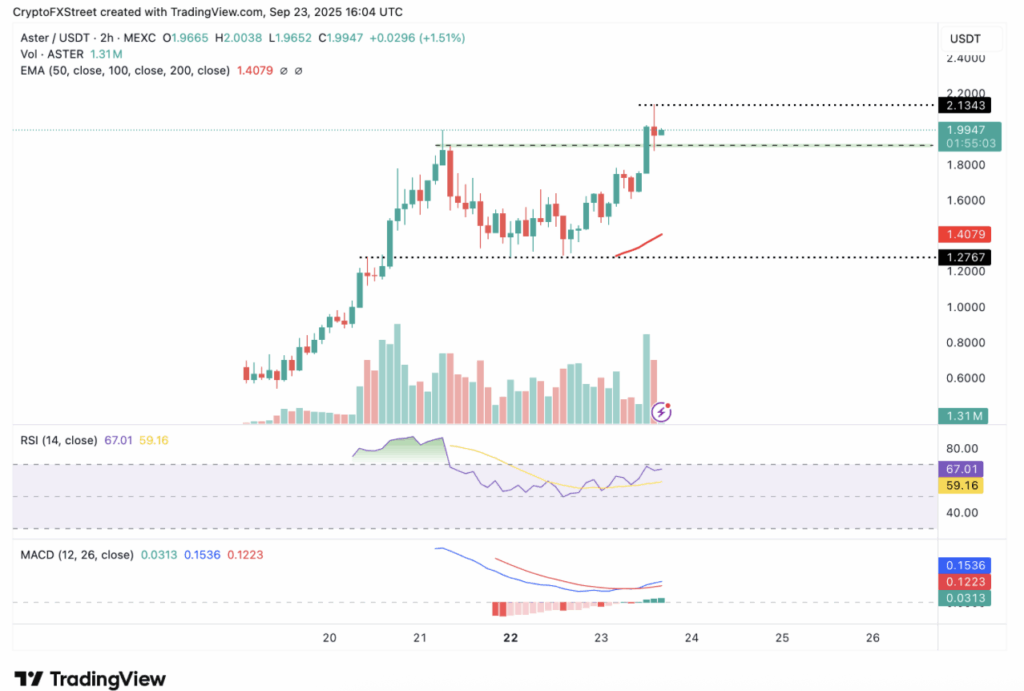

Aster (ASTER) made headlines after shooting up to a fresh all-time high of $2.14, only to ease back just under the $2.00 mark on Tuesday. The token, which fuels the Aster decentralized exchange (DEX) for perpetuals on Binance, has quickly become one of the most-watched names in DeFi. Backed by YZi Labs—formerly known as Binance Labs—the project is flexing serious muscle for such a young platform.

Explosive Growth in Trading and TVL

In just days of going live, Aster’s perp DEX volume rocketed past $11 billion, highlighting its rapidly growing adoption. The platform’s website reports a staggering $544 billion in cumulative trading volume already, with more than 524,000 users plugging in. Open Interest has climbed to roughly $255 million, while staking and DeFi activity keep fueling momentum.

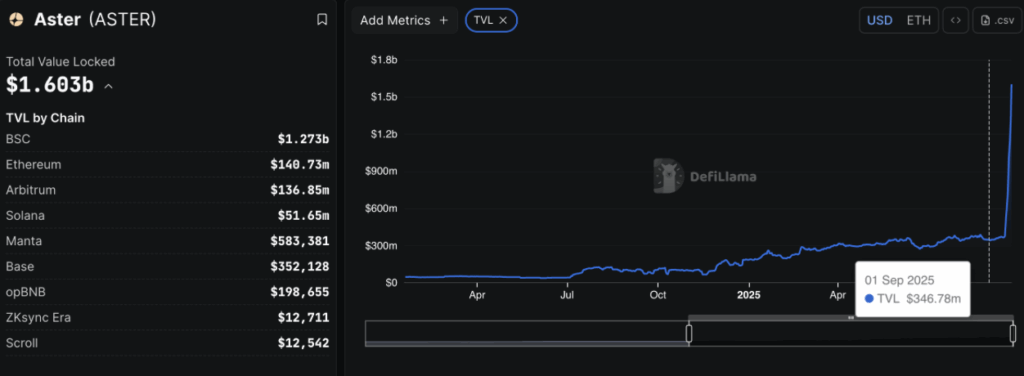

According to DefiLlama, Aster’s Total Value Locked (TVL) has hit $1.6 billion—up massively from just $347 million on September 1. That’s nearly a 5x leap in less than a month, showing that users aren’t just trading, they’re locking funds in and sticking around.

Technical Picture: Bulls Still in Control?

Right now, Aster is hovering near $1.95–$2.00. The $1.90 zone has emerged as short-term support, helping buyers defend against dips. On the charts, momentum is still tilted in favor of the bulls. The MACD, while flashing a short-term sell signal earlier, hasn’t dampened overall confidence. If traders pile in on these pullbacks, a fresh move over $2.00 looks likely.

The RSI sits around 68—closing in on the overheated 70+ level. That suggests strength but also a caution flag, since overly stretched conditions often bring a round of profit-taking. Traders are watching two main zones: the record $2.14 high on the upside, and the $1.90 support on the downside. Whichever breaks first could dictate Aster’s next short-term trend.

The Bottom Line

Aster’s fundamentals look strong, with surging trading volume, record TVL, and rising user growth backing the hype. Price action might wobble in the near term if RSI overheats or sellers push under $1.90, but the bigger picture suggests bulls are still steering the ship. A decisive break above $2.14 would set the stage for another leg higher, while failure to hold support risks a sharper pullback before the next run.