- Bitwise has officially filed for an ETF that would track the price of Aptos (APT).

- The company submitted an S-1 filing and still needs a 19b-4 form for SEC approval.

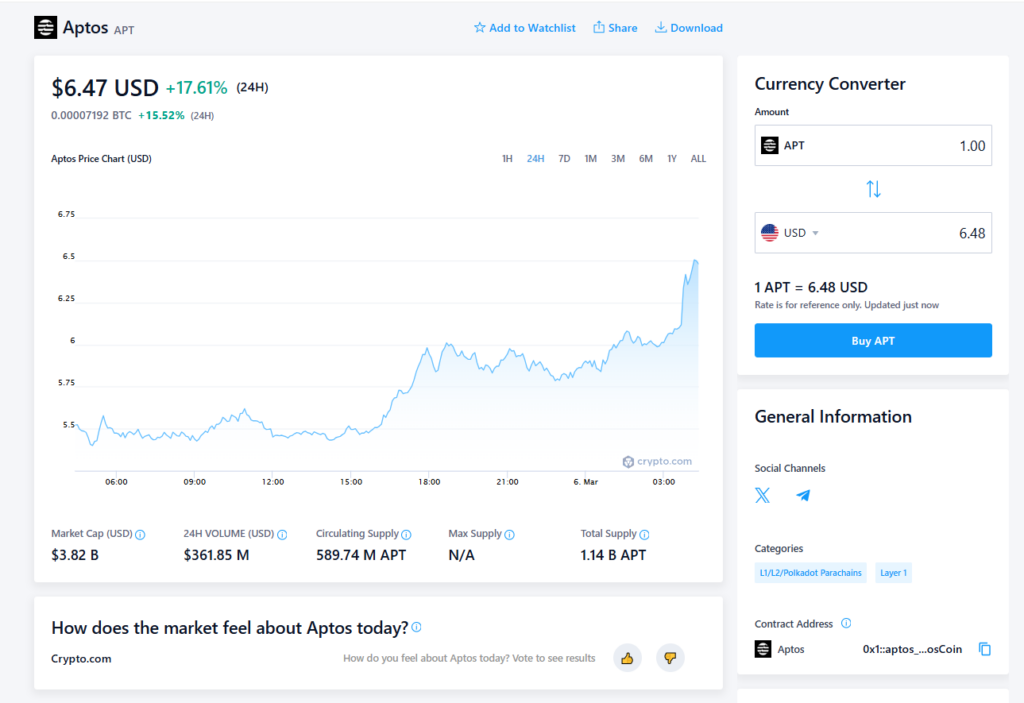

- APT surged 18% to $6.48 following the news, with investors eyeing potential adoption growth.

Bitwise is making moves—official ones. The asset manager has just filed paperwork for an exchange-traded fund (ETF) that would track the price of Aptos (APT), the native token of the Aptos network.

What’s the deal?

Last week, Bitwise dropped a hint by registering a Delaware trust entity for a potential Aptos ETF. Now, it’s putting that plan into motion. On Wednesday, the company submitted an S-1 filing with the Securities and Exchange Commission (SEC), a necessary step for launching a new security on a public stock exchange.

APT is a scalable Layer 1 blockchain token built on the Move programming language, designed for speed and efficiency. If approved, the ETF would allow traditional investors to gain exposure to Aptos without needing to hold the token directly.

But there’s one more step—Bitwise will also need to file a 19b-4 form. This filing signals a required rule change at the stock exchange planning to list the ETF, which then forces the SEC to operate on a strict timeline for approval or rejection.

Market Reaction

Following the announcement, APT surged 18% in the past 24 hours, climbing to $6.48 at press time. Investors seem to be betting that this ETF, if approved, could be a game-changer for Aptos adoption.

Now, all eyes are on the SEC. Will they greenlight another crypto ETF, or will regulatory hurdles slow this one down? Either way, the Aptos community is watching closely.