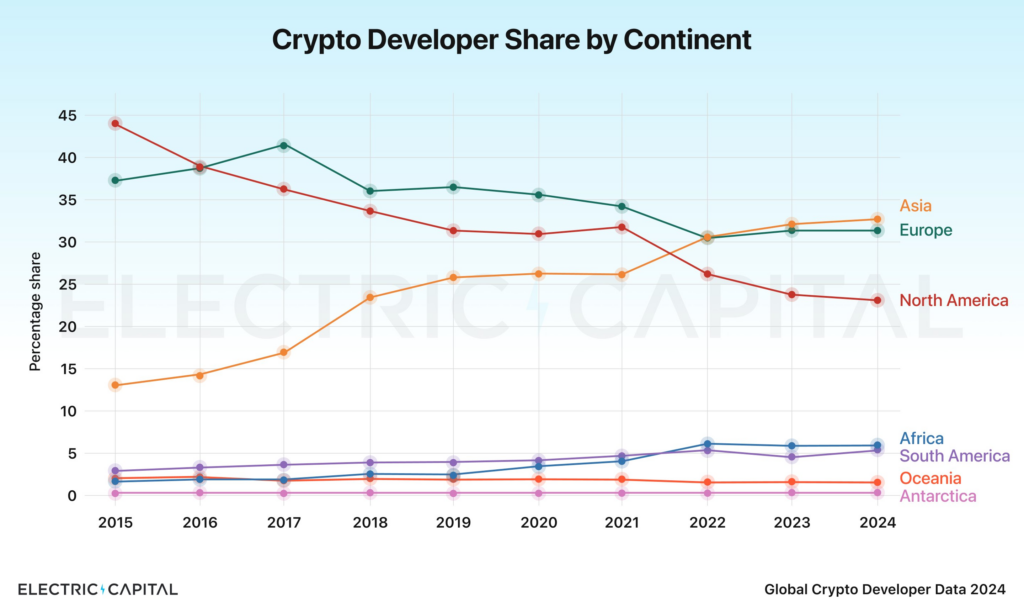

- Asia’s share of global cryptocurrency developers surged to 32% in 2024, surpassing North America

- The U.S. share of developers dropped by more than half since 2015, down to 24%

- Despite a decline, the U.S. still holds the largest individual share of developers at 18.8% globally

A recent report highlights Asia’s rise as the leading region for cryptocurrency and blockchain developer talent, surpassing North America. In 2024, Asia’s share of developers grew to 32%, up significantly from 13% in 2015. This shift indicates Asia’s increasing influence in blockchain innovation and development.

Electric Capital general partner Maria Shen shared these insights in an October 30 post, noting that North America’s developer share dropped to 24%, down from 44% in 2015. Shen emphasized that the trend reflects a critical shift in the global tech landscape, stating that cryptocurrency development impacts all U.S. states and should be viewed through a non-partisan lens.

Source: Maria Shen on X

U.S. Developer Share and Distribution

Although the U.S. still hosts the largest number of individual blockchain developers, the report shows a significant reduction in its share, falling by over 50.9% since 2015. The U.S. currently accounts for 18.9% of the global total, followed by India with 11.9% and the United Kingdom at 4.2%. The study found that within the U.S., California remains the primary hub, housing 22.4% of the country’s crypto developers, while New York follows with 13.8%. However, 63.8% of U.S.-based developers are located outside these two states.

The research analyzed data from more than 200 million crypto-related GitHub commits across 350,000 repositories and over 110,000 developer wallets with self-reported locations.

Institutional Growth and Crypto Interest in Asia

The growing developer presence aligns with increasing institutional interest in cryptocurrencies in Asia. For instance, South Korea reported a 20.9% rise in crypto investors during the first half of 2024. This surge contributed to a significant increase in operational profits for the top 21 local centralized exchanges, totaling $4.2 billion—a 105.7% increase compared to the previous year.