- Trump’s Tariff Strategy: Aimed at reviving U.S. manufacturing and reducing debt, Trump’s sweeping import tariffs (10% baseline) are a bold economic move—but risk triggering global trade wars and rising inflation.

- Impact on Tech & Crypto: Tech firms like Apple and Nvidia could face higher costs due to tariffed components, while crypto mining operations may suffer from pricier imported equipment and shaken investor confidence.

- Public & Market Reaction: Investors and consumers are bracing for turbulence—some joking, others genuinely worried—as the U.S. enters uncertain territory with high-stakes economic and geopolitical consequences.

Trump’s tariffs on global imports have once again made headlines. On one hand, the president claims that these measures will invigorate American manufacturing, bringing jobs back to the U.S. On the other, critics warn that such a drastic move could plunge the economy into turmoil. But things are not really as black and white as they seem. So, let us break it down.

The Problem

The U.S. is staring down an enormous $9.2 trillion debt that needs refinancing by 2025. With inflation still stubbornly high and yields pushing up costs, Trump’s team is trying to pull a rabbit out of the hat. Simply cutting rates won’t be enough to fix the problem. For example, a 0.5% reduction in rates could save about $50 billion over the next decade, but that is not nearly enough to solve the debt crisis. The situation is dire, and with the clock ticking, the Trump administration is looking for drastic measures, as every option on the table seems to carry heavy risks.

The Idea Behind the Tariffs

In an effort to manage the U.S.’s massive debt, Trump’s team is playing a high-risk game—using tariffs to stir market uncertainty. The core idea revolves around a simple premise that by making foreign goods more expensive, consumers would shift towards American-made products, boosting domestic industries. At the same time, the tariffs generate revenue that could help alleviate the national debt.

Beyond economics, tariffs serve as a geopolitical maneuver, pressuring trade partners to lower their own barriers. It is a bold move, aiming to either revive American manufacturing or risk deepening trade tensions and economic instability.

Liberation Day and Tariffs

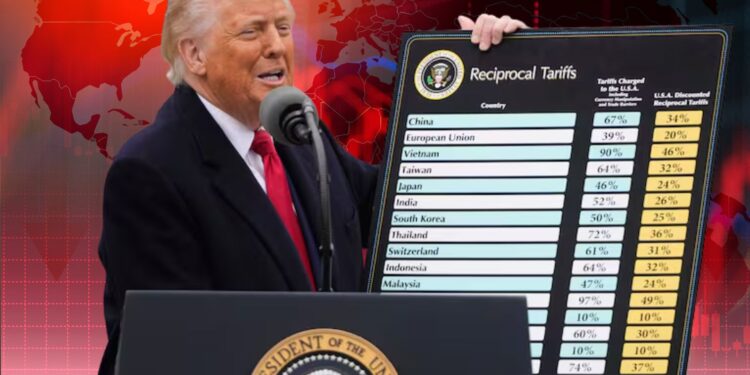

April 2nd was officially dubbed “Liberation Day” by Trump, marking the announcement of sweeping tariffs on imports from nearly all U.S. trading partners. According to the President, this was a day to “liberate” American workers from the shackles of unfair foreign trade practices. Essentially, the tariffs include a 10% baseline tax on all imports, with even higher rates for countries seen as unfairly targeting U.S. goods.

However, this aggressive stance has already triggered retaliatory tariffs from other nations, escalating the situation. So, while Trump frames this as a strategy to empower U.S. industries, the risks are high. These moves could lead to a series of tit-for-tat actions, potentially sparking a global trade war with far-reaching consequences.

What this Means for the Tech and Crypto Industry?

Currently, the tech industry is bracing for impact. Tariffs on imported components like semiconductors and electronics are driving up production costs, which could translate to higher prices for consumers. Companies reliant on global supply chains face disruptions, and innovation may slow as resources are diverted to manage these challenges. This means that major companies such as Apple, Nvidia, and Intel, which rely heavily on overseas supply chains, may find their profit margins squeezed, forcing them to either raise prices or absorb the cost hikes, which could harm their competitive edge.

In the crypto world, the effects are more indirect. Economic uncertainty fueled by tariffs could dampen investor confidence in riskier assets like crypto. Meanwhile, mining operations, heavily reliant on imported equipment, may see profitability decline. Overall, both industries are navigating uncharted waters, with long-term adaptation likely to come at a steep cost.

What’s the Reaction Like?

With these tariffs in action, we go from WAGMI (We All Going to Make It) to NOGMI (No One Is Going to Make It), and it is apparent that many are feeling the anxiety. Investors are already expressing concerns, with one remarking, “My 401k has been liberated from any chance of gains this decade”.

Consumers are preparing for sky-high prices, joking about $100,000 Honda Civics, while others voice concerns over the long-term economic fallout. Essentially, the mood is a mix of frustration, humor, and fear, as the tariff policy takes center stage, with the stakes higher than ever.

Final Thoughts

In conclusion, Trump’s tariffs have set the stage for a high-stakes gamble that could reshape both domestic industries and global trade dynamics. It is also important to highlight that while the administration aims to revive U.S. manufacturing and alleviate the crushing national debt, the risks—trade wars, inflation, and supply chain disruptions—are significant.

All in all, the next few months will be crucial in determining whether these bold moves can succeed, or if they will spiral into a global economic crisis. Either way, the world is watching closely as the U.S. charts a new and uncertain path in global trade.