- Large ETH holders (10k–100k ETH wallets) have been accumulating since early 2025, indicating strong institutional positioning before retail hype.

- Sentiment flipped from fear in April ($1,450 ETH) to a 2:1 bullish ratio by late July, with momentum building on healthier, less frothy optimism.

- Analysts like Tom Lee predict ETH could hit $10K–$15K, driven by ETF inflows, institutional adoption, and AI infrastructure growth.

Ethereum seems to be gearing up for something bigger, and it’s not just hype. On-chain data from Santiment shows that big wallets, holding anywhere from 10,000 to 100,000 ETH, have been quietly stacking coins since early 2025. This kind of activity usually points to serious institutional players moving in before the retail crowd gets loud.

What’s interesting is that this wave of accumulation isn’t happening in isolation. Social chatter around ETH has been climbing too, but the tone feels more like calculated optimism than reckless FOMO. Santiment suggests that Ethereum, for once, isn’t just trailing behind Bitcoin. Its market value ratio against BTC has jumped about 64%, hinting that ETH is carving its own lane in this rally.

Sentiment Turns the Corner

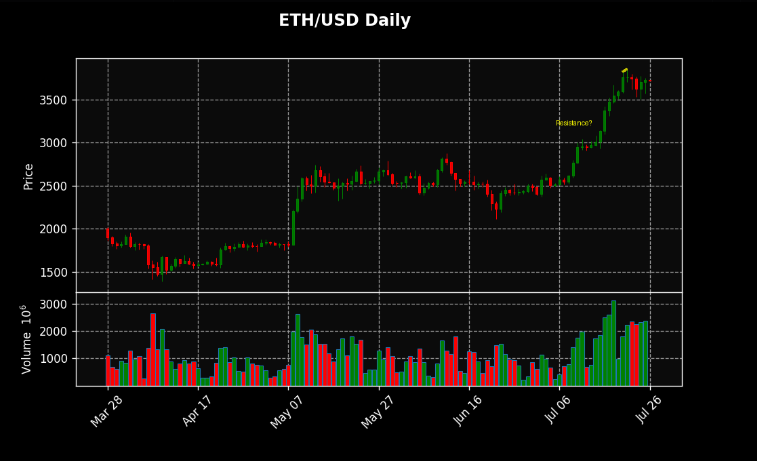

At the start of April, when ETH sank to $1,450, the mood was… let’s just say grim. Across X, Reddit, and Telegram, bearish comments were outweighing bullish ones, roughly 5 to 3. It looked like nobody wanted to touch it. But, as history tends to show, fear often sets the stage for the next breakout. By late July, sentiment had swung sharply—traders were leaning 2 to 1 in favor of a bullish outlook.

This turnaround is pretty telling. While some FOMO vibes are creeping in, the crowd isn’t overly euphoric yet. Back in mid-June, bullish sentiment spiked to a frothy 3.5 to 1 ratio. Compared to that, the current mood feels more grounded. This kind of tempered optimism might actually be what ETH needs for a more sustainable rally instead of another quick pump-and-dump run.

Independent Strength Building

One of the key shifts in this cycle is how Ethereum is breaking away from Bitcoin’s shadow. In past years, ETH’s price action almost mirrored BTC, but now it’s moving with its own momentum. Analysts see this independence as a sign of growing maturity in the Ethereum ecosystem, especially with factors like institutional staking and ETH’s role in powering DeFi and AI-linked projects.

The foundation looks solid, and if the social buzz cools just enough, the next wave up could be significant. Institutional players seem to be betting on this too, given the steady accumulation. It’s like they’re setting the stage for something bigger while retail traders are still catching their breath.

The Road to $10K?

Adding to all this optimism, Tom Lee from Fundstrat has thrown in a bold prediction—he believes ETH could hit somewhere between $10,000 and $15,000. His reasoning? ETF inflows, rising institutional demand, and the growing intersection between Ethereum’s infrastructure and AI tech. While those numbers sound ambitious, the combination of strong on-chain data and moderating sentiment suggests that the path upward might not be as far-fetched as it sounds.