- Retail sentiment and smart-money confidence flipped bullish together as ADA retests channel support, boosting the odds of a rebound attempt.

- Strong Taker Buy CVD, top-trader long positioning, and rising short liquidations point to growing buyer aggression beneath the surface.

- ADA aims for a move toward the mid-channel region around $0.53 if momentum holds, though the broader trend still depends on breaking out of its falling channel.

Cardano’s sentiment backdrop has taken a pretty noticeable turn lately, with both retail traders and so-called smart-money players leaning bullish at the same time—something that honestly doesn’t happen very often. Retail optimism has been climbing slowly, almost cautiously, while smart-money sentiment has flipped sharply positive in a way that tends to matter more. These two groups hardly ever sync up, so when they do, it usually hints that confidence is forming near a key accumulation zone.

The timing also feels strangely aligned, coming right as ADA retests the lower edge of its falling channel. Sentiment alone doesn’t guarantee a full trend reversal, of course, but it does reinforce the idea that the structure beneath the price is improving. It’s the kind of environment where rebounds don’t look so far-fetched anymore.

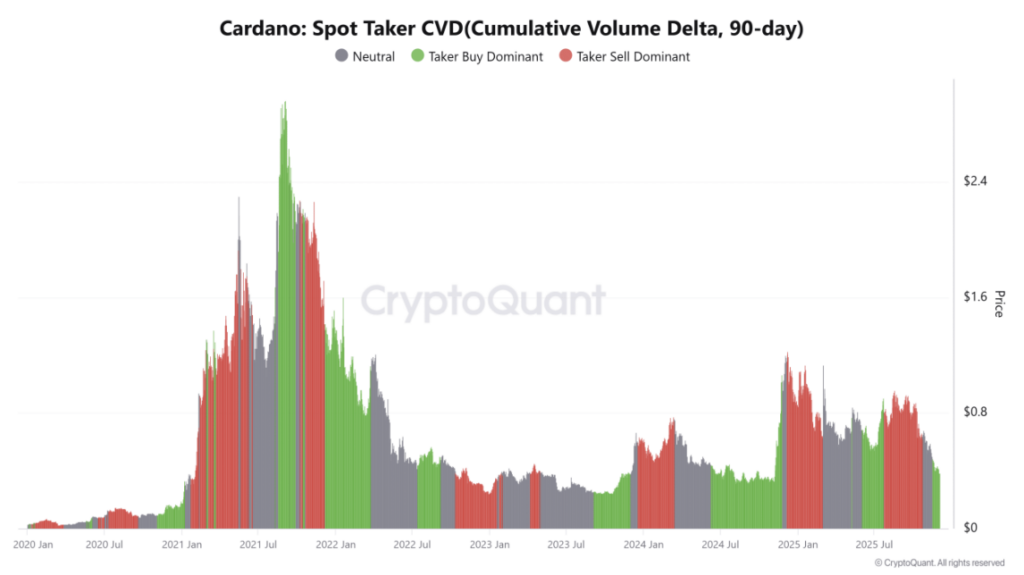

Taker Buy CVD Shows Strong Buyer Aggression

The Taker Buy CVD metric has been climbing for almost 90 days straight, signaling that buyers have been quietly absorbing sell pressure even while ADA stayed stuck inside a descending channel. It’s unusual behavior—buyers stepping up their bids instead of letting the trend drift into deeper weakness.

This kind of steady accumulation often shows up right before relief rallies, especially when price sits near support. And right now, that’s exactly where ADA is—pressing against the lower boundary of its channel and trying to bounce. The consistent buyer aggression also tells us that confidence is building despite the messy volatility over the last few weeks. Combined with the improving structure, it adds one more reason to expect upside attempts.

In short, order-flow strength continues steering the bullish case forward.

Top Traders Lean Heavily Toward Longs

On Binance, the top-trader Long/Short Ratio shows a pretty dominant tilt toward long positions—almost 70% of high-value accounts are positioned for upside. That’s a level of conviction you don’t see every day, especially when an asset is hovering near support rather than mid-trend.

Even more telling, the ratio kept rising before ADA’s latest bounce attempt, suggesting traders were quietly positioning early. When you match that with CVD strength, positive crowd sentiment, and smart-money bullishness, the alignment becomes hard to ignore. Multiple independent signals now point in the same direction, and traders are watching closely to see whether all this positioning finally turns into real momentum.

ADA Attempts a Rebound Inside Its Falling Channel

Cardano remains inside its multi-month falling channel, but price is once again reacting from the lower boundary—this time around the $0.37 region. The chart shows a clean bounce forming, and the MACD is starting to curl upward, hinting at improving momentum. It’s not confirmation of a trend reversal just yet, but the early signs are definitely there.

If ADA can maintain strength, the next logical target sits near the mid-channel zone around $0.53. The structure is clean and gives traders a straightforward roadmap: hold support, tap mid-channel, and reassess. Momentum, sentiment, and order flow all support this rebound attempt, making it more meaningful than a random bounce.

Short Liquidations Add Fuel to the Setup

Liquidation data shows shorts getting wiped out more aggressively than longs during ADA’s recent move. It isn’t a huge liquidation event—nothing like past spikes—but the imbalance still adds fuel to the early rebound. When short positions get forced out at support, it often accelerates upward movement, especially inside a defined channel.

With ADA pressing against structural support, this small wave of liquidations fits perfectly into the broader setup. Rising liquidation pressure toward the downside often marks early momentum shifts. Traders now wait to see if follow-through strength appears in upcoming sessions.

Final Thoughts

ADA now sits at a pretty critical point where sentiment, positioning, order flow, and price structure are all finally pointing in the same direction. The falling channel still controls the big picture—that hasn’t changed. But the pressure underneath it is turning bullish. If momentum continues building, Cardano looks ready for a breakout attempt toward the mid-channel region in the sessions ahead.