- Aave’s DAO treasury just hit an all-time high of $125M, marking a 123% yearly jump.

- ETH’s rise could drive increased borrowing, boosting Aave’s fee revenue and usage.

- On-chain activity is ticking up, hinting at early momentum for a potential breakout.

If you’re watching DeFi right now, Aave [AAVE] just threw out a big signal—it’s not one to ignore. On July 20th, the protocol’s DAO treasury (excluding its own AAVE tokens) climbed to a record-smashing $125 million. Yep, that’s a wild 123% increase compared to where it was just a year ago.

And it’s not just the number that’s turning heads—it’s how they got there. This treasury boom shows that Aave knows how to stack revenue and hold onto value, even when the crypto waters get choppy.

Now, let’s peek under the hood: 44% of Aave’s DAO treasury sits in stablecoins, 41% is locked in ETH, and the rest—about 15%—is sprinkled across various DeFi tokens. It’s a smart mix. Balanced, but still fully plugged into the crypto current. No reckless aping, just tactical allocation.

Why ETH’s Rise Could Be Aave’s Boost

So here’s where it gets even more interesting—Ethereum. ETH’s been on a tear lately, and that momentum could seriously power up Aave. Historically, when ETH rallies, folks get more active with borrowing. And where do they go? Platforms like Aave, which lets them borrow against ETH as collateral.

As that borrowing demand spikes, Aave earns more in protocol fees—and those fees? They go straight into bolstering its value. Basically, ETH pumping = more action = more income for Aave. A pretty tidy feedback loop, if you ask me.

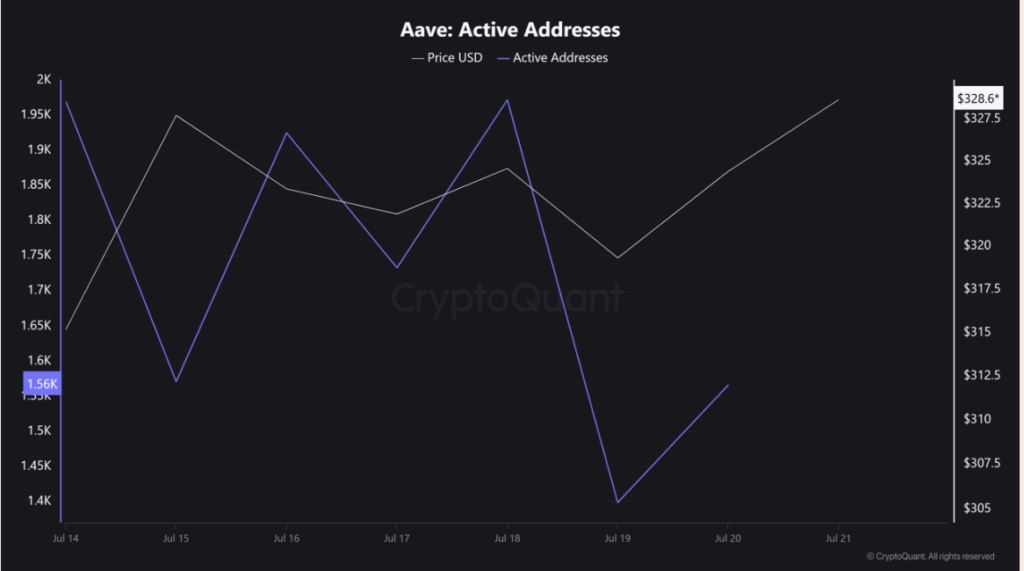

And it’s not just speculation. According to Token Terminal, Aave’s seen a noticeable uptick in active addresses over the last 24 hours. It’s not moon mission stuff yet, but growing on-chain activity usually means something’s brewing.

Something’s Stirring—But Is It the Breakout?

Look—it’s still a bit early to call a full-blown breakout. But the pieces? They’re falling into place.

You’ve got a treasury flexing hard, ETH lighting up the charts, and user engagement starting to bubble. If Aave leans into this—maybe rolls out some smart upgrades or tweaks incentives a bit—it could seriously take off from here.

So, keep it on your radar. Because when all the fundamentals line up like this, things can move fast in DeFi.