- AAVE is down over 50% since late December amid heavy selling and market weakness.

- A governance dispute between Aave DAO and Aave Labs has added uncertainty.

- A broader market rebound, potentially led by Bitcoin, may be key to recovery.

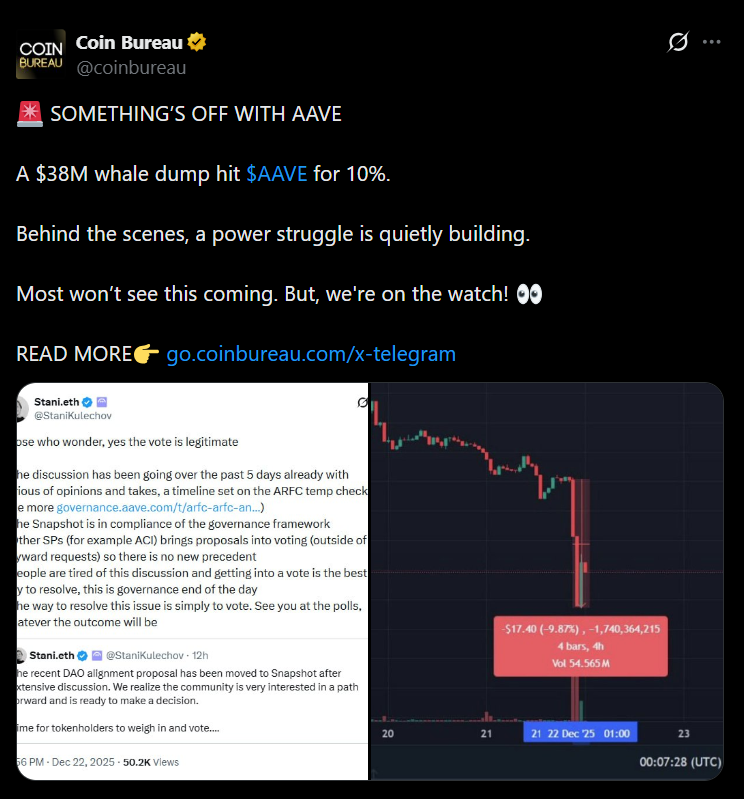

Aave is facing a rough stretch as internal governance tensions collide with a broader market downturn. The token recently suffered a sharp selloff after a whale offloaded roughly $38 million worth of AAVE, triggering a sudden 10% drop, according to Coin Bureau. While prices have clawed back slightly since then, the damage is still visible across higher timeframes.

Price Weakness Reflects Market and Internal Stress

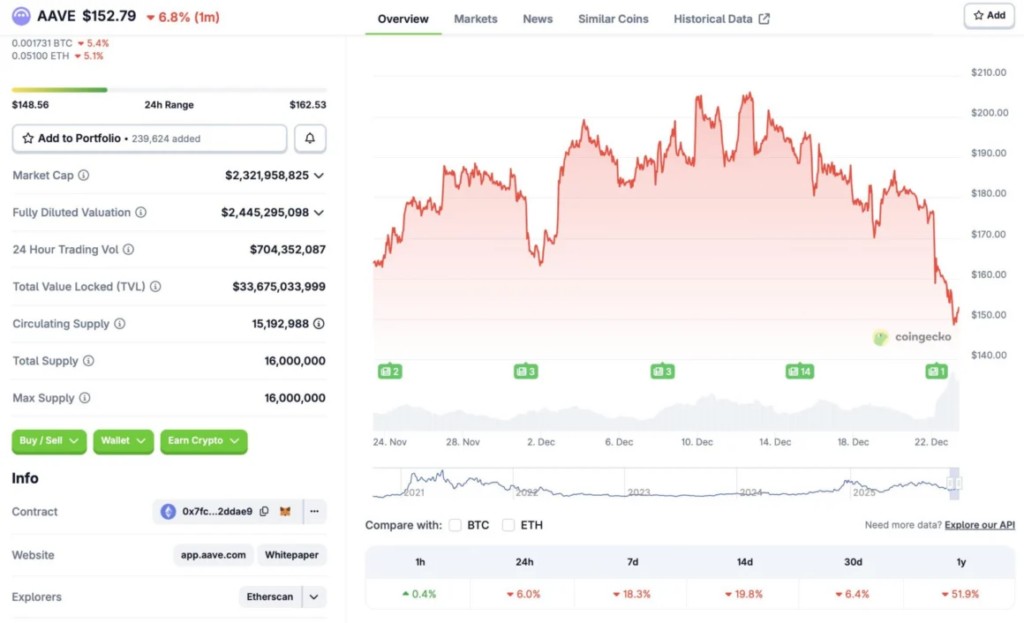

According to CoinGecko data, AAVE is down 6% in the last 24 hours, 18.3% over the past week, nearly 20% across 14 days, and more than 51% since late December 2024. The decline mirrors weakness across the broader crypto market, with Bitcoin slipping below $88,000 and dragging most assets lower. Despite two Federal Reserve rate cuts since October, investors remain cautious, favoring capital preservation over risk-taking.

Governance Dispute Clouds Confidence

Beyond macro pressure, Aave is dealing with internal friction that has rattled investor confidence. Members of the Aave DAO have raised concerns over Aave Labs allegedly diverting protocol revenue without explicit DAO approval. This perceived breach of governance norms has sparked debate around transparency and control, two pillars critical to DeFi credibility.

For decentralized protocols, consistency matters. Any deviation from established governance processes can quickly erode trust, and in Aave’s case, the dispute has added another layer of uncertainty during an already fragile market phase.

Recovery Likely Hinges on Market Conditions

AAVE’s path forward appears closely tied to broader sentiment. With investors largely avoiding high-risk assets, a meaningful recovery may be difficult in the near term. Macroeconomic uncertainty continues to weigh on crypto, and confidence will likely need to improve before capital rotates back into DeFi tokens.

Many market participants are looking toward 2026 as a potential turning point, with expectations that Bitcoin could reach a new all-time high. If that scenario plays out, renewed momentum in BTC could spark a wider rally, giving AAVE a chance to regain lost ground.