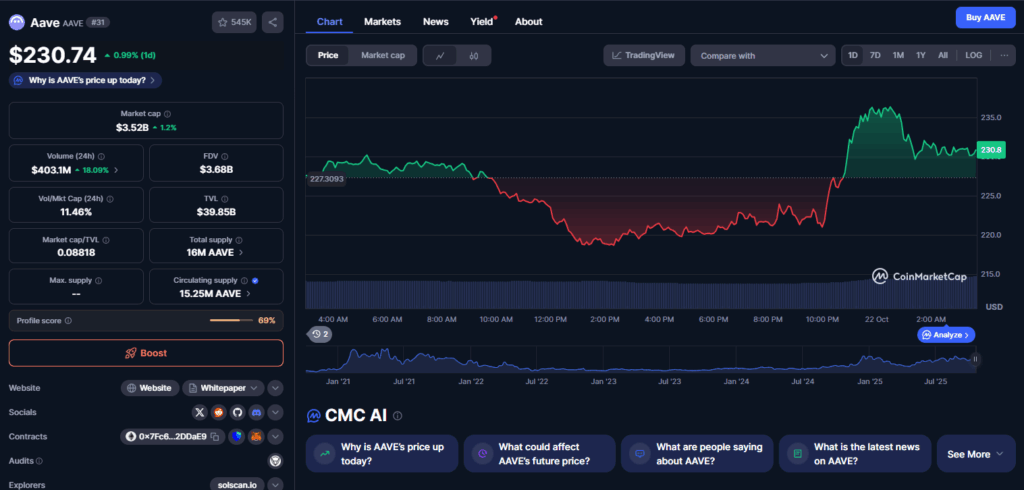

- Support: Strong double-bottom confirmed between $220–$221.13.

- Resistance: Breakout validated above $224.50; next target sits near $238–$240.

- Volume: Trading activity surged 87% above average, signaling conviction buying.

Aave (AAVE) staged a strong rebound on Tuesday, climbing 2.5% to $232 and confirming a double-bottom reversal from the $220 zone. The move marked a sharp turnaround from the previous night’s selloff, with trading volume spiking nearly 90% above its daily average. According to CoinDesk Research, the breakout above $224.50 signaled renewed buying interest and possible institutional accumulation into the close.

The broader crypto market also showed signs of recovery, aided by a steep selloff in gold and silver that reignited risk appetite. As capital rotated back into digital assets, Aave stood out among DeFi leaders, confirming that sentiment may be stabilizing after weeks of uneven flows.

Aave Partners with Maple Finance to Add Institutional Collateral

On the fundamental side, Aave announced a new partnership with Maple Finance (SYRUP) to integrate institutional-grade yield tokens as collateral within its lending markets. The rollout begins with syrupUSDT and syrupUSDC, which are backed by Maple’s managed yield strategies. These tokens will soon be available as borrowing collateral on Aave’s Plasma and core markets.

The collaboration bridges institutional credit with DeFi liquidity, connecting Maple’s network of capital allocators to Aave’s deep liquidity pools. For users, this means higher-quality collateral and more stable borrowing demand. For Aave, it’s a step toward building predictable, capital-efficient lending mechanics, even in a volatile macro climate.

Why It Matters for DeFi

This partnership could set a precedent for how traditional capital interacts with decentralized markets. Maple manages billions in on-chain credit, while Aave has facilitated over $3.2 trillion in lifetime deposits since its 2020 launch. Bringing these two together introduces a layer of professional-grade financial infrastructure into the DeFi ecosystem, giving institutions a safer on-ramp into decentralized lending.

If successful, it could make Aave a benchmark for regulated on-chain finance, where risk-managed yield meets DeFi liquidity. It’s a small step technically, but strategically — a massive one for trust and scalability in decentralized markets.