- Aave Labs signaled openness to sharing non-protocol revenue with AAVE holders

- Governance tensions center on frontend fees, profit sharing, and IP ownership

- A formal proposal is expected as the protocol eyes expansion into new asset classes

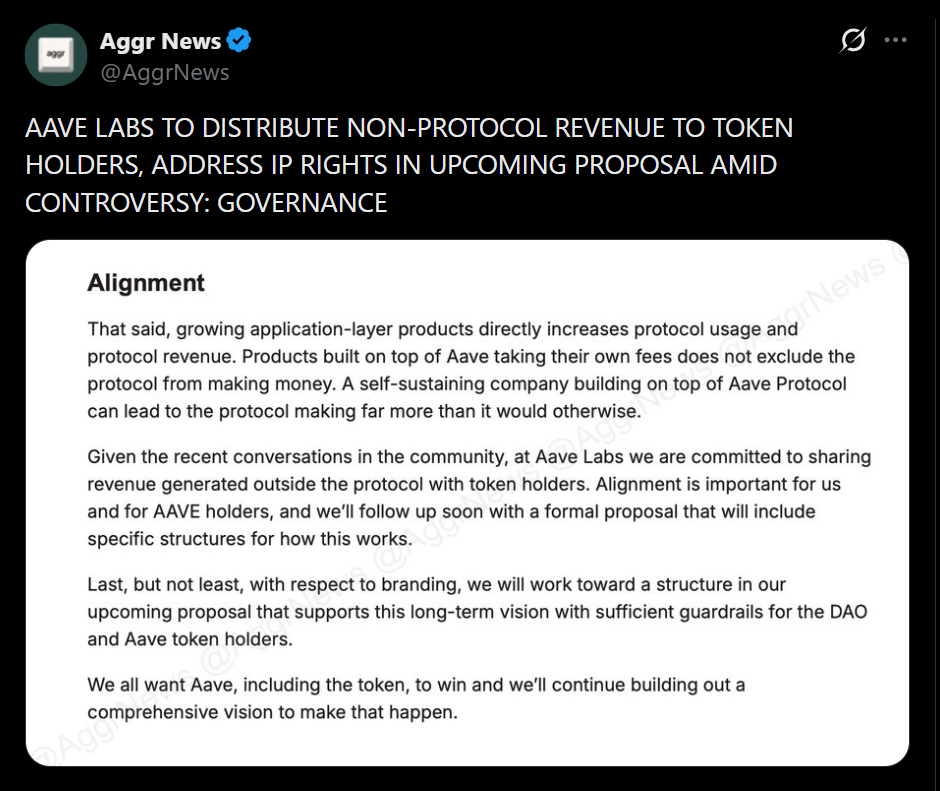

Aave founder Stani Kulechov has moved to calm growing friction within the Aave ecosystem by signaling a potential shift in how value flows to token holders. In a governance post on Friday, Kulechov said Aave Labs is open to sharing revenue generated outside the core protocol with AAVE holders, marking a notable concession amid an escalating debate with the Aave DAO.

Why the Aave Governance Debate Escalated

The dispute was sparked after community members questioned Aave Labs’ decision to redirect frontend fees away from the DAO. While Aave Labs originally built the protocol, the Aave DAO now governs and maintains it, creating tension around ownership, revenue rights, and long-term alignment. Token holders have increasingly pushed for clearer profit-sharing mechanisms and stronger guarantees that value accrues back to the DAO.

Kulechov’s Proposal and Long-Term Vision

Kulechov emphasized that alignment between Aave Labs and the DAO is essential as the protocol expands beyond crypto-native lending. He highlighted ambitions to support real-world assets, consumer-facing products, and institutional lending models, arguing that independent teams should be free to build on top of the permissionless Aave protocol while the core system benefits from increased usage and revenue. A formal proposal detailing revenue-sharing structures is expected to follow.

Branding, IP, and What Comes Next

Beyond revenue, the post also addressed branding concerns, responding to calls for Aave Labs to transfer intellectual property rights to the DAO. While no final resolution was outlined, Kulechov acknowledged the issue and framed it as part of a broader effort to define how Aave evolves as a decentralized yet commercially viable platform.

The coming proposal could play a key role in shaping Aave’s governance model and determining whether tensions between builders and token holders ease or intensify in 2026.