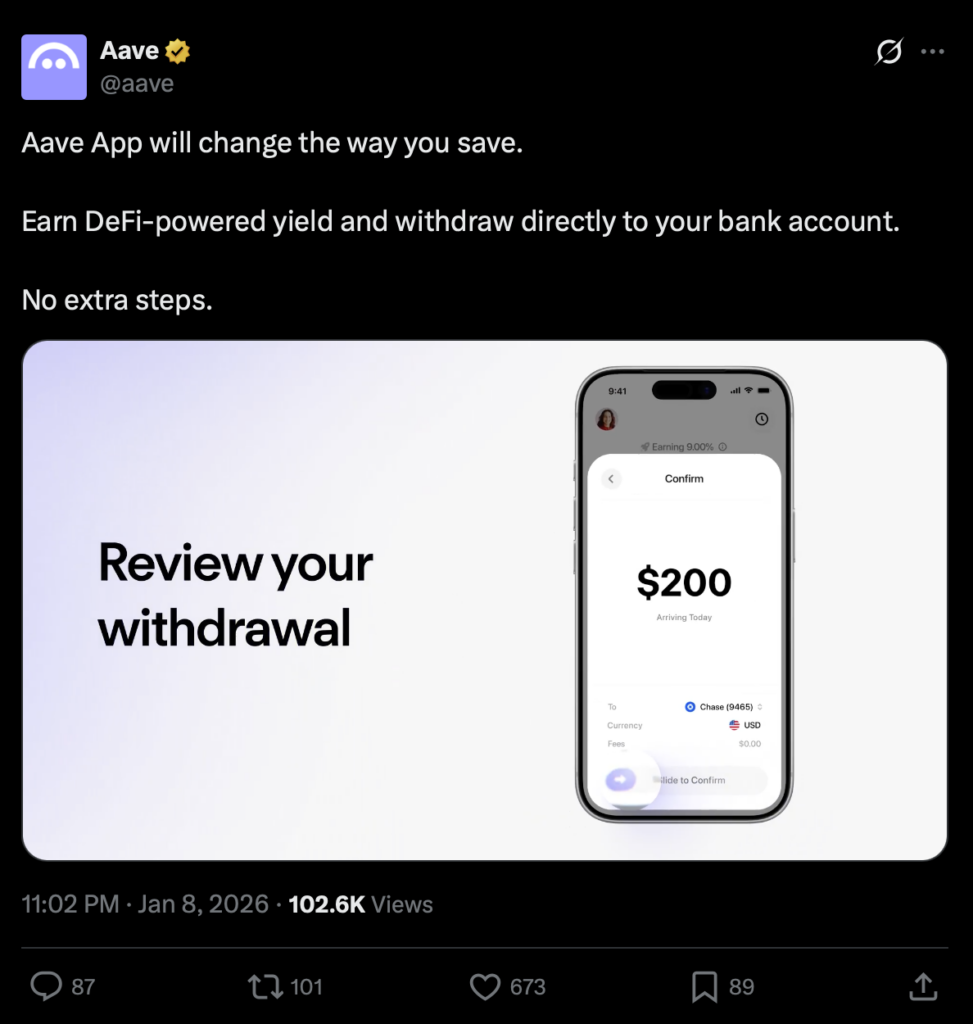

- Aave now allows users to earn DeFi yield and withdraw funds directly to a bank account

- The update removes much of the technical friction that has kept DeFi out of reach for everyday users

- Aave’s growing market share highlights rising demand for simple, regulated-friendly DeFi access

Aave has quietly rolled out a feature that changes how people interact with decentralized finance. The Aave App now lets users earn DeFi-powered interest and withdraw funds straight into a traditional bank account. No extra hops, no complicated off-ramps.

It’s a small update on paper, but a meaningful one. By linking blockchain-based yield directly with familiar banking rails, Aave is lowering the barrier for both newcomers and experienced users who want simplicity without giving up returns.

DeFi Savings, Without the Headache

DeFi has grown fast over the last few years, offering alternatives to savings accounts, loans, and even complex investment strategies. The problem has always been friction. Wallets, tokens, gas fees, smart contracts, it adds up quickly, especially for beginners.

The Aave App smooths much of that out. Users can deposit fiat or crypto, earn yield automatically, and move money back to their bank account when needed. There’s no requirement to manually swap tokens or route funds through third-party exchanges, which often feels like the riskiest step in the process anyway.

Take a simple example. A small business owner with $5,000 sitting idle could deposit those funds through the Aave App and start earning yield generated by DeFi lending markets. If cash is needed later, the funds can be sent back to a checking account within days. It starts to feel less like an experiment, and more like a modern savings tool.

How the Yield Is Actually Generated

Behind the scenes, the mechanics are still pure DeFi. Deposits flow into liquidity pools where borrowers take out loans and pay interest. That interest is then shared across everyone who supplied liquidity, creating a passive income stream tied to real usage, not just speculation.

What’s changed is the interface. The app handles the blockchain complexity, so users don’t have to manage private keys or monitor smart contract activity. For many people, that’s the difference between being curious about DeFi and actually using it.

Aave’s Growing Footprint in DeFi

Aave’s rise hasn’t been subtle. In just two years, it’s expanded its share of the DeFi market from roughly 8 percent to about 28 percent today. That growth reflects more than hype. It shows steady adoption of its lending and borrowing protocols across retail and institutional users.

By combining transparent smart contracts, competitive interest rates, and increasingly user-friendly tools, Aave has positioned itself as one of the few DeFi platforms that feels ready for scale. Its growth also mirrors a broader trend across the space, where platforms that prioritize accessibility and security are capturing a larger slice of the $100 billion-plus DeFi market.

This latest update fits that pattern. DeFi doesn’t need to feel complicated to be powerful, and Aave seems intent on proving that, one feature at a time.