- Bitcoin dominance is hovering near a historical pivot zone that has preceded past altcoin rotations

- Early-stage rotation metrics suggest the market is not yet euphoric, leaving room for expansion

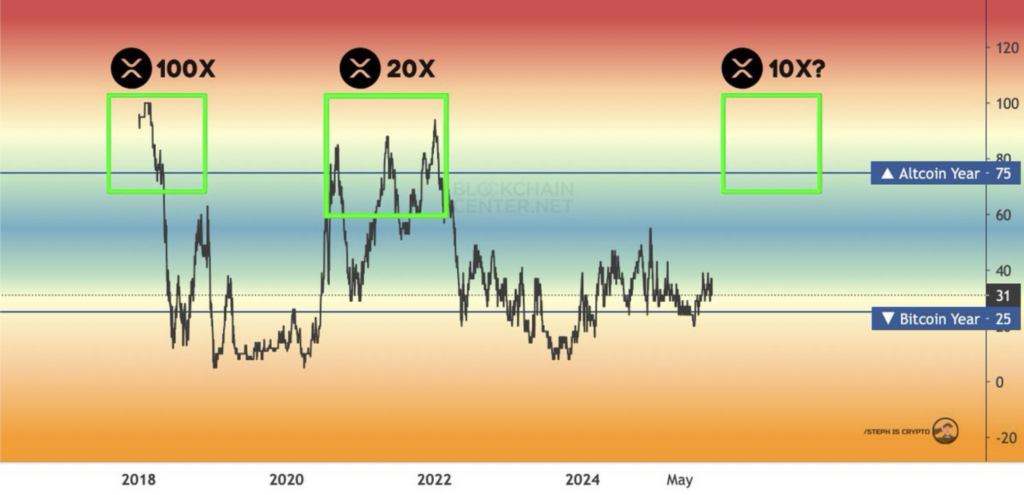

- XRP has historically moved quickly once capital begins rotating away from Bitcoin

Crypto market cycles rarely flip on a headline or a single candle. More often, the real signals sit quietly in the background, easy to miss unless you’re looking for them. While Bitcoin continues to command most of the market’s liquidity, subtle structural changes are starting to show beneath the surface, and those tend to matter.

These shifts usually appear before capital rotates, not after the move is obvious. For XRP holders, recent data suggests that the same conditions seen ahead of previous upside phases may be quietly forming again, even if price hasn’t reacted yet.

Bitcoin Dominance Nears a Familiar Turning Zone

In a recent post gaining traction on X, analyst STEPH IS CRYPTO pointed to a macro signal he considers historically reliable. Rather than zooming in on XRP price alone, he focused on Bitcoin dominance trends using data from Blockchain Center. His argument is simple, rotations don’t start with hype, they start with structure.

Bitcoin dominance is hovering near the 59% level, a zone that has repeatedly acted as a pivot point in past bull cycles. When dominance stalls around this range, Bitcoin often begins to lose relative strength as traders and funds start searching for higher beta opportunities elsewhere. In past cycles, similar pauses were followed by sharp dominance drops and strong altcoin outperformance.

Steph notes that dominance doesn’t need to collapse overnight. Early rotation often shows up as hesitation, slowing momentum, or sideways movement, and that’s usually when large-cap altcoins start catching bids first.

Altcoin Season Index Signals “Not Yet” Energy

Backing up that view, the Altcoin Season Index currently sits around 37. That’s still firmly in Bitcoin-dominant territory, meaning most altcoins have not outperformed BTC yet. Historically, that’s not a late-cycle warning, it’s an early-stage setup.

Steph interprets this as a sign that the market hasn’t reached euphoric conditions. Instead, there’s still room for expansion. According to Blockchain Center’s longer-term models, this mix of high Bitcoin dominance and weak altcoin performance often precedes what it defines as a mini altseason, rather than following one. Their projections place that phase closer to mid-2026, which lines up with Steph’s near-term expectations.

Why XRP Often Moves Faster Once Rotation Starts

XRP has a habit of lagging during Bitcoin-led phases, frustrating holders along the way. But historically, once capital rotation begins, it tends to move fast. Its deep liquidity, established infrastructure, and reduced regulatory overhang compared to prior cycles make it a natural early beneficiary when funds start reallocating.

Steph pointed out that similar dominance setups in previous cycles came just before sharp XRP rallies. The move doesn’t usually start with XRP leading, it starts with Bitcoin stalling, then XRP catching up in a hurry.

Probabilities, Not Promises

Steph is careful to frame this as probability, not certainty. Dominance charts don’t override macro conditions, liquidity shifts, or institutional behavior. Any of those can delay or derail rotation entirely.

Still, the alignment between historical dominance behavior, early-stage rotation metrics, and current market structure forms the basis of his conviction. For XRP holders, the data suggests the market may be closer to transition than surface-level price action lets on. Whether that transition arrives soon or takes longer, the setup is becoming harder to ignore.