A study by Cointelegraph Research revealed that most institutional investors hold or plan to buy crypto soon. The researchers set out to determine institutional investors’ appetite for digital assets and recorded that up to 43% were already digital asset owners.

According to the report, Cointelegraph Research surveyed 84 experienced investors from different parts of the world cumulatively managing up to $316 billion worth of assets. With this research and statistics, the investigators established that crypto-related investment attributed to 3.3% of this total, equivalent to about $10.42 billion.

The study also revealed that some of the sampled investors were neck-deep in crypto, with at least 50% attesting that they were exposed to digital assets in one way or the other. Nevertheless, the respondents’ median percentage of crypto investments stood at approximately 3%.

An analysis of the data revealed that 44% of the respondents rated ‘risk vs. return’ as a crucial factor in their investment decisions. This means that the risk-return ratio was a fundamental consideration every time they invested in cryptocurrencies. Beyond risk-return, other respondents also cited diversification and a strong belief in the technology’s potential. The report stated:

“…my company is convinced that the technology will be important in the future.”

The latter two issues were dimmed ‘relatively less critical compared to the risk versus return consideration.

Digital Assets that Institutional Investors Consider for Purchase

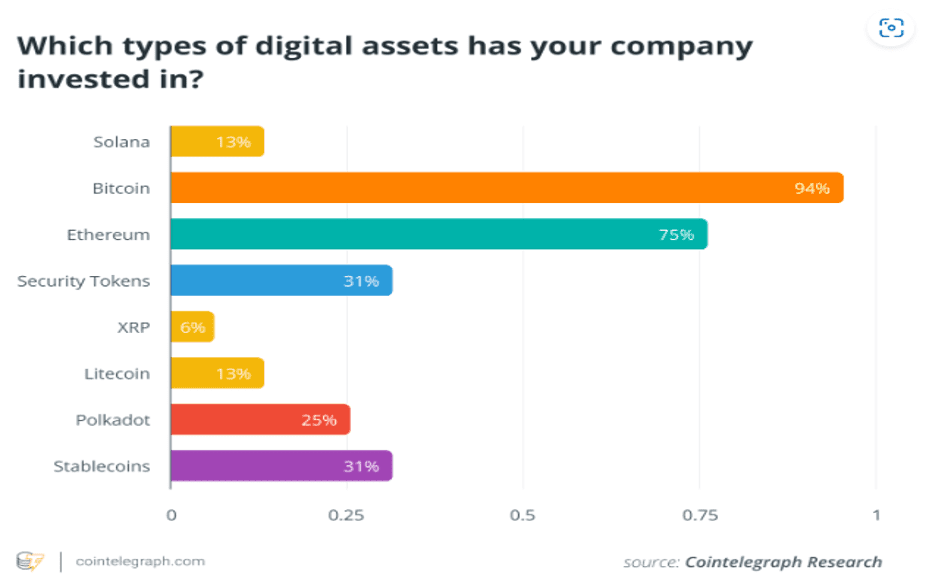

The respondents disclosed some of the digital assets they consider for purchase, and as expected, Bitcoin (BTC) ranked highest in terms of popularity among investors.

From the survey, 94% of the sampled institution investors confessed to owning the flagship crypto, Bitcoin (BTC). Ether (ETH) followed closely as 75% of the respondents said they held the second largest crypto by market cap. When asked about security tokens and stablecoins, 31% of institutional investors responded in the affirmative.

Beyond crypto, the study also revealed other digital assets that attract the interest of institutional investors, including tokenized securities and non-fungible tokens (NFTs). Noteworthy, a significant portion of the respondents disclosed plans to diversify their investments by integrating tokenized securities and NFTs as part of their portfolios.

The metaverse was another area of interest for another faction of institutional investors, who indicated an inclination towards metaverse projects. This is evidenced by McKinsey data showing that in 2022 alone, metaverse-related projects have already garnered up to $120 billion in investments.

The McKinsey report has also registered the interest of up to 59% of consumers, noting their excitement to move their daily activities to individual metaverses. It is imperative to note that market pundits speculate that the metaverse sector will attain up to $5 trillion worth of market impact by 2030.

Passive Funds as Gateways for Institutional Investors to Crypto Investments

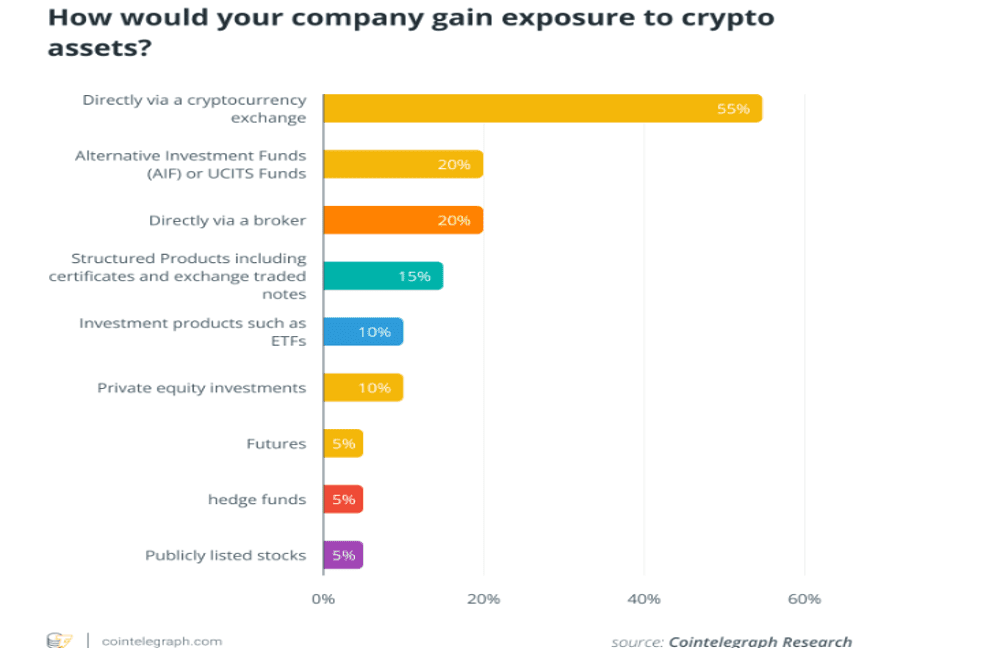

While most institutional investors opt for direct investments in cryptocurrencies over investment funds and structured products, the same majority also agreed that passive funds like Grayscale’s Bitcoin Trust provide a gateway for their exposure to crypto and other digital assets.

The study also revealed that institutional investors acquire their shares from sources other than actively and passively managed funds. According to the respondents, the crypto derivatives market is also an area of interest among veteran investors who leverage its high liquidity.

Ether’s options open interest recently surpassed that of Bitcoin, recording $5 billion and $4.8 billion, respectively. This indicates that professional investors are more drawn to ETH over BTC, with their spot markets attributing 12.5% to 20% of the liquidity offered by the derivatives market for Bitcoin (BTC) and Ether (ETH), delivering 20% to 25%.

While annual inflows into crypto trusts hit $9.3 billion in 2021, the share prices of these funds took a grave hit in 2022 following the year’s plummeting cryptocurrency prices. Noteworthy, the most affected were the ones managed passively.

Investors are Worried about Liquidity Risks

Another discovery from the study is that investors are concerned about issues like cybercrime and fraud risks, but the most prominent concern is liquidity risk. Survey data recorded that 51% of respondents marked this factor as the most problematic, posing a formidable hurdle to crypto adoption. In this regard, it follows that the degree of volatility expressed by an asset is indirectly proportional to the ‘interest to hold’ among conservative investors.

For instance, in the spring of 2021, electric carmaker Tesla sold a portion of its BTC holdings to demonstrate the asset’s liquidity. The move proved successful as it convinced Tesla shareholders and the entire equity market that holding digital assets like BTC might be advantageous.