- MicroStrategy has purchased an additional 12,333 bitcoins between April 29 and June 27, 2023, bringing its total Bitcoin holdings to over $4.5 billion.

- The company is the largest Bitcoin holder among publicly traded firms, holding approximately 0.726% of the total available supply of 21 million bitcoins.

- MicroStrategy has funded its Bitcoin purchases in part by issuing and selling shares, indicating its unwavering confidence in Bitcoin’s long-term viability.

In a recent move that underscores the company’s unwavering belief in the value of Bitcoin, MicroStrategy, the business intelligence and software company, has significantly bolstered its holdings of the leading digital currency. A recent U.S. Securities and Exchange Commission filing shows that the firm purchased an additional 12,333 bitcoins for approximately $347 million in cash between April 29 and June 27, 2023. This purchase, the largest to date by the firm, now brings their total Bitcoin treasury to a staggering 152,333 digital coins, equivalent to over $4.5 billion.

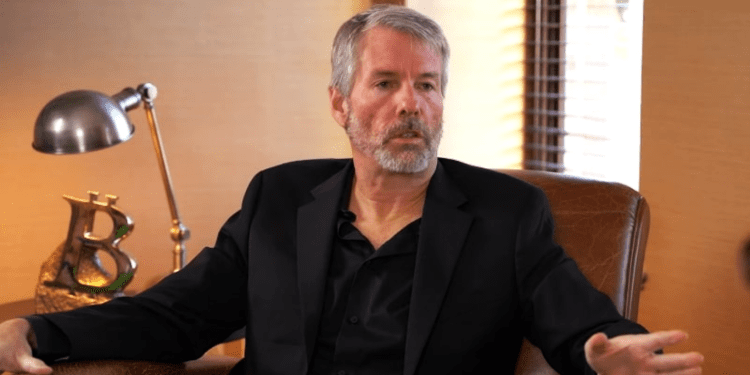

The enterprise software maker, co-founded by cryptocurrency advocate Michael Saylor, embarked on its cryptocurrency journey in August 2020, viewing Bitcoin as a strategic hedge against inflation. Saylor has previously likened Bitcoin to “engineered, synthetic, pharmaceutical-grade gold”, signifying its value as a digital store of value.

MicroStrategy: A Market Leader in Corporate Bitcoin Investment

MicroStrategy’s bold investment strategy has positioned it as a unique entity among publicly traded companies. As of the second quarter of 2023, no other publicly traded firm holds more Bitcoin than MicroStrategy. Their Bitcoin investments amount to an estimated 0.726% of Bitcoin’s total available supply of 21 million coins, demonstrating the company’s significant foothold in the digital asset space.

Interestingly, despite the value of MicroStrategy’s Bitcoin holding exceeding its market capitalization, the company has remained consistent with its strategy. To fund these purchases, MicroStrategy has, in part, issued and sold shares that resulted in net proceeds of approximately $333.7 million. Despite the risky nature of this strategy, the firm’s confidence in the longevity of Bitcoin’s value seems unwavering.

Navigating Volatility: MicroStrategy’s Resilience Amid Market Ups and Downs

While Bitcoin has seen a steep nosedive from its all-time high of $69,044 in November 2021 to an average purchase price of around $29,668 per coin, the performance of MicroStrategy’s stock has shown remarkable resilience. Trading as MSTR on the Nasdaq, the company’s stock is up by over 162% since its first Bitcoin buy in 2020. This resilience is a testament to the company’s robust strategy and its ability to navigate the volatility typically associated with cryptocurrency markets.

MicroStrategy’s approach is not purely investment-oriented, though. The company is also working on an “enterprise Lightning solution” aimed at leveraging the Lightning Network, a second-layer network that enables swift and cheap Bitcoin transactions, to help companies move money quickly.

MicroStrategy’s aggressive Bitcoin acquisition strategy, despite the market’s unpredictable swings, demonstrates the firm’s staunch belief in the digital asset’s long-term value. As Bitcoin continues to find its footing in the corporate world, all eyes will remain on MicroStrategy, whose trailblazing approach is paving the way for future corporate investments in digital assets.