- The Swiss National Bank is piloting a wholesale Central Bank Digital Currency on the Swiss SIX digital exchange.

- The SNB believes that a wCBDC could offer more stability and lower risk to the DeFi ecosystem, and could complement existing stablecoins.

- The SNB maintains a cautious approach towards a retail CBDC and does not foresee the replacement of physical cash.

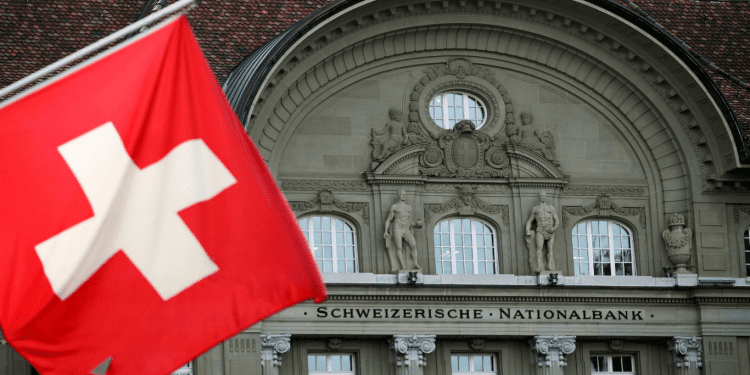

In a move that marks a significant development in the world of blockchain and digital currencies, the Swiss National Bank (SNB) has announced plans to conduct a pilot project for a wholesale Central Bank Digital Currency (wCBDC). This progressive initiative, revealed by SNB Chair Thomas Jordan at the Point Zero Forum in Zurich, sets Switzerland at the forefront of monetary innovation. However, the nation still holds a “prudent” stance towards a retail CBDC.

Exploring the Potential of Wholesale CBDC

Switzerland’s central bank will pilot the wCBDC project on the Swiss SIX digital exchange, with the intention of testing real transactions with market participants. Jordan noted that the wCBDC is not merely an experiment—it is an endeavor aimed at producing “real money equivalent to bank reserves”. This stands as a stark deviation from the position taken by SNB chief economist Carlos Lenz only a year earlier, who voiced skepticism over the suitability of blockchain for a CBDC.

SNB has a history of trialing wCBDCs. As part of its Project Helvetia, the central bank had previously integrated a wCBDC into the back-office systems of five banks. This marked a major shift from SNB’s prior stance, proving that it’s serious about adopting blockchain-powered solutions for the financial system. However, it’s important to remember that the move does not necessarily suggest that the SNB will formally issue a wholesale CBDC in the future.

Bridging DeFi and CBDCs

Despite the cautious approach to retail CBDCs, SNB officials believe that CBDCs and decentralized finance (DeFi) could be complementary. Thomas Moser, an SNB governing board member, pointed out that stablecoins have facilitated the popularity of DeFi. Yet, he argued, a CBDC, being a stable digital currency backed by a central bank, could offer more stability and lower risk to the DeFi ecosystem than current stablecoins. In this context, a wholesale CBDC has potential to boost the burgeoning DeFi sector.

Interestingly, even as the SNB explores digital finance, it doesn’t foresee the replacement of physical cash. Andréa Maechler, an SNB governing board member, asserted that the central bank believes “the risks outweigh the benefits” concerning a retail CBDC. She highlighted that the SNB’s focus is primarily on the role that wholesale CBDCs could play, echoing a sentiment expressed by many central banks around the world.

The Road Ahead

While SNB’s pioneering steps towards a wCBDC bring excitement, it’s clear that the bank is moving with caution, ensuring that it thoroughly understands the potential risks and rewards of digital currencies. The experiment demonstrates that the central bank is staying ahead of technological change, preparing for a future where digital assets and DLT may play a crucial role in global finance.

Despite the significant work to be done, the Swiss National Bank’s pilot project signals a broader global trend. Central banks around the world are increasingly investigating the possibilities of digital currencies and their potential implications for monetary policy, financial stability, and the broader economy. As these explorations unfold, the world watches with anticipation, awaiting the dawn of a new era in finance and banking.