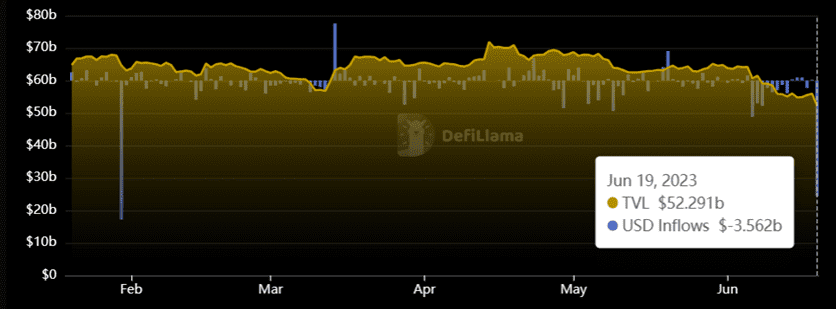

In the last 24hrs, Binance has experienced a net outflow of $3.56 billion, the largest withdrawal amount the CEX has undergone since January.

This intense outflow can be attributed to the settlement that Biance.US reached with the SEC late on Friday, June 17, 2023.

Settlement Details

The agreement order between the SEC and the defendants in the litigation (Binance Holdings Limited, BAM Management U.S. Holdings Inc., BAM Trading Services Inc., and Binance founder Changpeng Zhao) ensures that Binance.US customers can freely withdraw their assets from the exchange and that assets that remain on the platform are safeguarded.

The agreement orders explicitly require the defendants to repatriate assets held for the benefit of BAM’s U.S. customers back to the United States. Also, BAM must maintain U.S. customer assets within the country throughout the litigation period and facilitate customer withdrawals.

Furthermore, the order explicitly forbids BAM from transferring assets or funds to Binance Holdings Limited, Changpeng Zhao, or their affiliates. Additionally, BAM’s spending of assets is restricted to ordinary course business expenses, with oversight provided to the SEC. Lastly, the agreement order prohibits the destruction of records, mandates expedited sworn accountings of specific assets, and necessitates expedited discovery on the custody and security of customer assets.

Conclusion

The substantial net outflow of $3.56 billion within 24 hours highlights the impact of the settlement and the importance of transparency and regulatory compliance within the cryptocurrency industry.

This outflow also signifies the importance of self-custody as initially, in the lawsuit, the SEC had requested to freeze all assets on Binance. U.S. Keeping your funds secured and you’re the only person accessing them is the most effective way to protect crypto holdings.