- Mark Cuban sheds light on the challenging situation of differentiating between securities and non-securities.

- The SEC has been faulted for giving unclear guidelines to the cryptocurrency industry.

- Proper regulation calls for collaboration among investors, regulators and digital exchange companies.

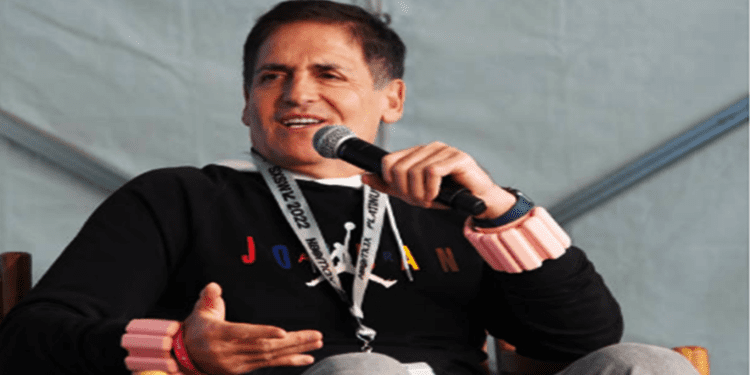

Mark Cuban, one of the outspoken billionaires, a shark tank investor, and owner of Dallas Mavericks, has faulted the U.S. Securities and Exchange Commission (SEC) for failing to define what crypto securities are clearly.

What are Securities?

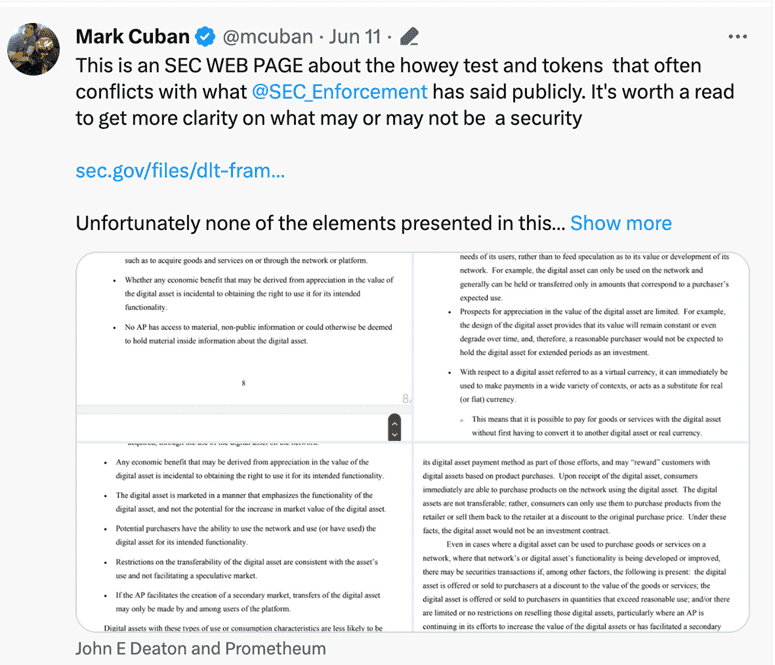

In a tweet on June 11, Cuban indicated that the SEC registration framework fails to identify which of the mentioned assets are securities and which are not. Cuban said in a Twitter post:

“Unfortunately, none of the elements presented on this page are part of the registration process. It is nearly impossible to know what is or is not a security in the crypto universe, with or without an army of securities lawyers.”

Cuban goes ahead to elaborate in the Twitter thread by sharing part of the information provided by SEC on its page as follows:

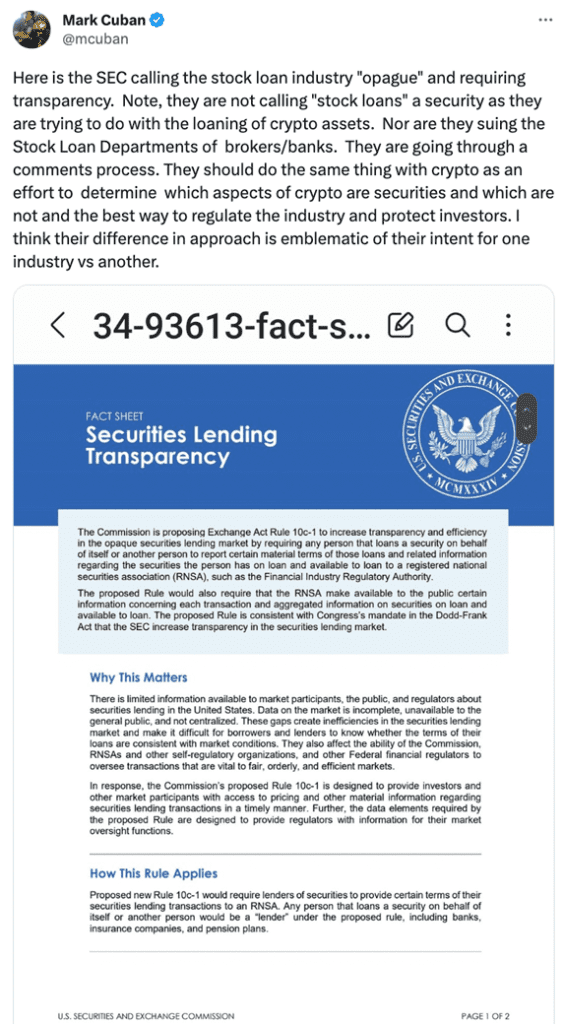

Still, in the same thread, Cuban provides another extract from his June 9 tweet, where SEC calls the stock loan industry “Opague” and requires transparency, as shared below:

The document, as provided by the SEC, elaborates on what needs to be done to protect investors. The record, as shown by Cuban, tells what needs to be done to provide the information for investors to decide which securities to invest their resources in.

Although Cuban shows that the other industries are receiving clear financial information from SEC compared to the cryptocurrency industry. He shows that SEC is engaged in discussions rather than giving guidelines on which aspects are securities and which are not.

“They should do the same thing with crypto as an effort to determine which aspects of crypto are securities and which are not,” -Cuban

As construed in the financial world, securities have owned financial instruments and interest values. The best examples of these securities include bonds, stocks, and mutual funds.

However, this definition has evolved, and the latest report has become more complex. This complexity is because some cryptocurrencies have found their way to being referred to as potential securities making the landscape more complicated.

Why it is Nearly Impossible to Determine Modern Securities in the Financial Landscape

There have been calls for the SEC to give clear guidelines concerning digital assets. People have reacted to discredit SEC, with the latest criticism coming from U.S. Senator Cynthia Lummis, who tweeted:

“The SEC has failed to provide a path for digital asset exchanges to register, and even worse, has failed to provide adequate legal guidance on what differentiates security from a commodity.”

This discussion sought to unravel why this remains a challenge. These factors were majorly credited to be the leading causes. There is an ever-evolving investor expectation where many people are increasingly looking for investment alternatives, including tokenized projects and digital assets.

The demand has created the need for new financial products outpacing regulation authorities. In this regard, it is challenging to differentiate between securities and non-securities.

Fast-changing technology and innovation have also introduced new investment opportunities. Cryptocurrencies, for instance, have presented challenging situations for regulators as they fumble between tokens and securities.

There needs to be more complexity in defining legal requirements related to digital assets. Countries consider securities differently and need a standardized regulatory framework, making distinguishing between deposits and non-securities challenging.

What Needs to be Done?

The issue of regulating cryptocurrency calls for enhanced collaboration. The partnership between the regulator and the cryptocurrency agencies will help to solve the complexities surrounding securities and non-securities.

The regulatory bodies need to adapt swiftly to the trend of digital dynamism to enhance the formulation of flexible regulations.

There should be further education for investors to make them aware of the available investment opportunities and the required regulatory frameworks.