- Reggie Fowler, the former part-owner of the Minnesota Vikings, has been sentenced to over six years in prison for processing hundreds of millions of dollars in unregulated crypto transactions.

- Fowler’s company, Global Trading Solutions (GTS), misled banks to facilitate over $700 million in unregulated transactions.

- Fowler’s shadow banking also ensnared Bitfinex, which handed over $850 million to Crypto Capital for processing withdrawals.

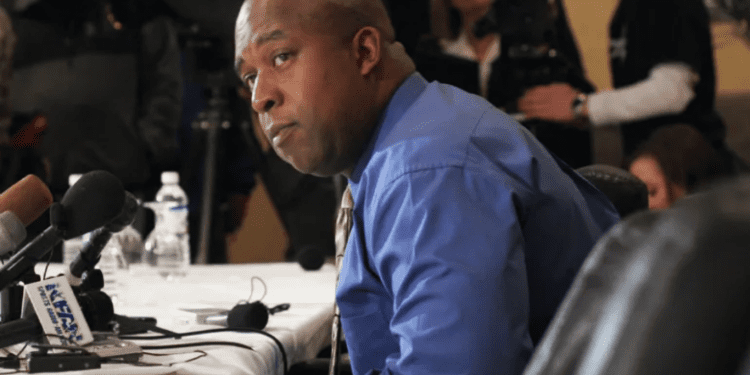

In a notable development in the crypto world, Reggie Fowler, the former part-owner of the Minnesota Vikings, has been sentenced to approximately six years in prison for orchestrating an illicit cryptocurrency scheme. Fowler was charged with evading federal laws and processing hundreds of millions of dollars of unregulated transactions on behalf of cryptocurrency exchanges through a so-called “shadow bank.”

Fowler’s fraudulent activities were conducted during his tenure at Global Trading Solutions (GTS), where he deceived banks into processing over $700 million in “unregulated” crypto transactions. This evasion of federal law exposed the U.S. financial system to significant risks. Prosecutors shed light on the fact that Fowler, through his shadow bank Crypto Capital Corp, had enabled crypto startups to operate outside the traditional banking system, thus conducting transactions devoid of necessary regulations and scrutiny.

Bitfinex, a well-known crypto exchange, also became entangled in this complex web. Bitfinex gave Crypto Capital $850 million to process customer withdrawals. In a controversial move in 2021, it was alleged that Tether, which shares a parent company with Bitfinex, had loaned Bitfinex the amount to cover potential losses.

Impact on Banks and Legal Consequences

Reginald Fowler’s activities involved lying to various financial institutions and establishing dozens of accounts that processed crypto transactions without the knowledge of the banks concerned. Fowler’s fraudulent operations violated federal laws and jeopardized the integrity of the financial system.

In a case of significant magnitude, the Southern District of New York has ordered Fowler to forfeit an astounding $740.2 million of the proceeds from his illicit activities. Prosecutors had initially called for a seven-year prison term and a hefty sum of over $720 million in fines. Fowler’s sentencing signals a tough stance on unregulated cryptocurrency transactions and indicates the mounting regulatory scrutiny on shadow banking in cryptocurrency.

Reggie Fowler’s Fall from Grace

Fowler’s case represents a massive fall from grace for the former NFL team owner. He started his criminal enterprise in 2018 when he established GTS to provide Israeli blockchain businesses with a means of exchanging fiat for crypto. However, as banks were cautious of handling crypto transactions, Fowler, GTS, and its affiliated “Crypto Companies” misled them to open accounts and process crypto transactions. This culminated in an astounding $750 million in unlicensed transactions over ten months.

This case isn’t Fowler’s first run-in with questionable legality; in 2019, his Crypto Capital enterprise was linked to a controversial transaction from the Bitfinex exchange. The case revolved around Bitfinex attempting to cover a massive $850 million shortfall using funds from the stablecoin Tether without disclosing this to investors. Bitfinex claimed the money was deposited with Fowler’s payments processor and then seized by law enforcement in the U.S., Poland, and Portugal.

The saga of Reggie Fowler serves as a cautionary tale for the crypto industry. It highlights the need for increased transparency and regulation to ensure the safety and security of the financial system. As we move forward in the era of digital currencies, it’s evident that stringent checks and balances are critical to protect investors and maintain the integrity of the banking system.