- Coinbase joins Gemini in the rollout of global exchange plans.

- Coinbase shares have reportedly been plummeting.

- Coinbase is open in 30 jurisdictions, including crypto-friendly states like Bermuda and Hong Kong.

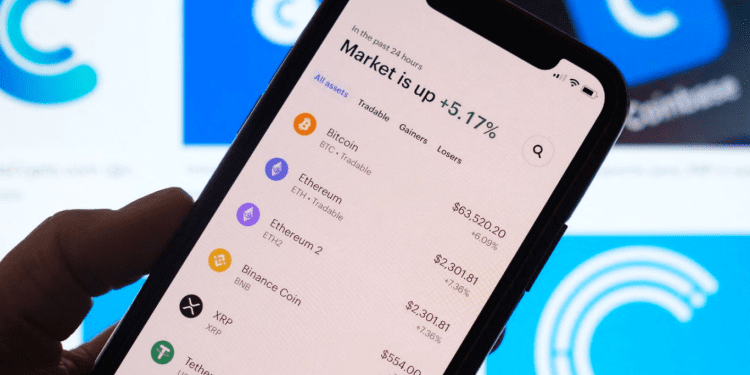

Coinbase’s international exchange will roll out its trading plan by listing Bitcoin and Ether perpetual futures. Amidst the regulatory hurdles facing the crypto industry in the United States, public crypto firm Coinbase is moving ahead with its plans for a global derivatives platform.

Coinbase announced the launch of the new Coinbase International Exchange, a new institutional platform for crypto derivatives trading.

The Coinbase International Exchange is expected to start trading by listing Bitcoin and Ether perpetual futures later this week. All of the tradings for the International Exchange will be settled on Coinbase-backed stablecoin USD Coin and will require no fiat on-ramps.

The exchange stressed that direct access trading on Coinbase International Exchange would be made available to institutional clients through an application programming interface in non-United States Jurisdiction with eligibility. Coinbase, however, added that the products are not available to retail customers presently.

The exchange did not give a response to Cointelegraph’s request to provide more details on the exact jurisdiction where Coinbase International Exchange would be made available.

Coinbase is not the only exchange that launched a non-U.S. derivatives platform; Gemini, a major crypto exchange, also founded one on May 1st, and they have announced that the business is open to customers in 30 jurisdictions globally, with the inclusion of Hong Kong, Thailand, Philippines, Bermuda, and Singapore, amongst others. However, the Gemini Foundation will not be available for customers in the United Kingdom, the European Union, and the United States.

According to an announcement by the exchange, the new international crypto platform was launched with the support of regulators in Bermuda, which is a vast difference from the scrutiny exchanges are facing in the United States. Coinbase also obtained a license from the BMA (Bermuda Monetary Authority) in April. The class F license allowed the exchange to operate a digital asset exchange and a digital asset derivatives exchange provider and services like token issuance and sales.

Coinbase praised the Bermuda regulatory system for its high level of compliance, transparency, and cooperation.

Bermuda is well known as a self-governing British overseas country with a parliamentary government and a similarity to the UK, where cryptocurrencies are currently legal tender. Bermuda has remained a crypto-friendly environment, repeatedly growing bullish on the crypto space.

The news of Coinbase’s new International exchange comes amidst US investment bank Citigroup downgrading Coinbase shares to a neutral or high-risk buy level with a $65 price target, down from its former 80 dollars price.

Conclusion

Coinbase shares have reportedly been plummeting for several weeks; over the last month, Coinbase’s shares went down more than 20%, dropping from its high of $72 back in April to $50 by the beginning of this month.

It was also previously reported that Coinbase had planned to set up a global crypto exchange since mid-March 2022, so the rollout now is not shocking.