- Bitcoin and gold are both rising, but the market narrative is shifting beyond a simple “either-or” debate.

- Cathie Wood believes AI-driven commerce could make Bitcoin a core financial infrastructure asset.

- Institutions appear to be pairing gold for stability with Bitcoin for upside, changing how portfolios are built.

Bitcoin vs gold has been one of those debates that just refuses to die. For months now, investors have gone back and forth on which asset really deserves the “store of value” crown, and honestly, the argument is only getting louder. That’s partly because both charts have been all over the place lately, with volatility making it harder for people to feel confident in either camp.

From a pure price standpoint though, Bitcoin has started showing some life again after taking a hit in recent weeks. At the time of writing, BTC was trading around $70,681, up 3.03% over the past 24 hours. That kind of bounce tends to bring back the “buy the dip” crowd fast, and it also keeps the digital gold narrative alive, even if it’s still a bit fragile.

Gold, to be fair, hasn’t exactly been sitting still either. The metal climbed 2.03% to roughly $4,966.26 per ounce, putting it right near that psychologically important $5,000 level. Moves like that usually signal one thing: demand for traditional safe-haven assets is still strong, even in a world where crypto is supposed to be replacing everything.

But here’s where things get more interesting. The Bitcoin vs gold conversation is no longer just about inflation hedges and fear trades. It’s being reshaped by AI, institutional behavior, and the idea that blockchains might become something closer to financial infrastructure than a speculative casino.

Cathie Wood’s take: Bitcoin is becoming core infrastructure

ARK Invest CEO Cathie Wood has been leaning hard into the idea that “agentic commerce” is coming. Basically, AI systems that can transact autonomously without humans clicking buttons all day. In her view, that pushes blockchains like Bitcoin, Ethereum, and Solana into a new category, not just assets people gamble on, but networks that could actually underpin the next era of finance.

Wood’s broader point is that investors are starting to treat Bitcoin less like a risky side bet and more like something that belongs in the center of modern portfolios. Not a meme. Not a temporary fad. More like a foundational asset, the way people used to talk about gold or even U.S. Treasuries.

She summed it up in a way that was pretty direct, saying Bitcoin is “leading the way” and that it remains “the most secure of all the crypto.” That security narrative has always mattered, but it hits differently now when institutions are allocating billions instead of retail traders chasing pumps.

What’s behind Bitcoin’s recent weakness

Even with the bounce, Bitcoin hasn’t been immune to pressure. Wood pointed to several macro forces weighing on crypto markets, including rising interest rates in Japan, tighter liquidity conditions in the U.S., and portfolio rebalancing from large investors. The key detail is that these aren’t “Bitcoin is dead” signals, they’re symptoms of Bitcoin being connected to global finance more than ever before.

In other words, Bitcoin isn’t acting like some isolated rebel asset anymore. It’s reacting to capital flows, risk appetite, and central bank policy, just like everything else. That’s not necessarily bad, but it does mean the price can get dragged around when the macro picture shifts.

She also suggested that gold’s momentum could weaken if China’s growth stays slow and inflation fears keep fading. And if that happens, capital may start rotating toward Bitcoin instead. Not because gold becomes useless, but because investors start looking for the next place where upside still exists, especially once the AI-stock trade gets crowded and overheated.

Bitcoin and gold might not be rivals anymore

One of the more subtle shifts in this whole debate is that Bitcoin and gold are starting to look less like enemies. Gold is still the old-school hedge when fear spikes and uncertainty hits, and it’s still the asset people trust during true crisis moments. But Bitcoin is increasingly being viewed as a digital counterpart, offering a similar defensive narrative while also bringing growth potential and programmability into the mix.

Wood even said she wouldn’t be surprised if gold “continued to come down to Bitcoin’s benefit.” That’s a bold claim, but it fits her thesis that Bitcoin is still in a long-term adoption curve, while gold is already fully established and, in a way, capped.

She also dropped another interesting line: “Gold precedes a big move in Bitcoin.” What she’s implying is that gold’s price action could act as an early signal, almost like a leading indicator, for Bitcoin’s next major breakout. It’s not a guarantee obviously, but it’s the kind of pattern that institutions pay attention to.

And that’s the bigger story. Institutions aren’t always choosing one or the other anymore. They’re pairing them. Gold for stability and insurance, Bitcoin for innovation and upside. That combination changes the question from “gold or Bitcoin?” into something more practical, like “how much of each do we hold?”

Are Bitcoin’s market signals flashing warning signs?

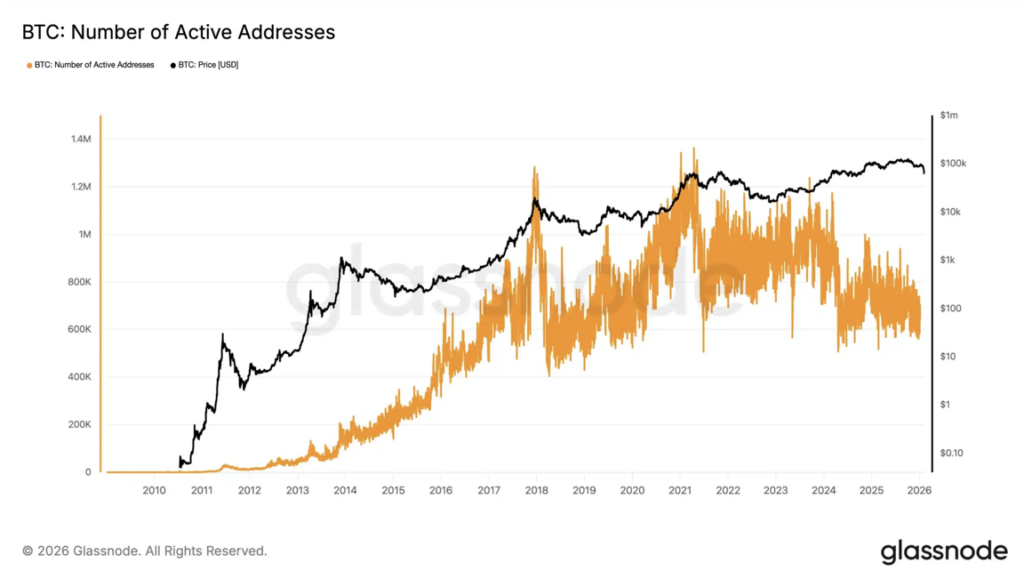

Bitcoin’s long-term outlook still looks strong, but short-term data has been a little messy. On-chain metrics from Glassnode showed a drop in active users, which usually hints at weaker retail participation. That matters because retail is often what fuels the most explosive moves, the kind where BTC doesn’t just grind upward, it launches.

At the same time though, Bitcoin’s market dominance climbed to around 59%. That’s usually a sign that investors are rotating away from riskier altcoins and moving back into Bitcoin as the “safer” crypto bet. It’s almost like a defensive move inside the crypto market itself.

Wood also reiterated that Bitcoin’s classic four-year cycle of massive rallies followed by brutal crashes might be breaking down. She said the current downturn could end up being the mildest in Bitcoin’s history, which is a pretty big statement considering how ugly past drawdowns have been. If she’s right, it could mean Bitcoin is slowly maturing into a more stable macro asset, not fully stable, but less wild than before.