- Solana is beating Ethereum in perp volume, stablecoin growth, and ETF outflow pressure during a risk-off market

- Ethereum is facing heavier FUD and large-holder selling, including a major realized loss from Trend Research

- SOL/ETH holding near 0.04 support could be a rotation signal, not random sideways price action

Nothing in this market is happening by accident right now. Not with volatility this high, not with liquidity this thin, and definitely not with big money rotating in and out of positions like it’s a daily routine.

After three straight days of outflows pushed major large-cap assets below key support zones, the market snapped back hard on February 6 with a single-day move of more than 10%. That kind of swing doesn’t just “catch traders off guard,” it wipes out anyone who’s positioned too confidently on the wrong side. And in this kind of environment, investors stop relying on vibes. They start watching data.

So when Solana (SOL) starts quietly outpacing Ethereum (ETH) across multiple metrics, it reads like more than just a short-term pump.

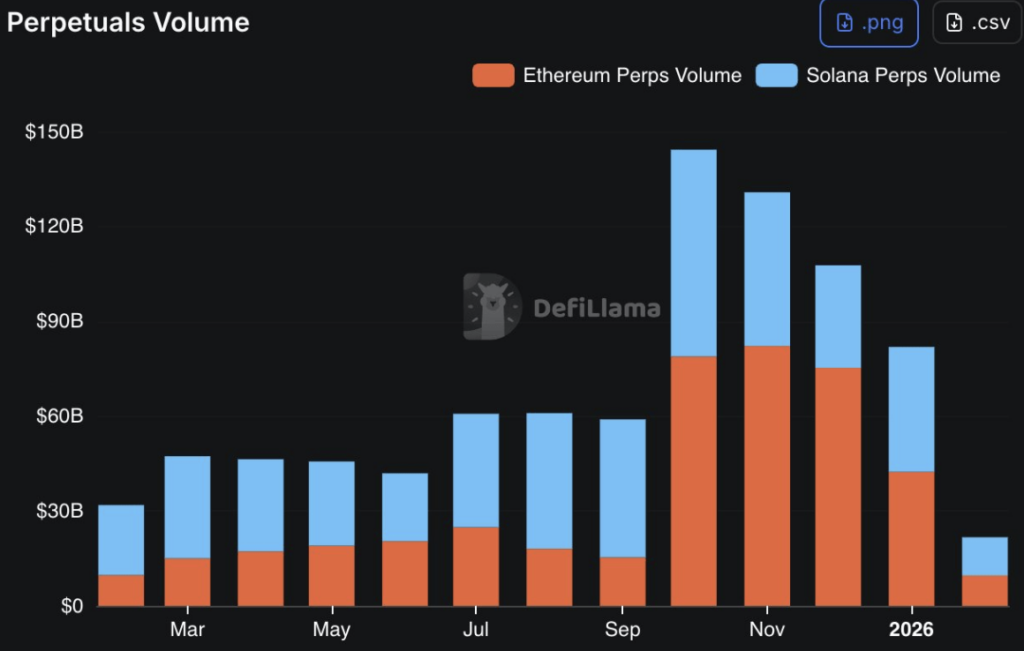

One of the cleanest examples is perpetual futures volume. According to DeFiLlama, Solana recently printed around $12.1 billion in perp volume, compared to Ethereum’s $9.6 billion. That’s roughly 26% higher, and it matters because perps volume is basically the market’s heartbeat. Higher volume doesn’t guarantee direction, but it does show where traders are spending their attention, and where liquidity is moving.

Solana’s momentum is showing up in the places that matter

The divergence gets even sharper when you look at institutional flows. Solana’s ETF narrative has taken a lighter hit during this sell-off, with about $18 million in net outflows over the past three days. Ethereum, on the other hand, saw roughly $180 million leave over the same window. That’s not a small gap. That’s a very loud signal.

And then there’s DeFi, where Solana has been pulling ahead in a way ETH holders probably don’t love seeing. Solana’s stablecoin market has climbed about 8.5% this week, while Ethereum’s stablecoin market barely moved, sitting around 0.2%. The fuel behind that jump is pretty direct too: roughly $2.75 billion in USDC was minted on Solana during the same period.

That’s the kind of flow that usually doesn’t show up unless there’s real demand. Stablecoins are liquidity. Liquidity is DeFi oxygen. And when stablecoins expand on one chain while another stays flat, it starts to look like capital is making a choice.

Ethereum is getting hit with heavy selling pressure

Ethereum’s last few days have been rough, and not just because price is red. The bigger issue is what the large players are doing.

As LookOnChain pointed out, Trend Research has nearly sold off its ETH position. The numbers are ugly. They reportedly withdrew 792,532 ETH at around $3,267, then later deposited 772,865 ETH back to Binance at around $2,326. The result? A loss of roughly $747 million.

That’s not retail panic. That’s institutional pain. And when you see that kind of loss being realized, it tends to feed the narrative that ETH is facing heavier pressure than most people expected.

Why the SOL/ETH ratio is suddenly the chart everyone should watch

This is where the SOL/ETH ratio starts to look important again. While Ethereum is dealing with sell pressure and headline-level FUD, SOL/ETH has been holding inside a tight range near a key support area.

At the time of writing, SOL/ETH was hovering around 0.04. That’s not a random number. It’s a level that sparked a 35% rebound during the Q3 2025 rally, so traders remember it. Markets have memory, even if they pretend they don’t.

And when you combine that with Solana outperforming ETH across perps volume, stablecoin growth, and ETF flow pressure, the sideways chop in SOL/ETH starts to look less like indecision and more like positioning.

This isn’t “coincidence” – it looks like rotation

In normal markets, you can shrug off these divergences as noise. But this isn’t a normal market. The last few days have been a risk-off environment, and risk-off markets usually expose what’s strong and what’s weak very quickly.

Right now, Solana is showing strength in the exact places that tend to lead. Trading activity, stablecoin liquidity, and relative institutional pressure. Meanwhile, Ethereum is dealing with heavy outflows and major holders exiting at a loss, which is the kind of story that can drag on sentiment for weeks.

So no, SOL/ETH chopping sideways near support doesn’t feel like coincidence. If this rotation holds over the next few sessions, it could easily set the stage for another SOL rally, driven less by hype and more by the market’s oldest rule: capital flows toward strength.