- Short-term volatility spikes reflect positioning stress more than fundamentals

- Options “panic” usually happens after the drop, not before it

- Zooming out makes most of the noise look smaller than it feels

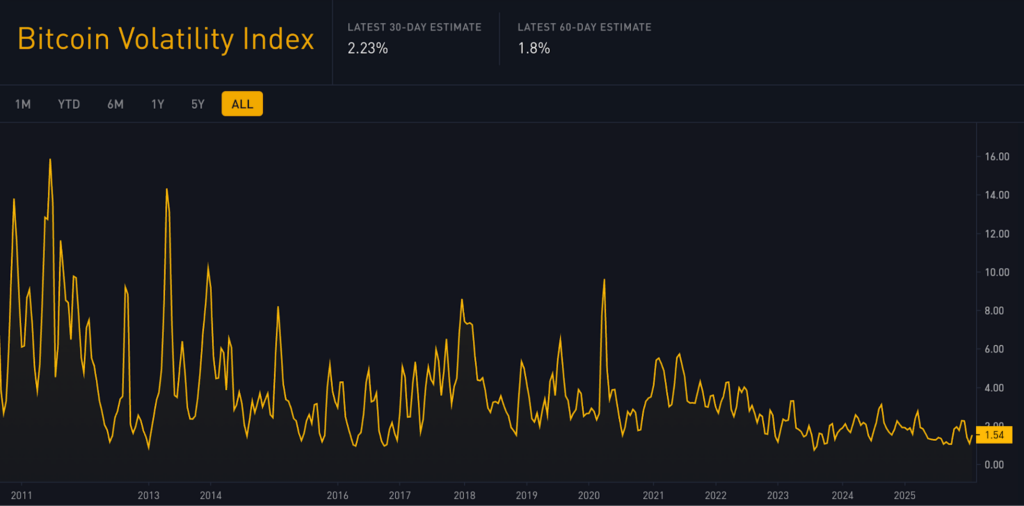

Yes, Bitcoin’s volatility jumped hard. The BVIV surged to levels last seen during the FTX collapse, and that comparison alone was enough to trigger instant doom narratives across crypto. But volatility isn’t a diagnosis. It’s a symptom, and most of the time it reflects demand for protection after the market has already been hit.

People see a scary number and treat it like a verdict. That’s the mistake. Volatility measures uncertainty, not structural damage. It tells you traders are nervous. It doesn’t automatically tell you Bitcoin is “broken.”

Options Fear Arrives After the Damage

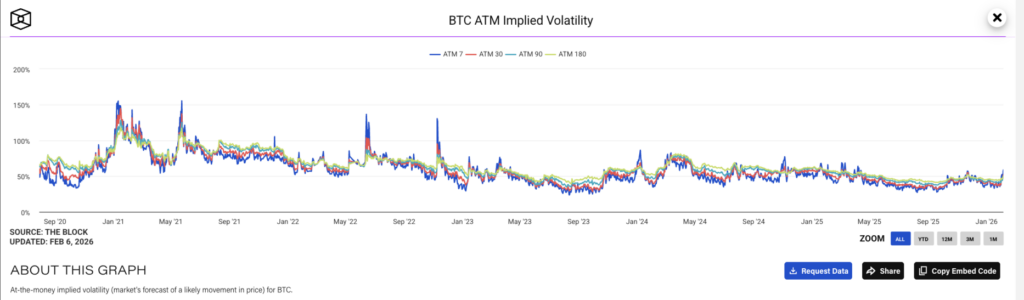

The rush into put options didn’t cause the selloff. It responded to it. When price breaks fast, traders scramble for insurance, and that insurance demand pushes implied volatility higher by definition. Calling that “panic” misses the order of events. It’s reactive, not predictive.

This matters because front-end volatility almost always overshoots during sharp moves. Short-dated fear spikes first, longer-dated expectations stay calmer, and the curve often inverts. That pattern is not collapse behavior. It’s hedging behavior, messy, emotional, and late.

Zooming Out Shrinks the Story

Step back and yesterday’s chaos barely registers in the bigger structure. Bitcoin has lived through drawdowns far worse than this and kept moving forward. The long-term volatility trend has been compressing for years, even as short-term spikes still appear during stress. One ugly week doesn’t erase that reality.

Markets punish people who stare too closely at the tape. They reward people who understand context. Crypto is basically built on that lesson, and it still catches people every cycle.

Noise Gets Loudest When You’re Too Close

This wasn’t a signal that Bitcoin is broken. It was a reminder that fear sells better than perspective, and volatility spikes are the easiest way to package fear into a chart. Stress pushes volatility higher, always has, always will. The mistake is treating a short-term reaction as if it’s a long-term verdict.

Stand back, lower the volume, and most of the so-called crisis disappears. What’s left is a market doing what it always does in fast moves, overshooting, hedging late, and making everything feel bigger than it really is.