- MARA transferred 1,318 BTC to Galaxy Digital, Two Prime, and BitGo

- The move comes as mining and crypto-linked stocks sell off sharply

- MARA remains the second-largest corporate Bitcoin holder after Strategy

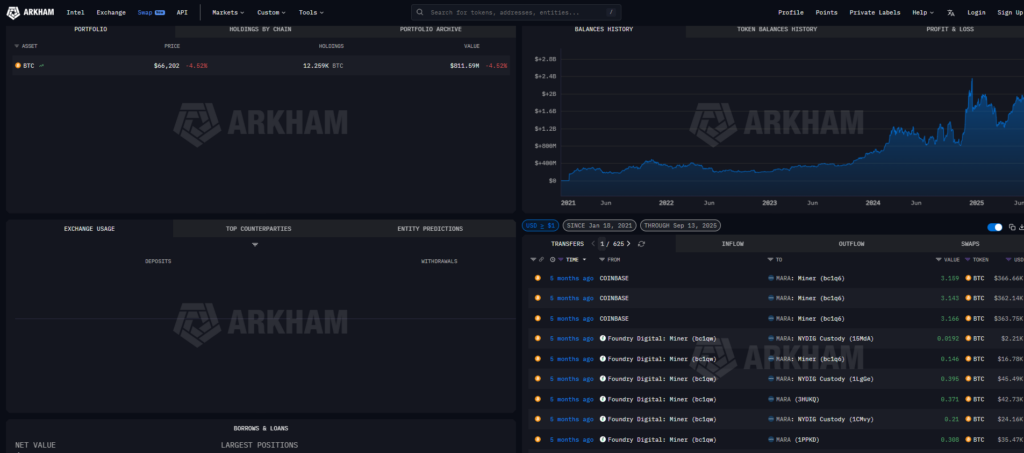

MARA Holdings, the second-largest corporate holder of Bitcoin, transferred 1,318 BTC worth roughly $87 million on Thursday, according to on-chain data tracked by Arkham Intelligence. The BTC was sent to Galaxy Digital, Two Prime, and BitGo, three names typically associated with custody, execution, and institutional crypto services. In a calm market, this might look routine. In this market, everything gets read as a signal.

The timing is what’s making traders pay attention. Bitcoin has been under heavy pressure and crypto-linked equities have been selling off aggressively. When a large miner moves coins during a drawdown, the market naturally asks the uncomfortable question first: is this treasury management, or is this a prelude to selling.

MARA’s Bitcoin Treasury Is Massive by Public Company Standards

MARA ended Q3 2025 holding 52,850 BTC, valued around $3 billion at the time, after mining and retaining 2,144 BTC during that quarter. That puts the company in a rare category. Among public firms, MARA trails only Strategy, which holds 713,502 BTC on its balance sheet, a gap so large it almost feels like a different asset class.

Because MARA is a miner, its Bitcoin position is often viewed differently than Strategy’s. Miners have operational costs, they have to manage cash flow, and they sometimes move coins simply to stay liquid. But in a fragile market, nuance tends to get drowned out by fear, even if the move is neutral.

Mining Stocks Are Taking the Hit First

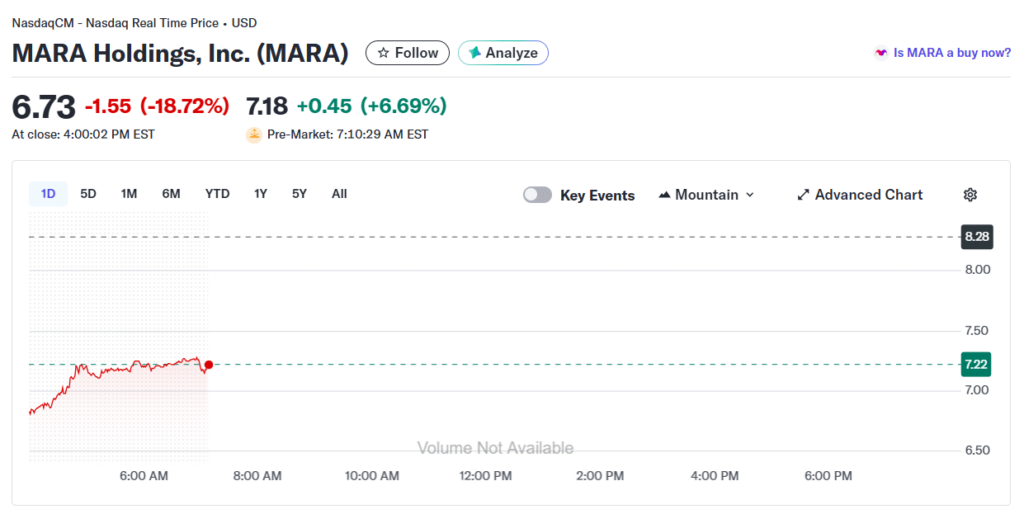

MARA shares fell nearly 19% on Thursday, pushing year-to-date losses to roughly 25% as crypto market pressure continues to build. The stock ticked slightly higher in premarket trading Friday, recovering some of the previous day’s damage, but the broader tone remains ugly. Miners are usually the first to get punished when Bitcoin breaks key levels, because their business model is both cyclical and highly sensitive to price.

And it wasn’t just MARA. Crypto-linked equities broadly sold off as investors reduced exposure to anything tied to digital assets. Strategy’s MSTR fell about 17%, Coinbase dropped roughly 13%, Robinhood lost around 10%, and IREN slid about 11%. The selloff looked less like company-specific news and more like a coordinated risk-off exit.

What the Transfer Could Mean, and What It Doesn’t

A transfer to Galaxy Digital, Two Prime, and BitGo doesn’t automatically mean MARA is dumping Bitcoin. These firms can be used for custody, structured products, collateral management, or execution services. Still, the market treats movement as potential intent, especially when liquidity is thin and price action is already unstable.

For now, the transfer reads more like positioning than panic. But in this environment, even routine treasury operations can become catalysts, because traders are already on edge. The bigger signal may not be the transfer itself. It may be how quickly the market is now reacting to anything that smells like supply.