- ETF holders are sitting on losses but not rushing for the exits

- Outflows look large in headlines but small versus total inflows

- Long-term conviction is being tested more than price levels

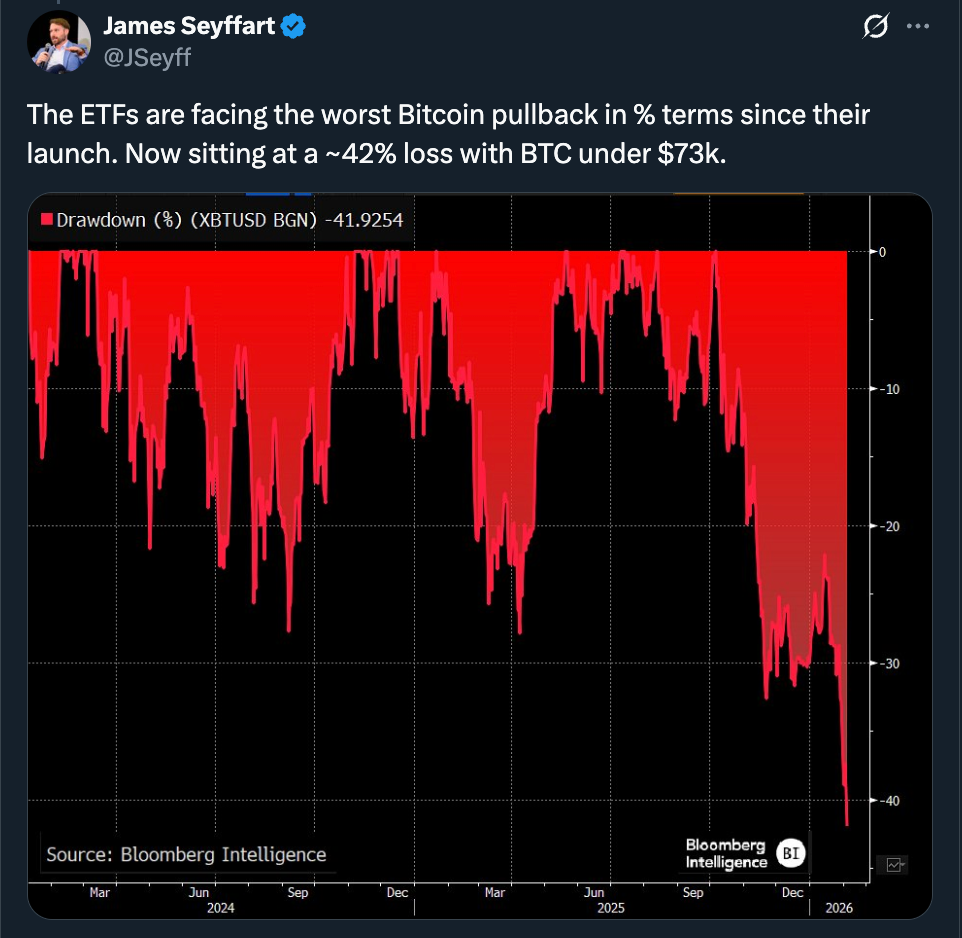

Bitcoin spot ETF holders are now facing their deepest paper losses since launch. With BTC hovering in the low $70,000 range, the average holder is roughly 24% underwater. In previous crypto cycles, that kind of drawdown would have sparked aggressive selling and emotional exits almost immediately. This time, it hasn’t.

Outflows are happening, but they’re controlled and slow. There’s no cascade, no stampede, no sense of urgency on-chain or in fund data. That difference alone suggests the buyer profile has changed in a meaningful way.

The Bigger Flow Picture Tells a Calmer Story

Zooming out shifts the narrative. Before the downturn, spot Bitcoin ETFs pulled in more than $62 billion in inflows. Even after months of weakness, net inflows are still hovering near $55 billion. That’s not capital fleeing, it’s capital digesting.

Three straight months of outflows sound dramatic when isolated. Against the scale of prior inflows, they look far less alarming. Losses feel sharper when they follow euphoria, but that doesn’t automatically make them structurally important.

This Phase Is Testing Time Horizons, Not Belief

Most of the anxiety comes from short-term framing. Bitcoin is down roughly 25% in a month, so sentiment flipped quickly. But zoom out further and the picture changes again. Since 2022, BTC is still up multiples compared to gold or silver, even after those metals posted their strongest years in decades.

ETF buyers were never day traders. They were allocators. Allocators don’t react to every drawdown if the thesis still holds. What’s being tested right now isn’t Bitcoin’s long-term case, it’s patience.

Boredom Looks Like Weakness Until It Doesn’t

ETF holders are underwater and still holding. That isn’t denial, it’s discipline. Markets often confuse discomfort with failure, especially in crypto where reactions are usually extreme.

This phase isn’t capitulation. It’s boredom. And boredom is often where longer-term positioning quietly gets built, not destroyed.