- HYPE is one of the strongest-performing crypto assets across short- and mid-term charts

- The rally follows Hyperliquid’s HIP-4 proposal introducing prediction market functionality

- Analysts warn broader market weakness could still trigger a sharp correction

Hyperliquid (HYPE) has rapidly climbed into the spotlight as one of the market’s top performers. According to recent data, the token is up nearly 22% in the past 24 hours, more than 39% over the last week, and close to 60% across the 14-day window. Zooming out further, HYPE has gained over 48% in the past month and more than 65% since February 2025, making it hard for traders to ignore.

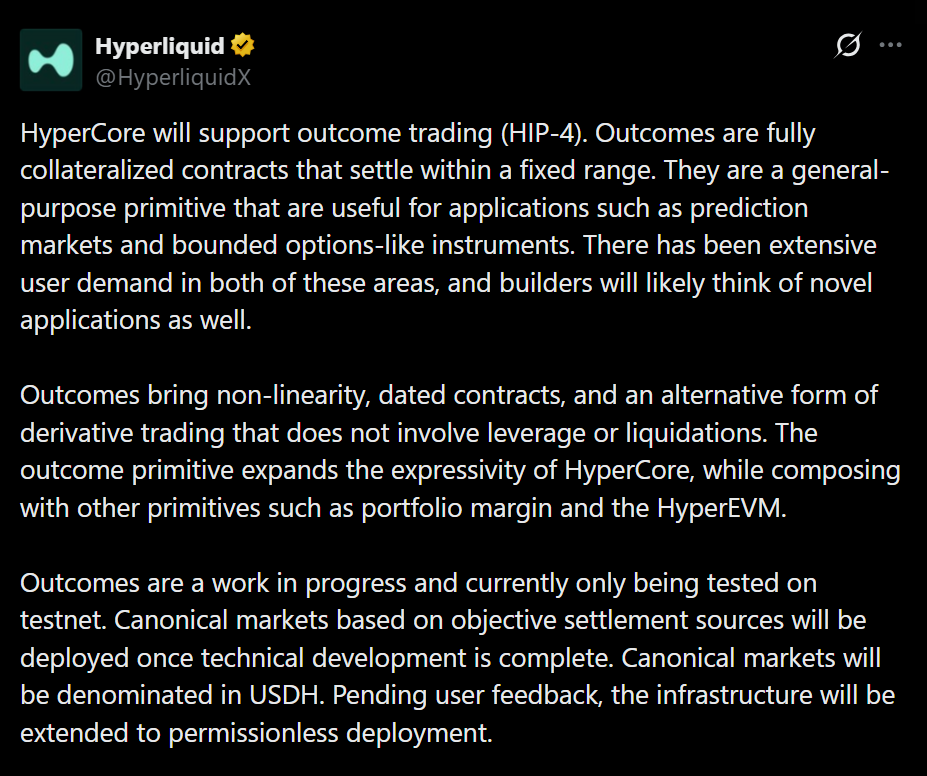

The immediate catalyst behind this move is the announcement of Hyperliquid’s HIP-4 proposal. The proposal introduces “Outcomes,” a new feature that signals the project’s entry into prediction markets. This would allow outcome-based trading on the platform, expanding Hyperliquid beyond its current derivatives-focused use cases. While the feature is still in development and only live on testnet for now, the announcement alone was enough to spark strong speculative interest.

How Far Is HYPE From a New Peak?

Hyperliquid previously reached an all-time high of $59.30 in September 2025. Despite the recent rally, the token is still down roughly 37% from that peak. That gap leaves room for upside if momentum continues, but it also highlights how much ground the asset would need to recover to enter true price discovery again.

The bigger concern is the broader market environment. Crypto has been largely risk-off for months, with many investors favoring safer assets as Bitcoin struggles to reclaim key psychological levels. In this kind of market, sharp rallies are often followed by equally sharp profit-taking, especially in fast-moving altcoins like HYPE.

Analysts Warn of a Possible Pullback

Not all forecasts are optimistic. Some analysts expect the rally to cool off in the near term, projecting a potential correction back toward the mid-$20 range. A move like that would represent a drawdown of more than 30% from current levels and would be consistent with previous hype-driven spikes seen during broader bearish phases.

That doesn’t negate Hyperliquid’s longer-term potential, but it does suggest traders should be cautious about assuming a straight-line move higher. Without stronger confirmation from the wider crypto market, HYPE remains vulnerable to sentiment shifts.

Conclusion

Hyperliquid’s surge shows how quickly narrative-driven momentum can return to select crypto projects, even during uncertain market conditions. The HIP-4 proposal has clearly captured attention, but whether HYPE can push toward a new all-time high will depend on follow-through, delivery, and the state of the broader market. For now, the rally is impressive — but fragile.