- The ISM is a business activity survey, not a reliable Bitcoin price indicator

- Historical data shows Bitcoin often moves opposite to ISM trends

- Supercycle narratives built on single macro signals have failed before

The ISM Manufacturing Index measures business conditions through surveys of purchasing managers, with readings above 50 signaling expansion and below 50 contraction. It’s a useful snapshot of corporate momentum, supply chains, and demand expectations. What it does not do is predict speculative asset behavior. Bitcoin is driven by liquidity, leverage, and positioning far more than factory output or procurement sentiment.

Yet in 2026, the ISM has been elevated to near-oracle status by traders searching for macro reassurance after several bullish narratives unraveled. That’s a dangerous shortcut.

History Shows the Disconnect Clearly

The historical record does not support the idea that a strong ISM lifts Bitcoin. In 2014, the ISM climbed steadily while Bitcoin collapsed from over $700 to near $300. In 2015, the opposite happened: the ISM fell into contraction while Bitcoin quietly ended its bear market and moved higher.

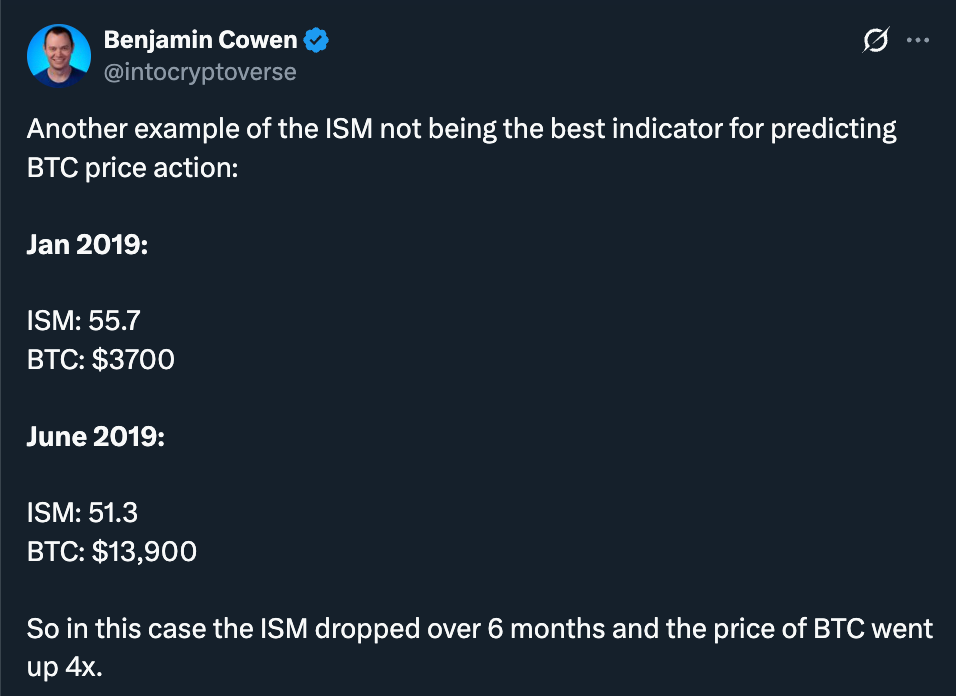

The pattern repeats elsewhere. In 2019, the ISM weakened significantly while Bitcoin surged nearly fourfold in six months. These were not edge cases. They were full-cycle failures in both directions.

Why 2026 Looks Uncomfortably Familiar

The ISM reading in January 2014 was 52.5. In January 2026, it sits at 52.6. That similarity matters because it highlights how easily history can rhyme. There is a very real scenario where business surveys improve this year while Bitcoin continues to bleed, catching supercycle believers offside.

Anyone anchoring positions to one macro indicator is underestimating how complex Bitcoin’s drivers actually are.

The Real Risk for Supercycle Believers

The danger isn’t that the ISM is useless. It’s that traders are using it in isolation to justify high-conviction Bitcoin bets. Context always wins. Liquidity conditions, leverage, regulation, and risk appetite matter far more than a single survey print.

Bitcoin has never moved in lockstep with the economy. Treating it as a macro mirror rather than a liquidity asset has cost people fortunes before.

Conclusion

A single data point does not make a trend. Using the ISM to validate a Bitcoin supercycle is not analysis, it’s hope dressed up as math. Bitcoin is not the economy, and betting as if it were is one of the fastest ways to get punished in this market.