- Binance’s emergency fund made its first Bitcoin buy in nearly two years

- The move follows a plan to rotate $1B from stablecoins into BTC

- Timing during market stress makes the signal more strategic than symbolic

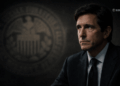

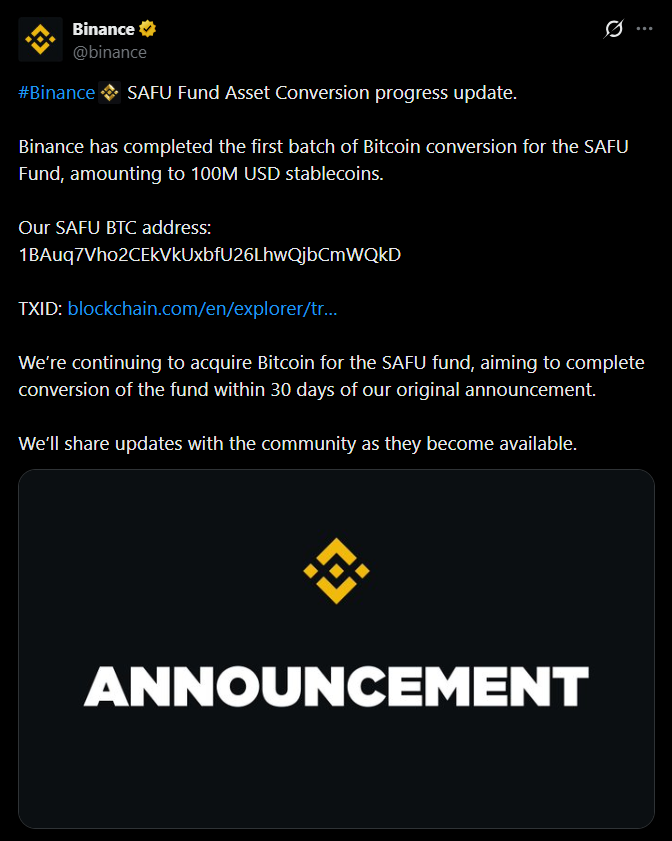

Binance confirmed that its Secure Asset Fund for Users purchased roughly 1,315 Bitcoin, worth just over $100 million, marking the fund’s first BTC acquisition in almost two years. SAFU was created in 2018 as an insurance reserve to protect users against hacks, exploits, or platform failures, and it has historically leaned heavily on stablecoins to limit volatility.

This purchase represents the first step in a broader strategy announced on January 30, when Binance said it would convert up to $1 billion in stablecoin reserves into Bitcoin over a 30-day period. Rather than a one-off buy, this is a phased reallocation.

Why the Timing Matters

The move comes during a period of heightened market volatility. Bitcoin dipped to around $74,600 over the weekend amid heavy selling pressure before rebounding toward the $77,700 range. Executing the purchase during weakness, rather than strength, suggests the decision was not driven by momentum or optics.

For a fund designed to act as a safety net, buying Bitcoin during drawdowns reflects confidence in BTC’s long-term role rather than short-term price stability.

From Stability to Strategic Rebalancing

SAFU has traditionally held reserves primarily in stablecoins to preserve capital and reduce risk. Shifting part of that reserve into Bitcoin introduces volatility, but it also aligns the fund with Binance’s stated view that BTC is the core long-term asset of the crypto ecosystem.

The key detail is that Binance plans to actively monitor SAFU’s valuation and rebalance if it falls below its $1 billion floor. That framing makes Bitcoin exposure a calculated risk rather than a speculative bet.

What This Signals to the Market

Insurance funds are not designed for aggressive positioning. When they adjust allocations, it usually reflects a change in underlying assumptions. In this case, Binance appears more comfortable holding Bitcoin as a reserve asset even during turbulent conditions, reinforcing BTC’s role as a foundational asset rather than just a trading instrument.

Conclusion

SAFU’s $100 million Bitcoin purchase is less about chasing a rebound and more about redefining what “safety” looks like in crypto. Binance is signaling that Bitcoin itself is now stable enough, structurally, to sit inside an emergency backstop. In volatile markets, that message carries weight.