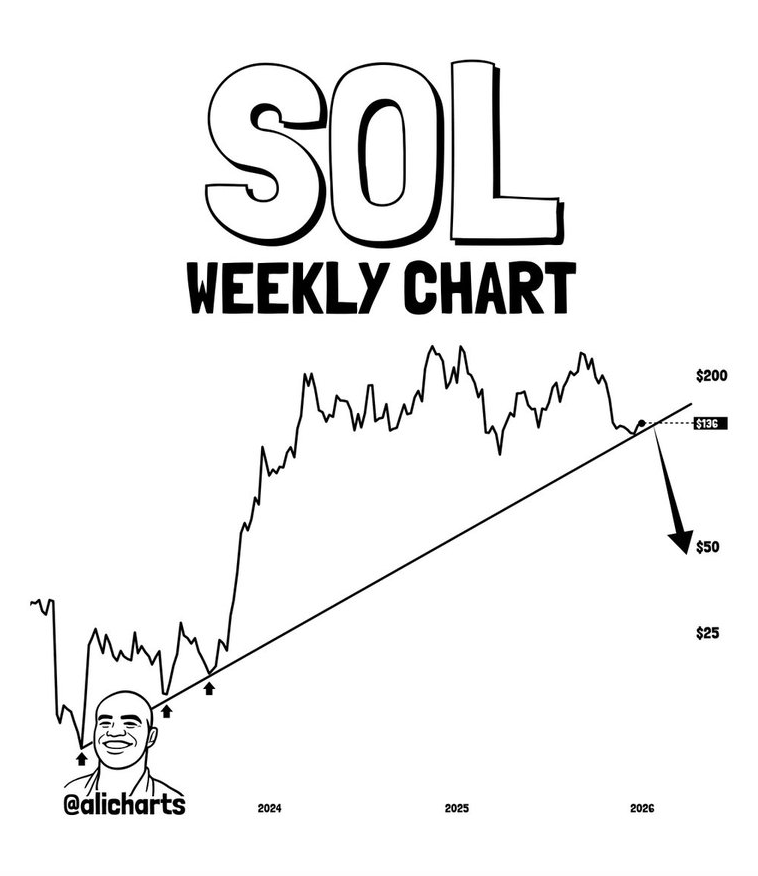

- Solana is testing a key long-term trendline near $136, with a clean weekly break potentially opening downside toward $50.

- Despite price pressure, on-chain activity has surged as AI-driven memecoin creation boosts network usage and fees.

- The next major move depends on whether SOL holds long-term support or confirms a structural breakdown.

A key trendline on the Solana chart has suddenly become the line everyone’s watching. According to one top crypto analyst, a clean break below it could reopen the door to much lower prices, with $50 now back in the conversation. It’s not a base case, but it’s no longer off the table either.

At the same time, something interesting is happening beneath the surface. Solana’s on-chain activity has surged, driven largely by a fresh wave of memecoin launches made easier by new AI tools. So while price is under pressure, network usage is moving in the opposite direction, which complicates the picture a bit.

Will Solana Price Really Drop to $50?

The focus right now is a rising trendline that has defined Solana’s uptrend since 2024. Crypto analyst Ali_charts pointed out that this level is essentially the market’s make-or-break point. On the weekly timeframe, SOL is still trading inside a long, clean uptrend, and that same trendline has acted like a floor throughout the move.

Each time price leaned into it in the past, buyers showed up and pushed SOL higher. At the moment, that support sits around the $136 area on the chart. As long as Solana holds above it on a weekly closing basis, the broader structure remains intact, and the recent pullback can still be viewed as a reset rather than a breakdown.

If that holds, the upside reference remains the $200 region, which stands out as the next major zone where selling pressure could reappear. It’s not guaranteed, but structurally, the path would still be open.

The risk shows up if SOL breaks below that trendline and fails to reclaim it. A clean weekly close under long-term support tends to change sentiment fast. Once that happens, the chart reveals a wide air pocket below, with the next meaningful target zone sitting near $50. In simple terms, if the floor gives way, there may not be much support until significantly lower levels.

For now, the playbook is pretty straightforward. Watch how Solana behaves around the $136 area and that rising support line. The reaction there likely decides the next major move.

Solana Network Activity Jumps Sharply

While price action grabs headlines, Solana’s on-chain data tells a different story. Daily active addresses surged past 5 million in the second half of the month, signaling a sharp increase in network usage. A lot more people are clearly interacting with the chain right now.

That jump came as memecoin creation picked up speed again, helped by the launch of Anthropic’s Claude Cowork, an AI agent that can operate a user’s desktop. With the barrier to launching tokens lower than ever, developers using the Solana Bags launchpad ramped things up fast.

The impact showed up in fees. On January 16, Solana generated roughly $4.5 million in daily fees, a massive jump compared to the previous few months. From September through December, daily fees often stayed below five figures, sometimes dropping to just a few hundred dollars.

Over the same period, Bags also pulled ahead in output. More tokens were successfully launched on the platform, overtaking volumes seen on other Solana-based memecoin factories like Pump.fun. It was a short burst, but an intense one.

Ethereum Activity Picks Up Too

Ethereum wasn’t left out of the activity surge. By late December, the network had moved ahead of major layer-2s like Base and Arbitrum in daily active addresses. Then in January, that activity climbed another 25%, showing the momentum carried into the new year.

This increase followed key network upgrades, including expanded blob capacity, which helped push fees sharply lower. By January 29, average Ethereum fees had dropped to under one cent. That wasn’t just a cosmetic improvement.

Lower fees align with Ethereum’s longer-term goal of becoming a network that can operate efficiently at scale. Even so, despite rising activity across both chains, the latest Solana price predictions have reignited debate over where SOL heads next. For now, price and fundamentals are telling slightly different stories, and the trendline in the middle may decide which one wins.