- BitMine Immersion is facing over $6B in paper losses after ether prices slid sharply

- The firm now holds roughly 4.24M ETH, making it highly exposed to market swings

- Ongoing deleveraging and liquidation pressure continue to weigh on ETH prices

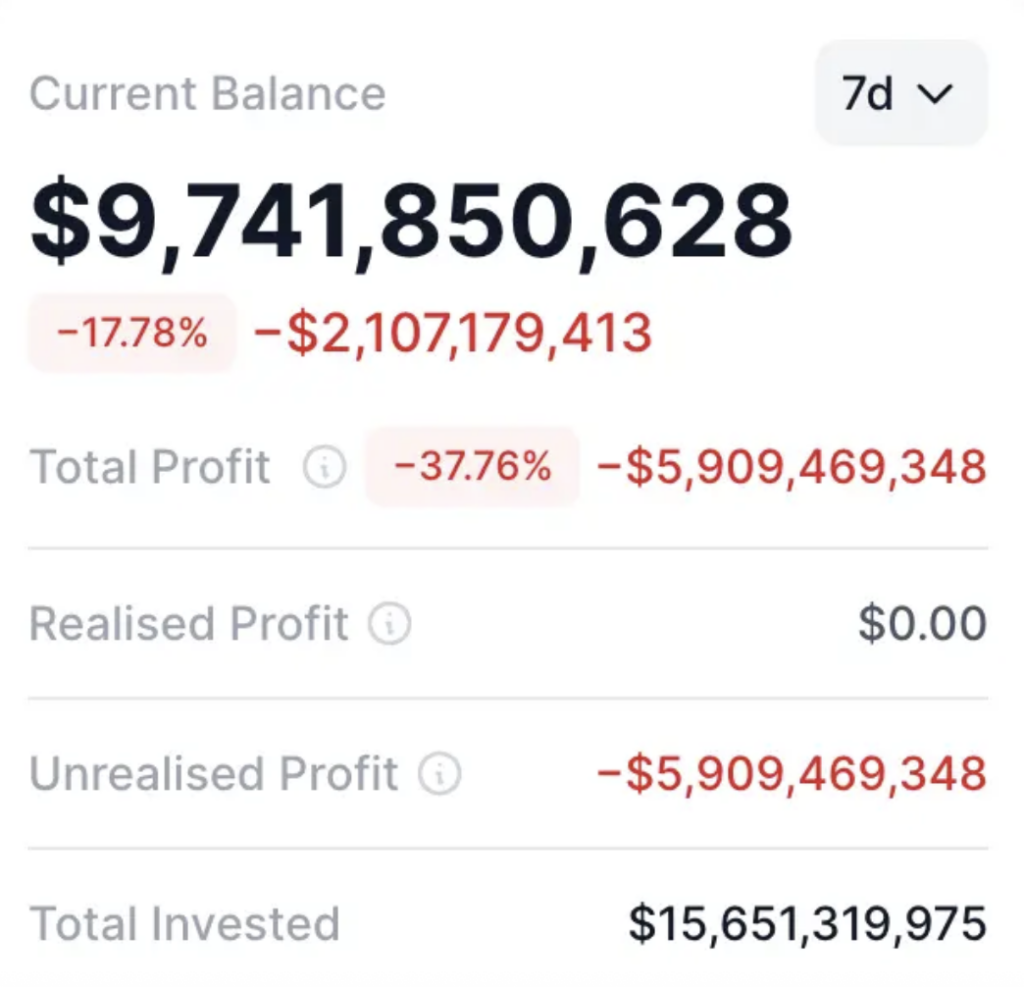

BitMine Immersion’s aggressive push into ether has suddenly gone the wrong way. After the latest leg down in crypto markets, the company is now sitting on more than $6 billion in paper losses tied to its ETH holdings, a sharp reversal from where things stood just a few months ago.

The publicly traded firm added over 40,000 ether just last week, pushing its total balance to roughly 4.24 million ETH, according to portfolio data tracked by Dropstab. At the time, the move looked confident. Since then, price action has done the opposite of cooperate.

Falling Prices Drag Treasury Value Lower

As selling picked up across the market, ether slid hard, pulling the value of BitMine’s holdings down to around $9.6 billion. That’s a steep drop from nearly $14 billion at the October highs, and it puts the scale of the drawdown into perspective quickly. On Saturday, ETH dipped toward the $2,300 level as downside pressure intensified across major tokens.

The timing hasn’t helped. Corporate crypto treasuries have become a defining feature of this cycle, but they cut both ways. Large positions can amplify upside when markets run, and just as easily magnify losses when bids thin out and sentiment turns cold.

Deleveraging Adds Fuel to the Decline

The broader market environment has only made things tougher. As ether slid, forced selling rippled through derivatives markets, adding momentum to the move lower. Liquidations across major venues picked up alongside ETH’s drop, compounding pressure on spot prices and making rebounds harder to sustain.

That feedback loop, falling price, liquidations, more selling, has been a familiar pattern during this downturn. For firms with heavy balance-sheet exposure, there’s little room to hide once it gets going.

A More Cautious Tone From the Top

Company chairman Tom Lee has recently struck a noticeably more cautious tone on the near-term outlook. While still constructive over the long run, he’s warned that the market is in the middle of a broader deleveraging phase and that early 2026 could remain choppy before conditions truly stabilize.

In a recent interview, Lee pointed back to October’s sharp sell-off, which wiped out roughly $19 billion in market value across crypto, as a key reset moment. That break, in his view, cleared excess positioning but also set the stage for continued volatility as the market digests it.

Staking Revenue Helps, But Only So Much

BitMine has previously said that a portion of its ether holdings are staked, generating estimated annual staking revenue of around $164 million. That income stream provides some cushion, but it comes with limits. Staking yields fluctuate with network conditions, and during fast drawdowns, they barely register against multi-billion-dollar price swings.

For now, BitMine’s ether strategy remains intact, but the recent move lower has brought renewed attention to the risks that come with running a leveraged bet on crypto prices. In this market, conviction can pay off, but timing still matters, sometimes more than anyone expects.