- Binance says most liquidations occurred before any exchange-specific issues appeared

- Data shows losses were spread across multiple platforms, not just one venue

- The crash is being framed as a leverage stress test under macro pressure

Binance has released a detailed post-mortem on the October 10, 2025 crypto flash crash, pushing back on the idea that exchange-side failures were the main trigger. According to the exchange, the $19 billion liquidation wave was largely driven by macro shocks and automated risk controls firing across the market, not by any single platform breaking down.

Internally dubbed the “10/10 incident,” the crash unfolded during a rough macro backdrop. Trade-war headlines resurfaced, global bond yields jumped, and equity markets were already sliding. That mix, Binance says, set off a rapid and aggressive deleveraging across crypto derivatives, with positions unwinding almost everywhere at once.

Clarifying the Record After Weeks of Criticism

The report comes after weeks of speculation and criticism aimed squarely at Binance. On social media and in analyst commentary, the exchange was frequently named as a possible source of the cascade. Traders pointed to brief price dislocations, unusual index behavior, and scattered reports of interface glitches as signs that something had gone wrong on Binance’s side.

Binance’s response is clearly meant to separate perception from sequence. By laying out a precise timeline, the exchange argues that the bulk of liquidations happened before any Binance-specific issues appeared. In its view, the market was already in freefall, and the exchange-level incidents came later, not first.

Liquidations Peaked Before Platform Issues Appeared

According to Binance, the most violent phase of liquidations occurred before 21:36 UTC. By that point, the exchange claims roughly 75% of all industry liquidations had already taken place. The two technical issues Binance later acknowledged only emerged after that peak window.

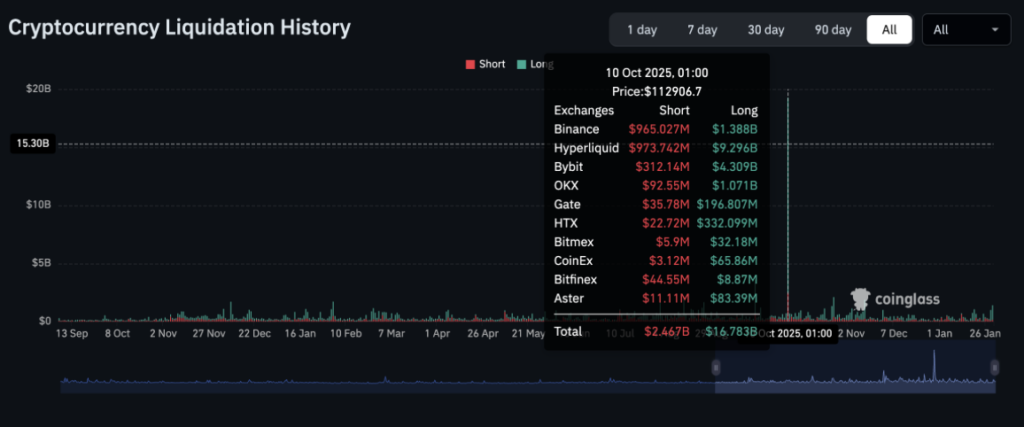

CoinGlass data illustrates just how widespread the damage was. At around 01:00 UTC on October 10, total liquidations hit roughly $19.25 billion, with long positions taking the brunt of the hit. Binance itself recorded about $1.39 billion in long liquidations and roughly $965 million in shorts. Hyperliquid saw an even larger figure, with $9.29 billion in long liquidations, while Bybit logged more than $4.3 billion and OKX over $1.07 billion.

The losses were spread across multiple venues, not concentrated on one exchange. Binance leans heavily on that point, arguing the scale and distribution point to a systemic leverage unwind rather than a single point of failure.

Two Incidents Acknowledged, Impact Downplayed

While rejecting blame for the broader crash, Binance did acknowledge two localized issues during the volatility window. The first occurred between 21:18 and 21:51 UTC, when its asset transfer system between Spot, Earn, and Futures briefly degraded. The issue was tied to database strain under heavy load. Some users saw zero balances in the interface for a short period, though Binance says actual funds were never at risk.

The second incident followed shortly after, between 21:36 and 22:15 UTC. During that window, abnormal index price deviations appeared for assets like USDe, WBETH, and BNSOL. Binance admitted those deviations likely contributed to margin calls and liquidations on certain pairs, especially where liquidity was thin.

Since then, the exchange says it has tightened deviation thresholds, improved cross-exchange reference pricing, and upgraded circuit breakers to reduce the odds of a repeat.

A Stress Test for Leverage, Not Just Infrastructure

Binance framed the October crash as a stress test of the crypto market itself, not just its own systems. In its view, leverage concentration and automated market-maker risk controls amplified volatility once macro pressure hit. When everyone tried to exit at once, the structure buckled, quickly.

The exchange says it has responded by expanding stress-testing programs, improving monitoring of database performance during volatility spikes, and increasing capacity planning for future shocks. The message is clear. October 10 wasn’t about one exchange failing. It was about a market still learning how fragile heavy leverage can be when the macro tide suddenly turns.