- Solana sustained high TPS during memecoin surges without lasting degradation

- Memecoin activity increased token deployments while network performance stayed stable

- Speculative volume translated into strong DEX activity and application revenue

At first glance, Solana’s latest spike in activity looks like pure memecoin chaos, loud, fast, and heavily speculative. But under the surface, something more interesting is happening. The network is being pushed hard in real time, and so far, it’s holding up, testing scalability, fee behavior, and throughput in conditions that feel anything but theoretical.

What stands out is that this isn’t a one-off performance burst. Solana’s transaction throughput has been operating at production-level consistency, not lab-grade peaks that vanish the moment pressure hits.

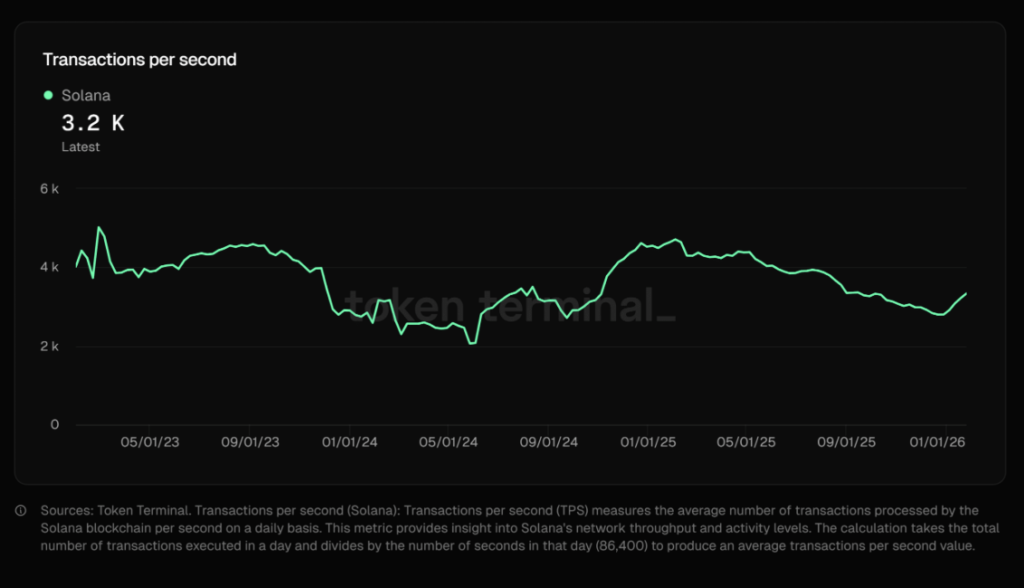

Throughput Holds Steady Under Real Demand

Since 2023, Solana’s transactions per second have consistently landed between roughly 2,000 and 5,000 TPS, with recent readings hovering near 3,200, even during aggressive memecoin launch waves. That matters, because speculative surges didn’t break the system or cause lingering slowdowns. Throughput spiked, then normalized quickly, which is exactly what you want to see when real demand shows up.

After dipping toward the 2,000 TPS range in mid-2024, Solana steadily scaled back into 2025. That recovery wasn’t tied to a single event or hype cycle, it tracked broader ecosystem growth. Weekly averages now show Solana capturing around 40% of total Layer 1 transaction throughput, second only to Internet Computer, which sits near 4,100 TPS. Most other major chains, including Ethereum, BNB Chain, and TRON, operate far lower, often under 150 TPS.

Solana’s advantage comes from parallelized execution, low fees, and an optimized networking stack. High activity doesn’t destabilize the system, it stacks on top of itself. Minimal degradation under stress isn’t a benchmark trick, it’s proof the network works in live conditions, not just on paper.

Memecoins Are Back, and the Network Isn’t Flinching

Memecoin activity on Solana has ramped up again, with daily token deployments pushing past 40,000, an eleven-month high. What’s notable is the timing. This resurgence happened while transaction throughput stayed firmly in the 3,000 to 5,000 TPS range, even during peak launch periods.

High-volume token creation didn’t clog the network. Instead, consistent execution allowed rapid launches, constant trading, and near-nonstop experimentation. Deployment counts climbed over recent months without stressing performance, confirming that scalability isn’t just theoretical, it’s being used.

Launch activity has also spread out. Rather than concentrating on a single platform, multiple launchpads are seeing participation, which points to broader ecosystem involvement. High TPS lowers friction, invites speculation, and reinforces Solana’s role as the go-to execution layer when memecoin cycles heat up again, which they always seem to do.

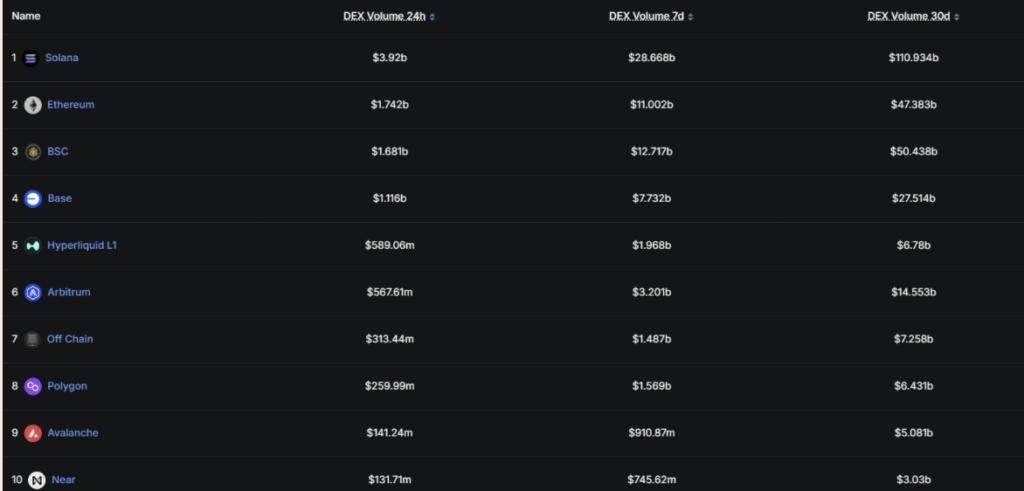

Speculation Turns Into Real Revenue

What really shifts the narrative is how speculation has translated into actual economic output. Over the past 30 days, Solana-based DEX volume topped $110 billion, more than double Ethereum’s roughly $47 billion during the same period. That’s not just noise, it’s sustained trading intensity.

Application revenue followed closely behind. Solana generated around $145 million in app revenue over that window, outpacing peers and validating its ability to capture fees at scale. And this didn’t happen during a quiet market stretch, it happened right in the middle of a memecoin-driven cycle.

As activity scales, base fees, priority fees, and MEV extraction all compound. Throughput isn’t hollow volume that disappears without impact. Usage pays, and the numbers show it. Solana’s current moment may look speculative on the surface, but underneath, it’s confirming something more durable, the network can handle chaos, and it can monetize it too.