- XRP remains range-bound as buyers defend key support but fail to break resistance

- Whale accumulation has increased despite mixed on-chain activity and price pressure

- Institutional flows and improving liquidity contrast with ongoing macro uncertainty

XRP is hovering near an important support zone while repeated attempts to reclaim resistance keep losing steam. The token remains stuck in consolidation following the broader market dip, and price action feels heavy, not broken, just undecided. Traders are caught weighing clean chart levels against mixed on-chain signals that don’t fully agree with each other.

What’s added a bit of tension is large-holder behavior. Wallet data shows a rise in so-called millionaire addresses, even as XRP struggles to regain the $2 level. It’s the kind of divergence that makes short-term traders nervous, but long-term watchers quietly pay attention.

Range-Bound Structure Defines the Near-Term Outlook

XRP has repeatedly defended a support area that continues to attract buyers on dips. Pushes below that zone have so far failed to produce meaningful follow-through, suggesting demand is still present, even if it’s cautious. Short-term charts show price compressing, with tighter candles and shrinking volatility.

Supply, however, has been just as consistent. Rallies keep stalling near a descending trendline, and momentum indicators aren’t offering much guidance either way. Until price breaks cleanly above resistance or decisively loses support, XRP remains stuck in a waiting game.

Support and Resistance Continue to Dictate Moves

Buying interest has clustered between the mid-$1.70s and around $1.80, a zone that has triggered several short-lived rebounds. Each bounce has been met with selling pressure, though, keeping the broader structure unchanged. These reactions suggest active trading, but not conviction.

Overhead resistance sits along a descending trendline and a wider distribution band that XRP has struggled to close above on higher timeframes. Price remains below the $2 psychological level after sliding during the recent market drawdown, briefly dipping toward $1.79, a level last seen during a prior pullback. For now, these boundaries remain the key trigger points.

Whale Accumulation Grows as On-Chain Signals Stay Mixed

On-chain data paints a more nuanced picture. Glassnode data shows XRP’s market capitalization stabilizing after earlier corrections, aligning with the current consolidation phase. Capital outflows have slowed, which often happens when markets pause rather than trend.

At the same time, network activity has been uneven. Active addresses rose earlier in the period, then fell sharply, while transaction counts produced brief spikes without sustained growth. Despite this, large holders continued accumulating. Santiment reported a net increase of 42 wallets holding at least 1 million XRP this month, bringing the total to 2,016, the first rise since September 2025, even as XRP is down roughly 4% so far in 2026.

Institutional Flows and Macro Pressure Collide

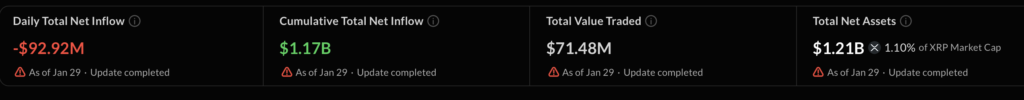

Nansen data also pointed to smart money accumulation rising more than 11% over the past 30 days, keeping institutional positioning part of the conversation. Spot XRP ETFs recorded net inflows of $91.72 million this month, pushing total net inflows to $1.26 billion since launch. Monthly inflows have remained positive since November, with strong contributions reported late last year as well.

Macro pressure hasn’t helped sentiment. XRP is down nearly 12% since mid-January, weighed by broader risk-off moves following renewed tariff warnings from US President Donald Trump toward the European Union and Canada. Even so, XRP Ledger liquidity trends have stayed constructive. Stablecoin liquidity climbed from $85 million earlier in 2025 to $406 million, with Ripple’s RLUSD accounting for the majority. Exchange data also suggests XRP was moved off platforms during much of the macro stress period.

Ripple has continued building on the product side, recently announcing Ripple Treasury, a unified dashboard combining crypto, cash, and treasury management. Meanwhile, asset manager 21Shares outlined a bull-case scenario targeting $2.69, citing ETF demand and growing institutional interest in issuing real-world assets on the XRP Ledger.