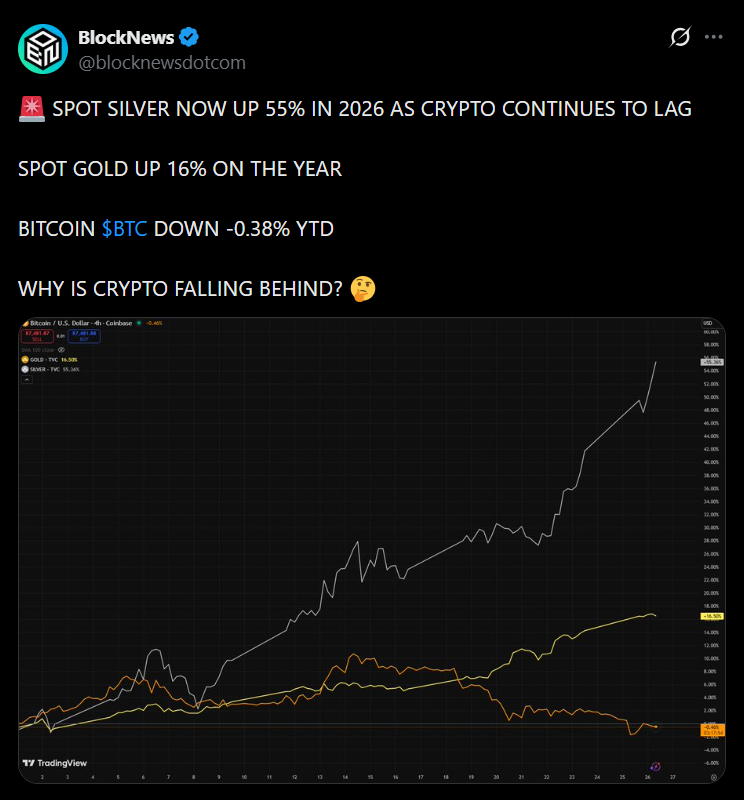

- Silver surged nearly 12% to a new record, sharply outperforming most risk assets

- Gold pushed above $5,000 as investors favored hard assets amid macro uncertainty

- Tight supply and momentum buying are reshaping cross-asset positioning

Silver surged to a fresh all-time high above $115 per ounce, posting nearly double-digit gains in a single session and decisively outperforming gold and most risk assets. The move reflects a combination of tight physical supply, strong retail participation, and aggressive momentum-driven buying. Unlike gold, silver’s dual role as both a precious and industrial metal has amplified price sensitivity during periods of supply stress.

Analysts highlighted that Chinese silver prices are trading at a premium to London benchmarks, a signal that near-term demand remains strong. While elevated prices could eventually pressure industrial usage, current flows suggest momentum remains firmly in control.

Gold Extends Its Run as Macro Stress Builds

Gold continued its steady ascent, reinforcing its role as a primary hedge against geopolitical risk and policy uncertainty. Prices climbed above $5,000 per ounce and briefly tested the $5,100 level as capital flowed into traditional stores of value. Central bank buying remains a core driver, with institutions continuing to diversify reserves away from the US dollar.

This sustained demand underscores how preservation-focused capital is behaving differently from speculative flows, favoring assets with long-standing monetary credibility.

What This Means for Crypto and Risk Assets

The metals rally is being closely watched by crypto markets, where price action has struggled to keep pace with hard assets during recent volatility. Silver’s leadership suggests that investors are prioritizing scarcity and supply constraints over growth narratives. For crypto, this divergence highlights a liquidity-driven environment where preservation assets outperform until risk appetite returns.

As trade tensions, currency intervention speculation, and pressure on central banks intensify, cross-asset positioning is becoming more defensive. Silver’s breakout, in particular, signals that this rotation may have further room to run.