- Solana is trading near $83 but remains in a broader downtrend below its 50-day and 100-day moving averages.

- Negative funding rates suggest heavy short positioning, raising the potential for a short squeeze if SOL breaks above $90.

- On-chain wallet growth is rising despite falling price, hinting at possible accumulation within the $75–$90 range.

Solana is hovering around $83.69, clawing its way back after dipping to $79.82 earlier in the session. On the surface, a 1.5% gain over 24 hours looks decent enough, especially with $3.25 billion in trading volume flowing through the market. Its market cap sits near $47.57 billion, which keeps it firmly in heavyweight territory. But zoom out a bit, and the bigger picture feels heavier.

SOL is still trading well below its 50-day moving average at $106.66 and even further beneath the 100-day at $124.18. Both averages are sloping downward, not flat, not curling up, just pointing south. That’s usually a sign that sellers still have control, even if short-term bounces pop up here and there. Momentum, structurally speaking, hasn’t flipped.

Key Levels: $90 Above, $75 Below

Right now, the $90 to $100 zone stands out as immediate resistance. Any push into that region is likely to meet supply, traders who’ve been waiting to sell into strength. A clean break above the 50-day moving average would be the first real technical hint that trend direction might be shifting. Until then, rallies may simply be relief moves.

On the downside, $78 is the near-term line in the sand. Lose that, and $75 comes into view quickly, which is not just technical support but psychological as well. Round numbers matter, especially in crypto where sentiment can turn on a dime. For now, SOL appears to be building a base, or trying to at least, though confirmation hasn’t shown up yet. It’s more pause than reversal.

Funding Rates Flash a Contrarian Signal

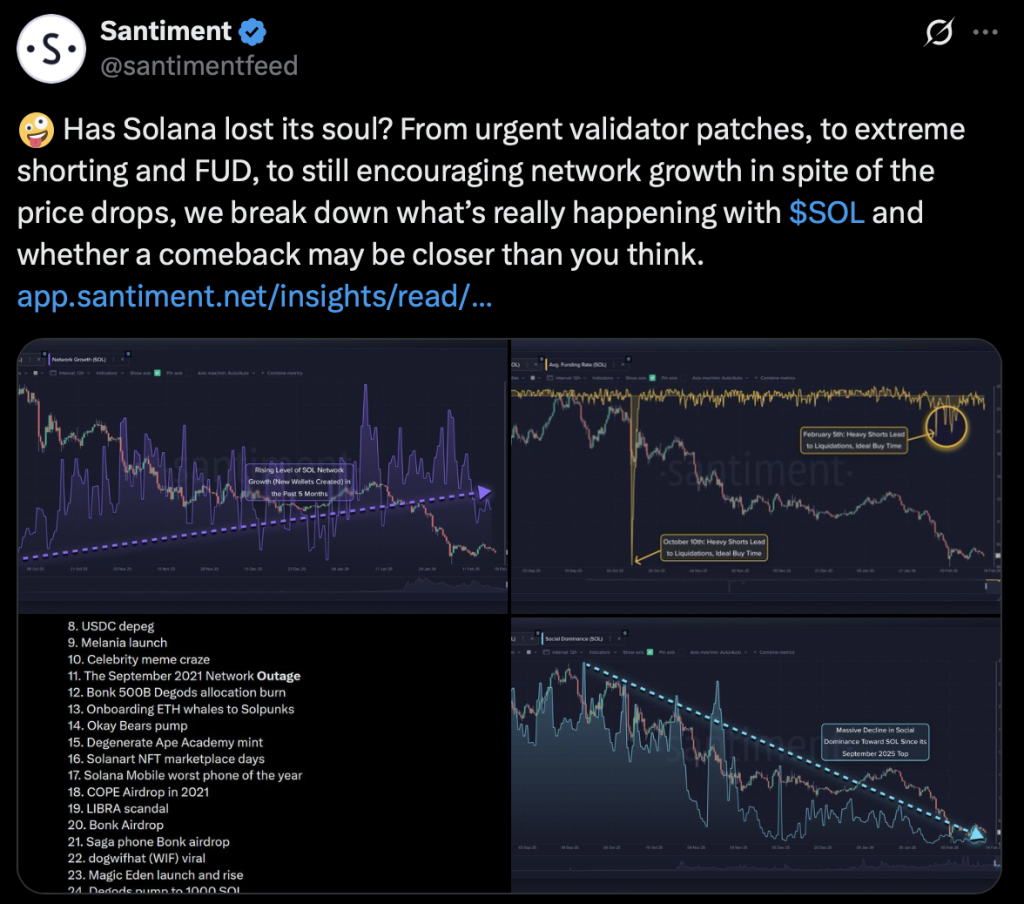

Interestingly, the derivatives market is telling a slightly different story. Funding rates have slipped sharply into negative territory, meaning a majority of traders are positioned short. When positioning leans too heavily one way, it can create fuel for the opposite move.

If SOL suddenly pushes higher, those shorts may be forced to close. That forced buying can cascade quickly, triggering what traders call a short squeeze. In past cycles, deeply negative funding rates have often lined up with local bottoms for Solana. A breakout above $90, backed by strong volume and rising open interest, would significantly increase the odds of that squeeze scenario unfolding toward $100. But volume has to confirm it. Otherwise, it’s just theory.

Adoption Climbs While Sentiment Cools

On-chain data adds another layer. New wallet creation on Solana has been steadily increasing, even as price drifts lower. That divergence, growing network activity alongside falling price, has historically appeared during accumulation phases. It doesn’t guarantee upside, but it does suggest the ecosystem isn’t shrinking.

Meanwhile, social dominance has cooled since its September highs. Fewer people are talking about Solana relative to other crypto assets. Oddly enough, that can be constructive. Reduced hype often means short-term speculators have exited, leaving behind quieter accumulation. The True Strength Index remains below zero, with readings around -33 and -35, showing bearish momentum still in play. Still, the lines are flattening. Selling pressure may be easing, slowly.

Analyst curb.sol is watching the $75 to $90 range as a consolidation zone. If SOL breaks above $90 convincingly, $120 becomes a realistic upside target. For now though, Solana sits at $83.69, balanced between pressure and possibility, waiting for its next decisive move.