- Cardano’s ADA fell 58.6% in Q4 2025, with market cap dropping to $12.2 billion and network activity declining sharply.

- Despite fewer active addresses, remaining users became more engaged, and governance reforms strengthened structural stability.

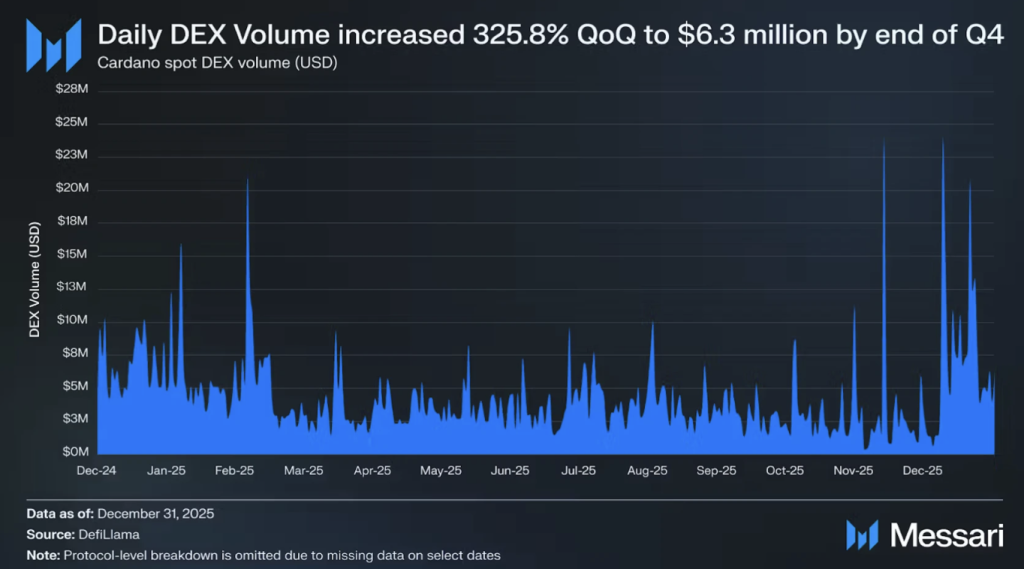

- DEX volume and NFT trading showed resilience, even as DeFi TVL and staking value declined alongside price.

Cardano had a rough fourth quarter. There’s no elegant way to put it. According to Messari’s February 20 report, ADA dropped 58.6% quarter-on-quarter, sliding to $0.33 and dragging its circulating market cap down from $29.5 billion to $12.2 billion. That decline pushed ADA to 11th place globally — a noticeable shift for a network that once hovered comfortably in the top tier.

But price alone doesn’t tell the full story. It rarely does.

Fewer Users, But More Active Ones

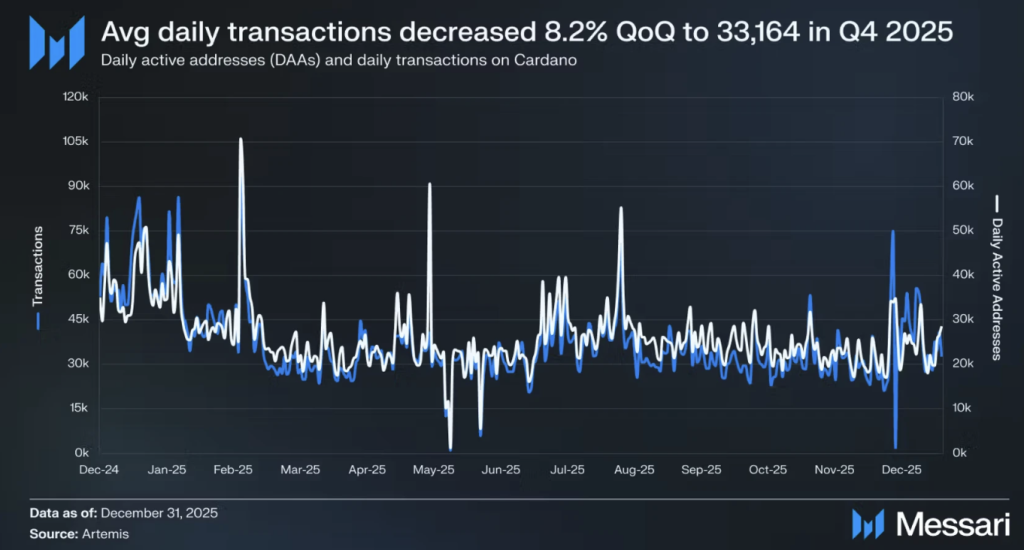

Network activity cooled alongside the price. Average daily transactions fell 27.4% to 25,970, while active addresses dropped nearly 30% to 18,641. On the surface, that suggests shrinking participation.

Yet there’s a twist.

Average transactions per active address actually climbed 27% to 1.70. So while fewer users were interacting with the network, the ones who remained were more engaged. It’s a subtle but important detail — the ecosystem may be contracting, but it’s not necessarily hollowing out.

Staking also softened. Total ADA staked declined 2% quarter-over-quarter to 21.4 billion ADA, bringing the staking rate down to 57.80%. In dollar terms, the value of staked ADA fell significantly due to price depreciation, landing near $7.1 billion. Network fees followed the same pattern, dropping 38% in USD terms to $524,202 and nearly 29% in ADA to 742,242 ADA. Lower price, lower activity, thinner fee generation. It tracks.

Governance Reforms Add Structural Stability

Amid the price turbulence, Cardano quietly restructured parts of its governance framework.

After the Cardano Atlantic Council resigned from the Constitutional Committee, a swift election restored the committee to its full seven-member composition. Cardano Curia secured the seat through delegated ADA voting, while Christina Gianelloni, who placed second, was added as an alternate to strengthen continuity and reduce governance friction moving forward.

The community also extended the Net Change Limit (NCL) for treasury withdrawals by eight epochs, pushing the deadline to February 8, 2026. The 350 million ADA cap remains intact, preventing what some called a potential “spending cliff.” This move allows development funding to continue without abrupt treasury drains.

Interestingly, Cardano’s treasury balance grew 4.46% quarter-over-quarter to 1.67 billion ADA. However, because ADA’s price fell sharply, the treasury’s USD value dropped 53.7% to roughly $585.9 million. Same tokens. Different valuation. Markets can be unforgiving like that.

Mixed Signals Across the Ecosystem

Despite the broader contraction, parts of the Cardano ecosystem showed resilience. Average daily DEX trading volume actually increased 17.3% to $4.44 million. That’s not explosive, but it’s meaningful in a quarter defined by retracement.

Minswap maintained dominance, capturing 72.4% of total swap volume. Its KuCoin listing and buyback-and-burn strategy likely contributed to that edge. Meanwhile, WingRiders and Danogo posted gains in trading activity, while older DEX platforms like MuesliSwap and Splash saw declines.

On the DeFi side, total value locked fell 48.1% to $177.3 million — a sharper drop than the broader market’s 25.2% decline. Still, Minswap held a 27% share of TVL, reinforcing its position as the network’s DeFi anchor.

NFTs offered a rare bright spot. Average daily NFT sales rose 3.6% to 276, while trading volume surged 133.4% to $612,454. The standout moment was the $44.8 million sale of the “GoodSamaritan” NFT series — a headline-grabbing transaction that briefly shifted sentiment. Stablecoins remained steady, with USDM at $14.7 million and USDA at $11.7 million, suggesting at least some capital stability within the ecosystem.

In short, Cardano’s Q4 was undeniably painful from a price perspective. But beneath the surface, engagement pockets remain active, governance has tightened, and specific verticals like DEX trading and NFTs are still finding traction.

Markets cool. Networks evolve. The real question is whether these structural adjustments will matter when sentiment turns again.