- Bitcoin dominates the crypto market and remains the safer, institution-backed choice

- Solana offers higher growth potential through smart contracts and stablecoin adoption

- The decision between BTC and SOL depends on risk appetite and long-term goals

Solana clearly has room to grow, but when it comes to safety and stability, Bitcoin still sits in a category of its own. That gap between upside potential and perceived security is what makes comparing the two so interesting as crypto moves into its next phase of adoption.

Bitcoin accounts for nearly 60% of the total crypto market value and has become, for better or worse, the most widely accepted face of digital assets. Institutional capital tends to flow there first, and regulatory changes over the past year have even opened the door for Bitcoin to slowly enter retirement products like 401(k)s. Solana, by comparison, is still seen as a higher-risk bet.

Why Bitcoin Remains the “Safer” Choice

Bitcoin’s reputation as digital gold continues to attract conservative investors, though the comparison isn’t perfect. Its price remains volatile and often moves in tandem with tech stocks during broader market stress. Energy consumption is another ongoing concern, even as miners increasingly redirect computing power toward AI data centers.

Still, Bitcoin’s advantages are hard to ignore. With more than $120 billion parked in spot Bitcoin ETFs, strong corporate adoption, and even government-level interest, its institutional backing is unmatched. Bitcoin reached several all-time highs in 2025 and, despite being down around 13% year over year, remains far less volatile than most altcoins.

Some forecasts remain aggressive. Ark Invest, for example, has projected Bitcoin could exceed $760,000 by 2030, reinforcing the idea that “safer” doesn’t necessarily mean low-return in crypto.

Where Solana’s Growth Story Stands Out

Solana isn’t a newcomer anymore. Nearly six years into its life, it blends high-speed transactions and low fees with an ecosystem built around smart contracts. That programmability is its biggest advantage over Bitcoin, allowing developers to build DeFi apps, NFTs, and stablecoin infrastructure directly on the network.

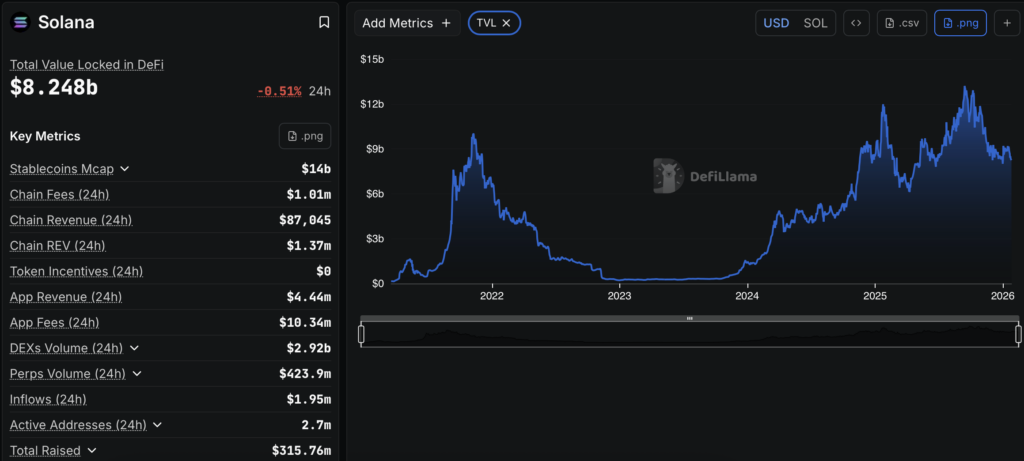

Stablecoins are a key piece of the puzzle. Around 4.5% of circulating stablecoins currently live on Solana, and its total value locked sits near $8.4 billion. Citigroup has suggested the stablecoin market could grow to $4 trillion by 2030. If Solana simply maintains its current share, its TVL could grow more than 2,000%, a figure that highlights why some investors view SOL as a high-upside asset.

At roughly $130, Solana trades well below its all-time high of $294.33 set during last year’s meme-driven surge. While that drop is notable, it also shows Solana was able to reclaim momentum, something many altcoins failed to do after peaking in 2021.

Risks Still Matter for Solana Investors

Solana’s upside comes with added risk. Its market cap is smaller, its track record shorter, and early in its history the network suffered from outages. While developers have made major improvements and the last major outage occurred in February 2024, the perception hasn’t fully disappeared.

That said, Solana offers something Bitcoin doesn’t, staking. SOL holders can earn yield by locking up tokens, generating passive returns while supporting network security. If stablecoin usage accelerates, Solana could benefit far more than Bitcoin, which may see its transactional role diluted by stablecoins in some regions.

Choosing Between Bitcoin and Solana

In reality, this isn’t an either-or decision. Bitcoin and Solana offer exposure to very different sides of the crypto ecosystem. Bitcoin appeals to investors seeking relative stability and institutional validation. Solana attracts those willing to accept more risk in exchange for potentially higher growth.

The key is understanding your own risk tolerance and investment goals. Crypto remains a young and evolving asset class, with regulation still taking shape. Whichever path you choose, it’s wise to treat crypto as a smaller slice of a diversified portfolio rather than the whole thing.