- SUI has fallen more than 30% in 17 days and is now testing a key daily support zone

- Price action shows buyer reactions, though indicators remain firmly bearish

- The next move will likely determine whether SUI forms a base or continues lower

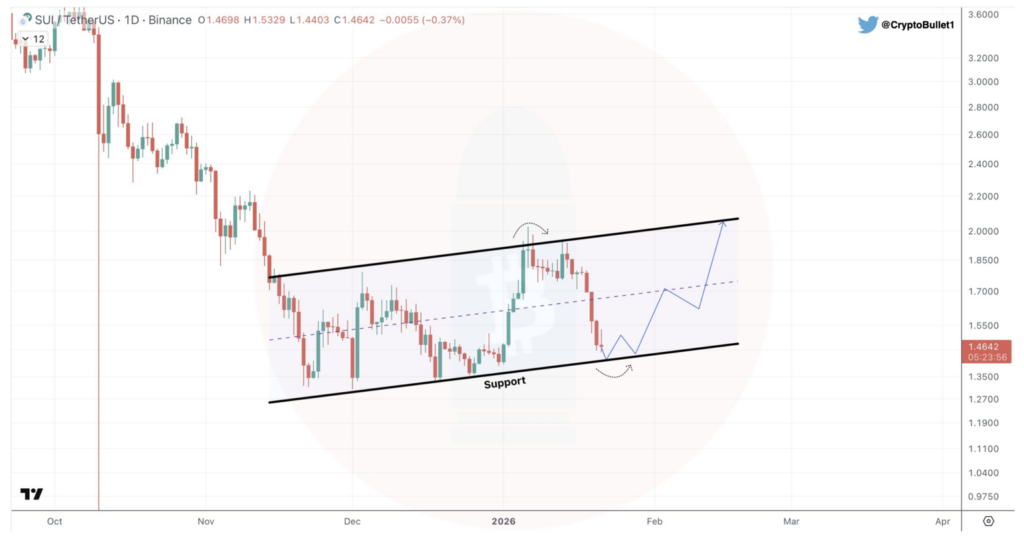

SUI has spent the past few weeks drifting lower, frustrating just about anyone watching the chart. Every bounce looked hopeful for a moment, then faded, with sellers keeping control of the broader structure. That slow grind has now pushed price into an area that actually matters, and the chart is starting to hint that something different could be forming.

Over the last 17 days alone, SUI has dropped more than 30%. Moves of that size usually leave a visible emotional footprint, especially when price revisits levels where buyers previously stepped in with confidence. SUI is now hovering right around that territory.

Buyers Begin Reacting at Daily Support

A recent observation from crypto analyst Sui Insiders noted that SUI has returned to daily support. The chart confirms it. Price is sitting near the lower boundary of its channel, an area where liquidity was absorbed in the past and where sharp upside moves once began.

As SUI slides back into this zone, the market is being forced to make a decision. Either buyers defend support again, or the level gives way and momentum accelerates lower. For now, the structure remains intact.

Compression Builds as the Channel Holds

The chart suggests a potential bounce toward the $2.05 area, which aligns with the top of the channel and a trendline that has rejected price multiple times before. Price action is compressing near support, and recent candles are showing long lower wicks, a sign that buyers are reacting even while the broader trend stays weak.

This doesn’t confirm a reversal on its own, but it does suggest sellers are no longer pushing price freely. That loss of control is often the first thing that changes before anything else does.

Indicators Still Lean Bearish

Despite the support reaction, technical indicators remain firmly cautious. Momentum readings are weak, trend indicators still point lower, and there’s no confirmed reversal signal yet. RSI remains below neutral, stochastics are oversold without turning, and MACD continues to favor downside momentum.

Indicators often lag price, especially during potential transition phases, but for now they reinforce the need for patience. Price action is improving slightly, yet confirmation is still missing.

Why This Isn’t a Confirmed Reversal Yet

Support reactions alone aren’t enough to call a bottom. Strong reversals usually come with higher lows, improving momentum, or expanding volume, none of which have clearly shown up yet. Without those, support can fail just as easily as it can hold.

For now, SUI is at a genuine crossroads. Buyers are showing up, sellers are losing some control, but the broader trend hasn’t flipped. The next move from this level should reveal whether this zone becomes a base, or simply another pause before continuation.