- Solana’s SKR token surged more than 200% following its launch tied to the Seeker smartphone

- Early gains were driven by staking incentives, low circulating supply, and major exchange listings

- Long-term performance will depend on real usage as airdrop dynamics and inflation ease

Solana’s latest experiment at the intersection of hardware and crypto took a sharp, and somewhat surprising, turn this week. The token tied to its new Seeker smartphone, known as $SKR, jumped more than 200% just days after launch, according to CoinGecko data. While early volatility was expected, the speed and scale of the move caught the broader market’s attention.

The rally followed the long-awaited token generation event and airdrop connected to Solana Mobile’s second-generation device. The Seeker, a $500 Android phone built specifically for on-chain activity, finally went live, and the market reacted fast. Whether that reaction proves durable is another question, but the debut was anything but quiet.

A Smartphone Designed for Crypto Natives

The Solana Seeker isn’t trying to compete with mainstream flagship phones. Instead, it’s positioned as a Web3-native device built around crypto usage from the ground up. Wallet security, identity tools, and staking features are baked directly into the operating system rather than bolted on later.

At the core is a built-in Seed Vault for private key storage, paired with biometric transaction signing. Users also get native access to Solana’s dApp Store, allowing them to interact with applications, stake tokens, and track rewards without relying on external wallets. It’s a tightly integrated experience, and that’s very much the point.

Demand appears strong, at least early on. Solana Mobile says more than 150,000 units were preordered during the first sales wave, and additional devices are now shipping as the ecosystem enters its second reward season.

Inside the SKR Token Launch

The Seeker ecosystem runs on SKR, a Solana-based token with a fixed supply of 10 billion. About 30% of that supply was set aside for users and developers through an airdrop tied to device ownership and on-chain engagement.

Token claims were handled directly through the Seeker wallet, with staking available immediately. Developers received some of the largest allocations, while heavy users reportedly earned six-figure token amounts. Unlike many recent launches, SKR entered the market with a relatively low fully diluted valuation, which helped limit early sell pressure.

That setup gave the token some breathing room during its first days of trading, even as activity ramped up quickly.

Why SKR Took Off So Fast

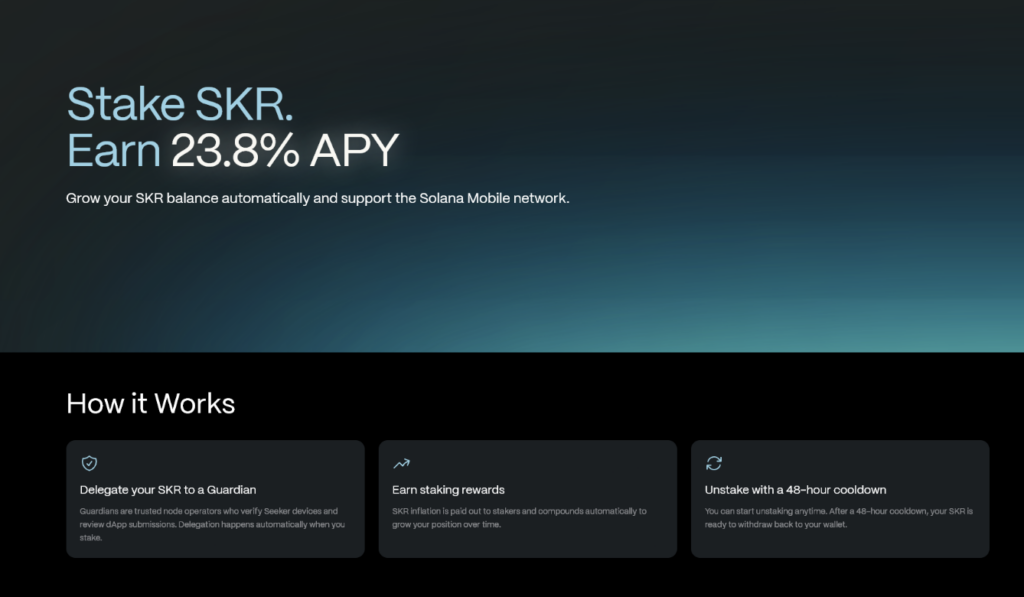

Several forces came together to drive SKR sharply higher in its opening window. First, staking removed a meaningful portion of the supply from circulation almost immediately. Solana Mobile’s design strongly incentivizes holders to lock tokens early, tightening available supply during price discovery.

Staking yields near 24% APY also played a role. Those rewards are funded through token inflation rather than protocol revenue, which naturally favors early adopters and discourages quick selling. For many, the math simply made holding more attractive than flipping.

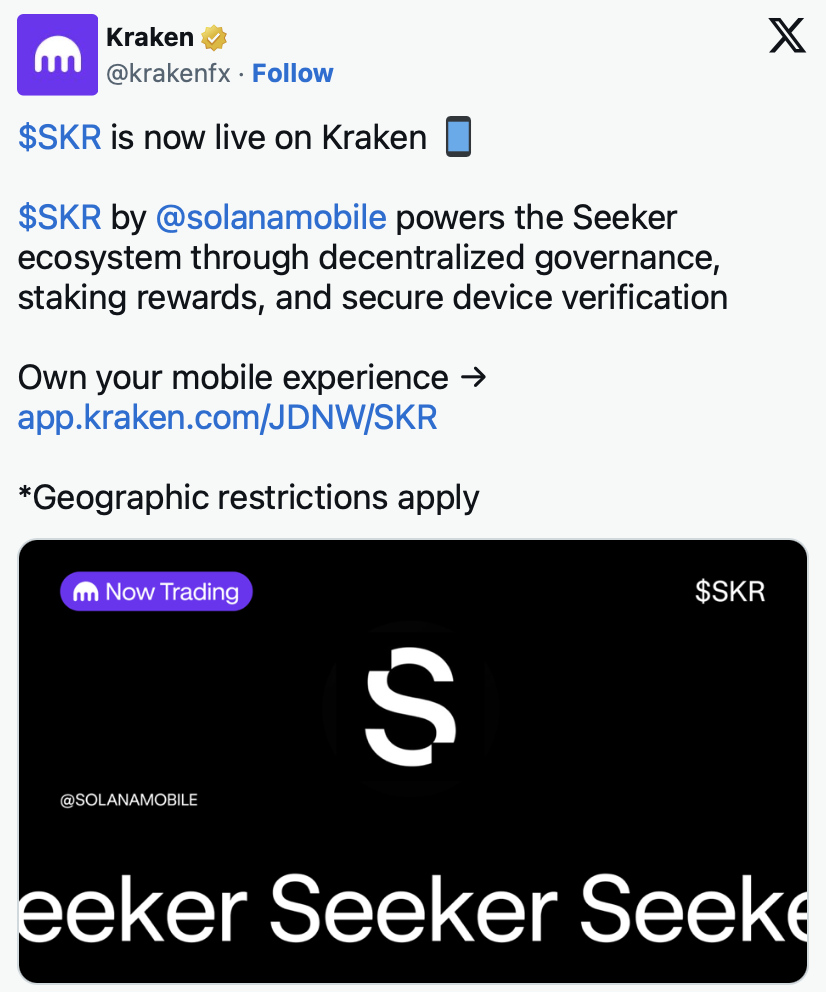

Exchange support added fuel. Major platforms like Coinbase and Kraken listed SKR early, and trading volume surged, peaking above $140 million in a single day. That’s a sizable number relative to a circulating market cap hovering near $200 million, and it helped accelerate price movement in both directions.

Together, these dynamics created a short-term supply squeeze during launch.

What Comes Next for Solana’s Hardware Bet

It’s worth noting that much of the initial demand was driven by airdrop mechanics, staking incentives, and thin liquidity, not yet by sustained usage or revenue. As unclaimed tokens enter circulation and inflation tapers off, selling pressure could return.

Still, the Seeker launch marks Solana’s most ambitious attempt so far to link physical hardware directly with tokenized incentives. Whether that model can scale beyond early adopters, and hold value once incentives normalize, remains an open question. For now, though, Solana has everyone watching.