- Deutsche Bank will use Ripple’s ledger for settlements, FX, and custody workflows

- XRP barely reacted, still trading around $1.40 with weak momentum

- Ripple partnerships often boost adoption narratives, not direct XRP price action

XRP is back in the spotlight after Deutsche Bank, one of Germany’s most influential financial institutions, announced a partnership with Ripple to upgrade parts of its settlement infrastructure using blockchain-based rails. The new payment framework is reportedly aimed at cross-border settlements, foreign exchange operations, and digital asset custody.

From a narrative standpoint, this is exactly the kind of announcement that reinforces Ripple’s long-running pitch: traditional finance wants blockchain efficiency, and Ripple wants to be the bridge. It’s another major stamp of legitimacy for Ripple’s fintech ambitions, and it strengthens the idea that tokenized payments and ledger-based settlement are becoming mainstream.

Why Blockchain Settlement Keeps Winning in TradFi

This partnership also reflects a broader shift. Blockchain-based payments are increasingly attractive to traditional financial institutions because they offer tamper-resistant recordkeeping and cleaner settlement logic. Once transactions are recorded on a ledger secured through cryptographic mechanisms, altering them becomes practically impossible without breaking the system.

For banks, the appeal is less about decentralization and more about efficiency, auditability, and reduced operational friction. Ripple has positioned itself as one of the most bank-friendly firms in this space, so Deutsche Bank leaning in makes strategic sense.

XRP Barely Moved, and That’s the Part People Keep Missing

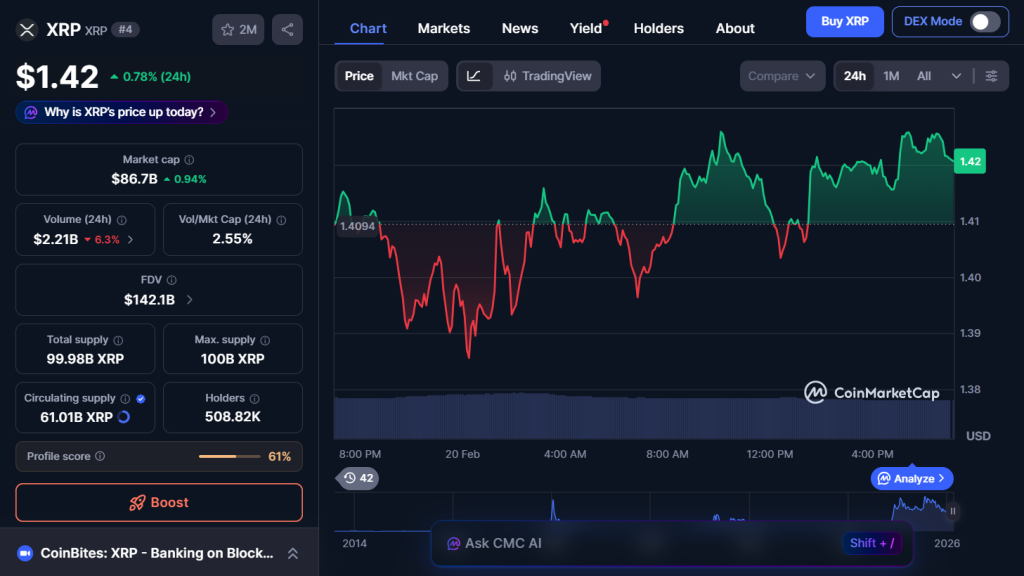

Despite the headline, XRP’s price barely reacted. The token remained stagnant around $1.40 and was down roughly 0.6% on the day. There was no breakout, no surge, and no real enthusiasm on the chart. If anything, XRP still looks fragile, with traders watching whether it could slip below $1 if market weakness continues.

This is the part many investors struggle with. Ripple the company and XRP the token do not move in lockstep. Ripple can sign partnerships with major global banks, but XRP’s price still depends primarily on broader crypto market conditions, liquidity cycles, and trader sentiment.

Ripple Adoption Doesn’t Automatically Translate Into XRP Demand

The blunt truth is that this Deutsche Bank collaboration does not necessarily require XRP to function. Ripple’s enterprise ledger solutions and XRP’s market performance are connected in branding, but not always in direct economic flow. That’s why XRP has declined nearly 48% over the last year despite multiple Ripple partnerships.

For XRP holders, that can feel frustrating. A huge bank partnership sounds like it should pump the token. But the market has learned that enterprise adoption headlines often don’t translate into immediate token demand, especially in a bearish environment.

What This Means Going Forward

Deutsche Bank and Ripple did not disclose a rollout timeline, which suggests this is still early-stage infrastructure work rather than a fully deployed system. That matters because markets tend to price in real usage, not future intentions.

Long term, this partnership strengthens Ripple’s credibility in traditional finance and supports the broader narrative that blockchain settlement is becoming standard. But in the near term, it likely means very little for XRP price action unless the wider crypto market turns bullish again.