- ADA remains over 90% below its 2021 all-time high of $3.10

- A $2,800 position today would require a move to $1 by 2030 to exceed $10,000

- Long-term upside depends on development execution, adoption growth, and macro conditions

Market sentiment across crypto remains cautious, maybe even tired. Most major assets are still trading well below their 2020–2021 cycle highs, and Cardano is no exception. Back in September 2021, ADA reached $3.10. Since then, it has lost more than 90% of that peak value, drifting through a long and often frustrating downturn.

For many long-term holders, that slide hasn’t just been about numbers on a chart. It’s been about patience being tested. Even during short-lived rebounds across the broader market, ADA has struggled to build sustained momentum. That pattern has left some investors questioning whether the recovery narrative is real or just wishful thinking.

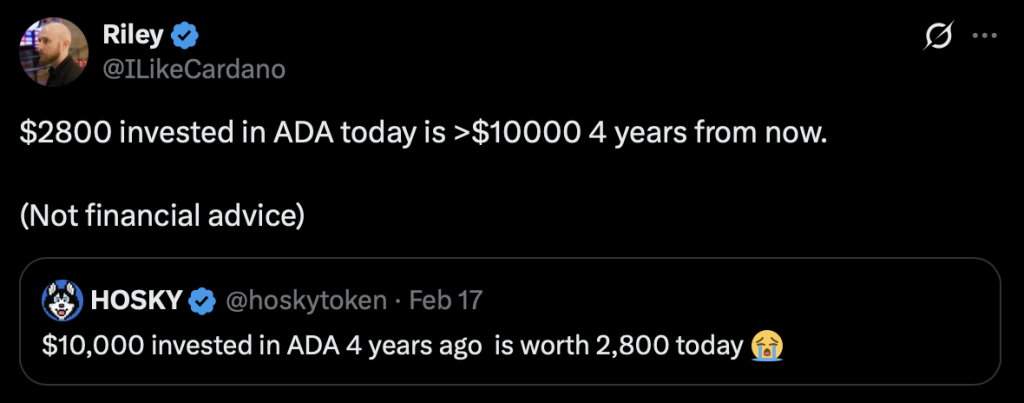

The $10,000 That Turned Into $2,800

The debate resurfaced recently after commentary from the team behind Hosky Token pointed out just how steep ADA’s drawdown has been. According to their framing, a $10,000 investment in ADA made several years ago would now be worth roughly $2,800. That figure hit hard, because it’s not abstract — it’s relatable.

Critics used the example to argue that Cardano has underperformed relative to expectations. And they’re not entirely wrong on a historical basis. The last four years haven’t rewarded passive optimism.

But the conversation didn’t end there.

A Different Angle From Inside the Ecosystem

Riley, a senior engineer at Input Output Global, offered a counterpoint that reframed the same numbers. Instead of focusing on what was lost, he focused on what $2,800 today might become. In his view, that amount could potentially grow back above $10,000 by the end of the decade if Cardano’s roadmap continues to progress.

That projection implies more than a threefold return over roughly four years. It’s not a moonshot scenario requiring a 10x rally overnight. It’s a steady appreciation thesis, anchored around development milestones and gradual adoption.

Of course, that’s a forward-looking opinion. Not a promise.

What Would ADA Need to Reach $1 Again?

For the $2,800-to-$10,000 scenario to work, ADA would need to trade at or above $1 by 2030. That may sound ambitious when price is sitting far below that level today. But historically, it’s not unprecedented.

ADA has traded well above $1 in prior cycles and came close to reclaiming that mark as recently as 2025. From a purely numerical standpoint, a move to $1 would represent a moderate appreciation relative to past expansions, not an extreme outlier. It’s not the same as calling for a return to $3.10, or beyond.

Independent forecasts add context. Analysts at Changelly have modeled ADA trading above $1.50 by early 2030. Telegaon researchers have outlined much more aggressive projections, even double-digit territory later in the decade. Those estimates vary widely, but importantly, the $1 threshold isn’t considered fringe.

Development Roadmap Still Moving Forward

Beyond price forecasts, Cardano’s development roadmap remains active. Scalability upgrades like Leios aim to increase throughput and efficiency. Interoperability initiatives are working to link Cardano with networks like Bitcoin and the XRP Ledger. DeFi capabilities continue expanding.

The argument from supporters is simple: if the infrastructure improves and real-world use cases grow, valuation should eventually follow. That’s the theory. Execution, of course, is where it gets complicated.

Markets don’t reward roadmaps automatically. They reward delivered outcomes, sustained demand, and favorable macro conditions.

Asymmetric Upside, But Not Without Risk

Riley’s perspective highlights a broader investing principle: asymmetric upside often appears when sentiment is low and price is depressed. Buying near peaks rarely offers that dynamic. Buying during prolonged stagnation sometimes does.

Still, uncertainty remains. Regulatory changes, macroeconomic cycles, competitive networks, and execution risks all influence outcomes. A return to $1 is plausible, but it is not guaranteed. Long-term projections require patience, and patience isn’t always easy when price drifts sideways for years.

For investors considering ADA at current levels, the opportunity may lie in measured expectations rather than extreme predictions. The question isn’t just whether Cardano can recover. It’s whether the development roadmap, adoption curve, and broader market environment align strongly enough to make that recovery sustainable.

And that, as always in crypto, takes time.