- Rising U.S. Treasury yields are forcing policy shifts and increasing refinancing pressure on U.S. debt

- Foreign investors are selling Treasuries and rotating into metals, weakening risk appetite

- Bitcoin remains cautious as capital favors gold and bonds over high-risk assets

There is clearly pressure building under the surface of the U.S. economy, and recent political moves are starting to look less random than they first appeared. President Donald Trump’s sudden decision to pull back the 10% tariff on the European Union feels more like a reaction than a strategic pivot, especially given what’s happening in bond markets right now.

The real signal came from rising U.S. Treasury yields, which have begun to strain the bond market at a time when the government can least afford it. As mid-year elections approach, higher yields translate into higher refinancing costs, and that’s not an easy sell to voters. While Bitcoin managed to rebound around 1.20% on the news, calling this a breakout would be a stretch, the pressure is only just starting.

Analysts have started framing this moment as a “capital war,” and that framing matters. The forces at play are structural, not short-term, and they suggest that the calm on the surface may not last much longer.

Europe’s de-dollarization push raises fresh concerns

The U.S. Treasury market is now facing a shock that’s hard to ignore. For decades, Asian and European countries have parked capital in U.S. Treasuries, earning yield while helping Washington fund its growing debt pile. European investors alone still hold close to $2 trillion in these securities, but that balance is shifting.

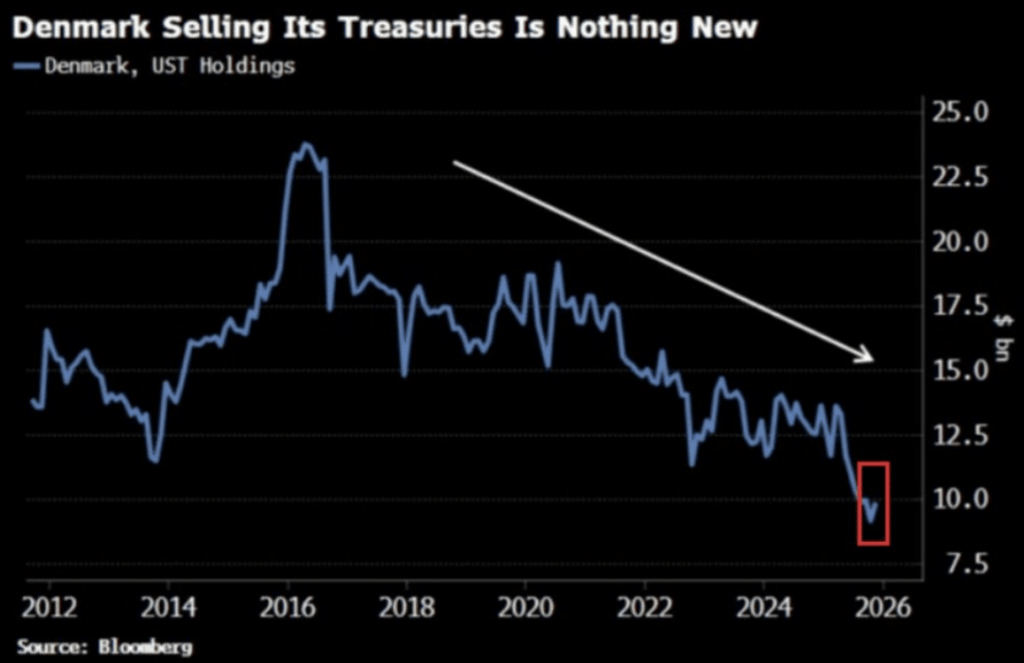

Foreign holders are quietly stepping back. Denmark, for instance, has cut its U.S. Treasury exposure to roughly $9 billion, the lowest level in 14 years, and it’s not alone. Europe has sold about $150.2 billion in Treasuries, China offloaded $105.8 billion, and India sold $56.2 billion, all reaching multi-year extremes.

This helps explain why Trump’s tariff retreat looks more defensive than diplomatic. As Treasuries were dumped, yields surged, with the 30-year yield pushing close to 5% and strength spreading across the curve. With around 26% of the $39 trillion U.S. federal debt maturing in the next year, higher yields mean refinancing becomes painfully expensive, fast.

Bitcoin shows signs of caution as investor confidence weakens

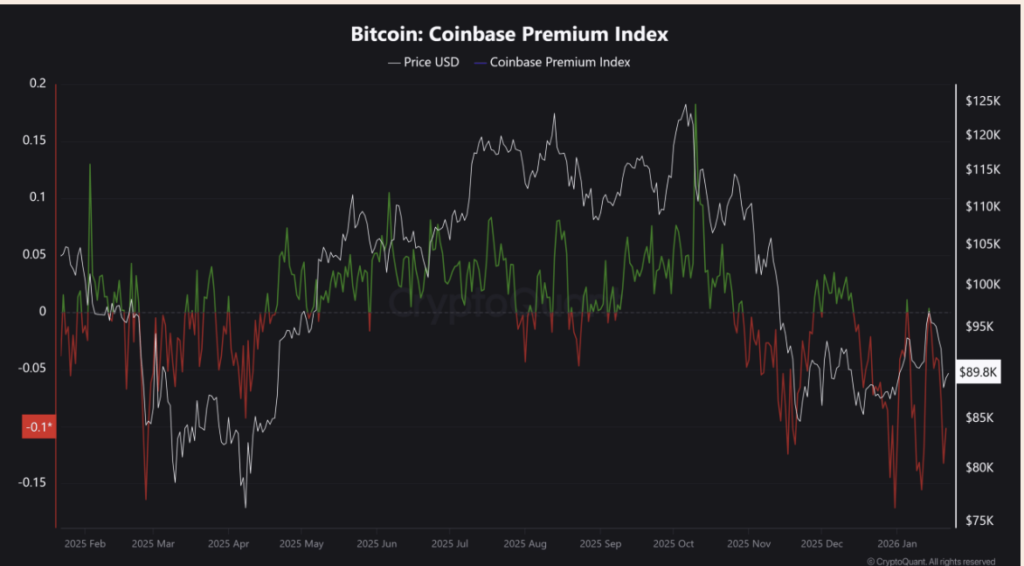

Macro volatility continues to shape how investors are positioning themselves. Trump’s tariff rollback and his softer tone on Greenland triggered a brief risk-on move, sending roughly $50 billion into markets, with about 60% of that flowing into Bitcoin and driving short-term BTC-led momentum.

Still, underlying confidence remains fragile. Bitcoin’s Coinbase Premium Index sits around -0.1 and has stayed negative since the October crash, a sign that U.S. investors are still hesitant. Historically, sustained Bitcoin bull runs tend to align with the CPI peaking, and that simply hasn’t happened yet.

The recent Treasury sell-off adds another layer of caution. With metals rallying and foreign capital stepping back from U.S. debt in what looks like a coordinated move, stress is building beneath the economy. In that environment, high-yield bonds become more attractive, pulling capital away from risk assets like Bitcoin, at least for now.

Bullish gold predictions are set to shape Bitcoin’s trajectory

Even this early into 2026, investor preferences are already taking shape. With the U.S. deficit under pressure and Treasuries being sold off, metals are back in focus. Gold is up roughly 12% and flirting with record highs, with near-term targets around $5,000 per ounce as investors look for shelter from rising yields.

This rotation has weighed on Bitcoin’s relative strength. The BTC-to-gold ratio has fallen to a two-year low, dipping below 18 ounces of gold for the first time since late 2023, a clear signal that capital is leaning toward traditional safe havens. Analysts argue this may only be the beginning, not the end.

Goldman Sachs recently lifted its year-end gold forecast to $5,400 an ounce, citing sustained demand. Russia has already benefited significantly from rising gold prices, while India’s silver imports have surged to a record $5.9 billion in just four months. Together, these trends point to countries stockpiling metals while reducing exposure to U.S. debt, a mix that could continue to cap Bitcoin’s upside until macro confidence stabilizes.