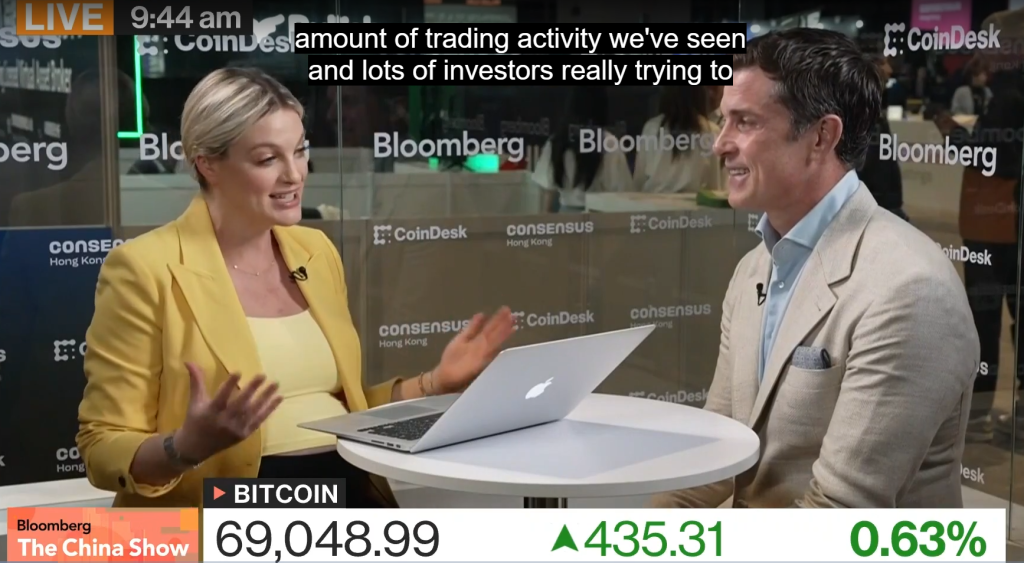

- Spot ETFs and CME futures shifted Bitcoin’s marginal buyer to US institutions

- The inflation hedge narrative cracked when BTC fell with risk assets

- Basis trades and fading leverage drained liquidity without panic

Bitcoin didn’t just attract Wall Street. It reorganized around it. Spot ETFs, CME futures, and regulated US custodians quietly shifted control of the marginal bid toward pensions, hedge funds, and institutional allocators. For the first time, the dominant buyer wasn’t a global retail crowd trading belief. It was capital that models risk in spreadsheets.

That shift changed how Bitcoin trades. Institutional money behaves differently. It rotates. It reallocates. It reduces exposure when volatility rises. The asset that once thrived on decentralized conviction began responding to quarterly positioning and macro risk signals instead.

The Hedge Narrative Broke at the Worst Time

Bitcoin was pitched as an inflation hedge, a currency debasement shield, even a crisis asset. But when inflation surged and markets wobbled, BTC often dropped alongside equities. At times, it fell harder. That cracked the narrative institutions were sold.

When an asset fails its job description, capital moves on. Gold found renewed interest. Certain equities rebounded. Bitcoin saw demand cool. The story wasn’t that Bitcoin stopped existing. It was that it stopped behaving the way allocators expected, and that matters in portfolio construction.

Leverage Quietly Left and Took Liquidity With It

The slowdown in CME futures activity is more important than it sounds. Less leverage means fewer reflex buyers chasing upside and fewer structured positions supporting price. The market can look stable on the surface, but underneath, participation thins.

This kind of drift lower is different from panic. There’s no cascade of forced liquidations dominating headlines. Instead, liquidity simply fades. And when fewer players feel obligated to step in, price weakens gradually, almost mechanically.

ETF Flows Were Structured Trades, Not Always Conviction

A significant portion of ETF demand wasn’t pure belief. It was basis trade math. Long spot exposure paired with short futures positions, capturing spreads. When yields elsewhere improved or spreads compressed, the trade unwound.

Those exits weren’t emotional decisions about Bitcoin’s future. They were automated reallocations driven by opportunity cost. When the math no longer worked, the capital moved. Bitcoin felt the outflow, but not because conviction vanished overnight. Because the trade structure changed.

Bitcoin Didn’t Lose Relevance, It Lost Insulation

Bitcoin is still here. It didn’t disappear, and its long-term thesis hasn’t evaporated. But by anchoring itself to US institutional capital, it tied its price behavior more closely to American risk cycles. That brought legitimacy, liquidity, and scale. It also brought correlation.

Until a new marginal buyer emerges, whether global retail, sovereign allocators, or something else entirely, consolidation may persist. Not as a temporary phase, but as the natural consequence of trading acceptance for insulation.