- The Fed is injecting $55B in liquidity through Treasury bill purchases

- Bitcoin has pulled back but historically responds well to liquidity expansion

- Geopolitical tension and risk-off sentiment remain major obstacles

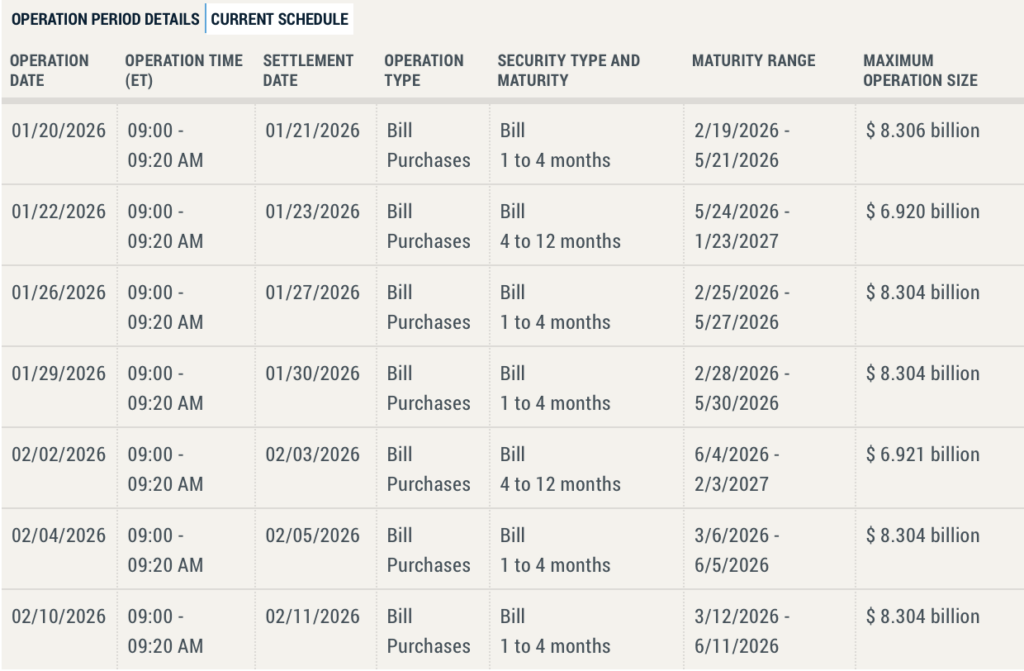

The US Federal Reserve is stepping back into the market with a fresh liquidity injection, announcing plans to buy $55 billion worth of Treasury bills starting today, January 20, 2026. According to the official schedule, the first operation alone will see $8.3 billion injected into the system. That move has immediately reignited speculation around Bitcoin, with many traders watching closely to see whether added liquidity can flip recent bearish momentum.

Why Liquidity Matters for Bitcoin

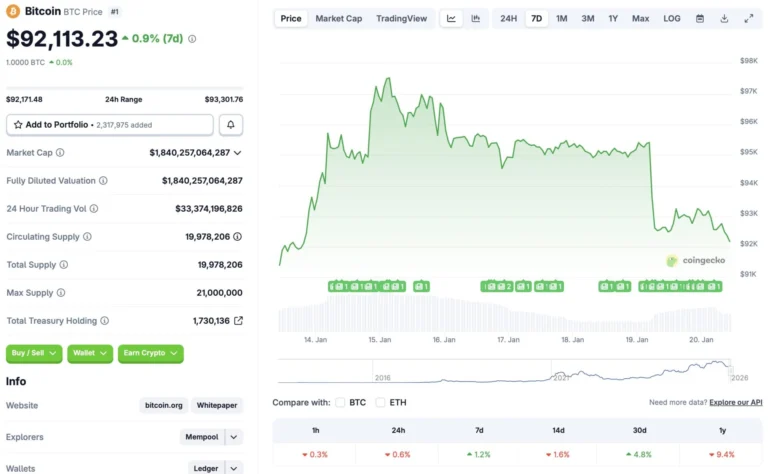

Bitcoin has struggled over the past several days, despite briefly reclaiming the $97,000 level on January 15. Since then, the asset has slipped back toward $92,000 as broader markets turned cautious. CoinGecko data shows BTC down 0.6% in the last 24 hours, 1.6% across the 14-day chart, and roughly 9.4% since January 2025. At the same time, Bitcoin remains up 1.2% on the week and nearly 5% over the past month, suggesting the longer trend hasn’t fully broken.

Historically, Bitcoin has responded positively to periods of expanding liquidity. When central banks increase balance sheets or ease financial conditions, risk assets often benefit, and BTC has frequently moved alongside those shifts. That historical context is what’s driving renewed optimism around this Fed operation.

Geopolitics Are Still Holding the Market Back

The recent pullback hasn’t been driven by crypto-specific weakness alone. Rising geopolitical tensions between the US and Greenland have unsettled global markets, especially after France, Germany, and Norway moved to support Greenland with troop deployments. In response, the US imposed additional tariffs on countries backing Greenland, amplifying uncertainty and pushing investors toward defensive positioning.

That risk-off environment has been evident in capital flows. Gold and silver have both surged to new all-time highs as investors seek safety, while cryptocurrencies and equities have faced pressure.

Can BTC Still Push Higher in 2026?

Despite near-term headwinds, long-term expectations for Bitcoin remain strong. Several analysts and institutions are still projecting a bullish 2026, with Bernstein even forecasting BTC could surpass $150,000 later this year. A sustained liquidity expansion could help revive momentum, especially if geopolitical stress eases and investors rotate back into risk assets.

That said, liquidity alone doesn’t guarantee an immediate rally. If macro uncertainty persists, Bitcoin could continue consolidating around current levels or even face further downside before a clearer trend emerges.

What to Watch Next

The key signal will be how markets respond after the first few rounds of Treasury bill purchases. If liquidity finds its way into risk assets, Bitcoin could regain strength quickly. If fear continues to dominate, the Fed’s actions may only soften downside rather than spark a breakout.

For now, Bitcoin sits at a crossroads, caught between supportive liquidity and restrictive geopolitics.