- Tron Inc. added 177,925 TRX at $0.28, pushing reserves above 681.9 million tokens

- TRX failed to hold its recovery and printed a lower low near $0.2685

- Traders are watching $0.2455 as the next major support and liquidity zone

Tron Inc. strengthened its crypto treasury strategy on Monday, February 16, after confirming it acquired 177,925 TRX at an average price of $0.28. While the purchase size itself is not massive, it adds to a much larger trend, pushing the NASDAQ-listed firm’s total TRX reserves beyond 681.9 million tokens. The move signals that Tron Inc. is treating TRX as a long-term balance sheet asset, not a short-term trade.

Corporate Accumulation Signals Long-Term Confidence

The company framed the acquisition as part of a broader plan to expand its Tron Digital Asset Treasury holdings. Instead of trying to time volatility, Tron Inc. appears focused on steadily increasing exposure and holding through market cycles. That kind of positioning is typically meant to enhance shareholder value through long-term appreciation, even if price action stays messy in the short run.

TRX Price Weakens After a Failed Recovery Attempt

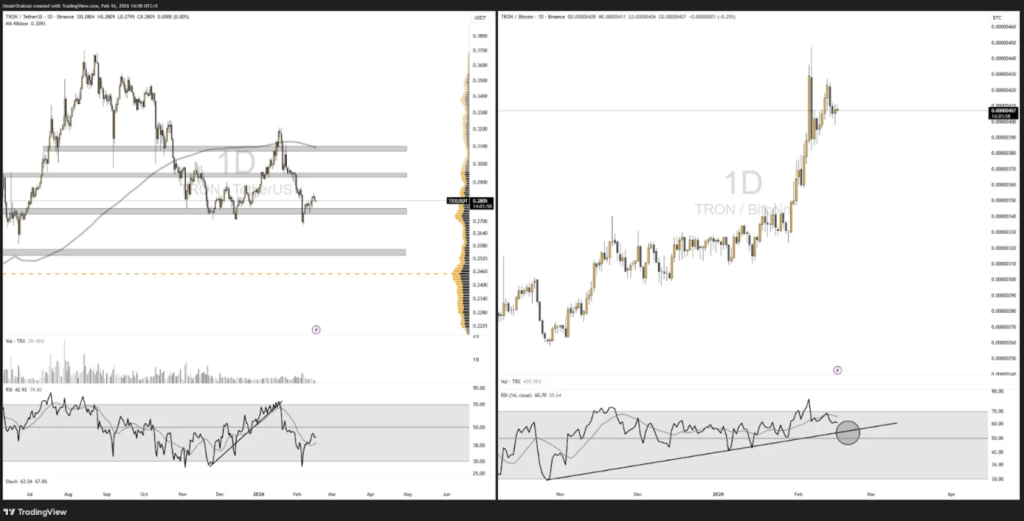

Despite the institutional buy, TRX is showing renewed downside pressure after failing to sustain its latest recovery bounce. After breaking out from consolidation, the token briefly reclaimed its 200-day simple moving average, but the move faded quickly and price retraced toward the $0.32 region before sellers took control again. TRX has now printed a lower low near $0.2685, reinforcing the idea that the market still isn’t ready to fully flip bullish.

The $0.2455 Support Zone Becomes the Next Key Level

Analysts are watching the $0.2455 area as a major support zone, since it aligns with a point of control and a visible liquidity cluster. If bearish momentum accelerates, this level could become the market’s next real decision point. A breakdown below it would likely shift sentiment toward a deeper range reset, while a strong defense could keep TRX trapped in its long consolidation instead of collapsing.

Momentum Indicators Add Caution Despite Treasury Strength

Further caution comes from TRX’s performance relative to Bitcoin, as the token is still trading near its relative highs. The RSI is also showing signs of weakness, and if its trendline breaks decisively, it could confirm fading momentum. For now, Tron Inc.’s continued accumulation supports the long-term narrative, but the short-term chart remains fragile and traders are staying careful.